To avoid years and years of debt after college, it is important to make financially smart decisions while you are still in school. This means doing things like applying for scholarships often and following a steady budget.

Over the few years you’re in college, student loan debt can quickly add up and be stressful on young graduates. So, while you’re in school, do what you can to end up with as little debt as possible going into your professional career.

The following are some tips you can follow the summer going into the fall semester to financially plan for the coming years.

HOW TO PAY FOR COLLEGE WITH NO MONEY

- Apply for scholarships

- Get a summer job

- Budget your school year expenses

- Start building good credit

- Create a plan for paying off student loans

1. Apply for scholarships

When it comes to scholarships, do not hesitate. You will be thanking yourself later.

You can get awarded so much money in scholarships, and applying is often very easy. Dedicate time in the summer to finding and applying for as many scholarships as you can. In the long run, this is going to save you a ton of money.

2. Get a summer job

With classes in session, it may be difficult to also balance a job. On campus jobs are always a good option for students to make a little extra money, but you’ll probably be able to earn a lot more cash in the summer when you have more free time.

Working a summer job can help you cover your expenses throughout the school year when your income is lower.

HOW TO NEGOTIATE A BETTER COLLEGE FINANCIAL-AID PACKAGE

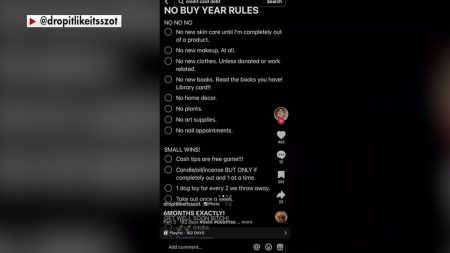

3. Budget your school year expenses

During the summer leading up to the fall semester, try to create a rough budget of what your expenses are going to be and plan out how you are going to cover them.

Carve out some room in your budget for your savings account as well just in case you wind up in a financial emergency and need to dip into it for some extra cash.

Consider things like transportation costs, food and spending money.

4. Start building good credit

If you don’t have a credit card yet, now is a good time to get one. You’ll want to start building your credit when you’re younger, so that you get approved for loans that you’re going to need in the future.

7 MONEY MOVES NEW COLLEGE GRADUATES SHOULD BE MAKING

Look for credit cards with no annual fees and one that gives rewards for spending. That extra rewards cash will come in handy while you’re on a tight college budget.

5. Create a plan for paying off student loans

It’s never too early to start thinking about your student loans. How much debt you’ll have totaled up at the end of your college career will depend on several factors, like the price of tuition and how many scholarships and how much financial aid you receive.

About 45.3 million Americans have student loan debt, totaling over $1.7 trillion, according to Credit.com. That debt can follow you around for years if not handled properly.

Map out how much you are likely going to end up with in student loans and figure out a plan of action to pay that off. Maybe that means getting an on campus job for some extra money to put toward the loan, or cutting down on your other expenses for the time being.

Also, remember that you don’t have to wait until you are done with college to pay your loans. You can make payments while you’re still in school to get that amount as low as possible when you graduate.

Read the full article here