A year of high inflation and market volatility delivered a hit to retirees’ nest eggs, a new survey shows.

So far in 2023, average retirees have $21,000 less in savings than they did in the beginning of 2022, according to a survey by Clever Real Estate. The loss marked a 10% drop from an average savings of $191,659 to $170,726. The share of retirees with nothing saved increased from 30% to 37%, the survey said.

Many retirees (83%) say inflation has impacted their retirement savings. And overall economic conditions have left many retirees without the recommended amount in savings to live a comfortable retirement, according to experts.

Retirees should have saved 10 times their income by age 67, according to guidelines by Fidelity Investments. The average American’s income is an estimated $54,132, according to data by First Republic bank.

By Fidelity’s guidelines, retirees would need to save an average of $541,320 by the time they are ready to retire. But the average retiree’s savings is currently just $170,726, according to Clever’s research.

If you’re struggling to save for retirement in today’s economy, you could consider paying down high-interest debt with a personal loan at a lower interest rate, which can help you lower your monthly payments. Visit Credible to compare options from multiple lenders at once and choose the one that’s the best for for you.

IRA BALANCES DROPPED NEARLY 25% AMIDST MARKET VOLATILITY: HERE’S HOW TO PROTECT YOUR RETIREMENT SAVINGS

Inflation impacts America’s retirement savings

Although inflation has risen at a slower rate than in previous months, it still strained the budgets of many retirees in 2022. In fact, 44% of retirees say they struggle to pay for basic living expenses, Clever found in its survey report.

Here are some of the most common expenses retirees had trouble affording, according to the survey.

- Groceries (31%)

- Utilities (26%)

- Gasoline (24%)

- Credit card bills (22%)

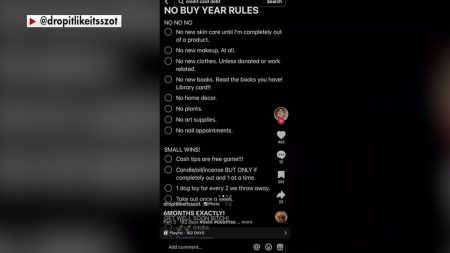

“As costs rise, some retirees have gone to extreme measures to stretch their savings,” Clever said in its survey report.

Some (18%) of retirees have skipped meals and 24% have skipped medical treatment or appointments to stretch their savings, the survey said.

If high-interest debt is preventing you from saving more for retirement, consider paying it off with a personal loan at a lower interest rate. Visit Credible to get your personalized rate in minutes without affecting your credit score.

INFLATION CAUSING AMERICANS TO CUT BACK ON SAVINGS: HERE’S HOW TO STAY ON TRACK

Finances causing anxiety for more than half of Americans

Current economic conditions are not only affecting Americans’ savings, but it’s also taking a toll on their mental health, a survey by Betterment at Work found. Seventy-one percent of respondents said their finances caused them anxiety and 88% say rising costs of living have noticeably increased their financial anxiety this year.

These are the most troublesome financial stressors, Betterment at Work found.

- Inflation increasing cost of living (61%)

- Credit card debt (30%)

- Stock market volatility (26%)

- Apartment and rent increase (18%)

- Buying a home (11%)

- Job loss and stability (11%)

- Student loan debt (10%)

“The shifting economic tides have impacted employees and employers in different ways,” Kristen Carlisle, Betterment at Work general manager, said in a statement. “Many workers are struggling with new challenges and financial anxiety, meaning financial wellness benefits have become more important than ever.”

If current expenses are preventing you from saving more for retirement, you could consider paying down high-interest debt with a personal loan at a lower interest rate to help reduce your monthly payments. Visit Credible to speak with a loan expert and see if this option is right for you.

MANY AMERICANS BELIEVE INFLATION, THE ECONOMY WON’T IMPROVE IN 2023: POLL — HERE’S HOW TO MANAGE YOUR FINANCES

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read the full article here