The challenge of paying off thousands of dollars of debt can be daunting for many Americans.

One Texas woman paid off $70,000 in debt in just two years by using a unique method of saving and spending.

Jasmine Taylor of Amarillo became debt-free by “cash stuffing.”

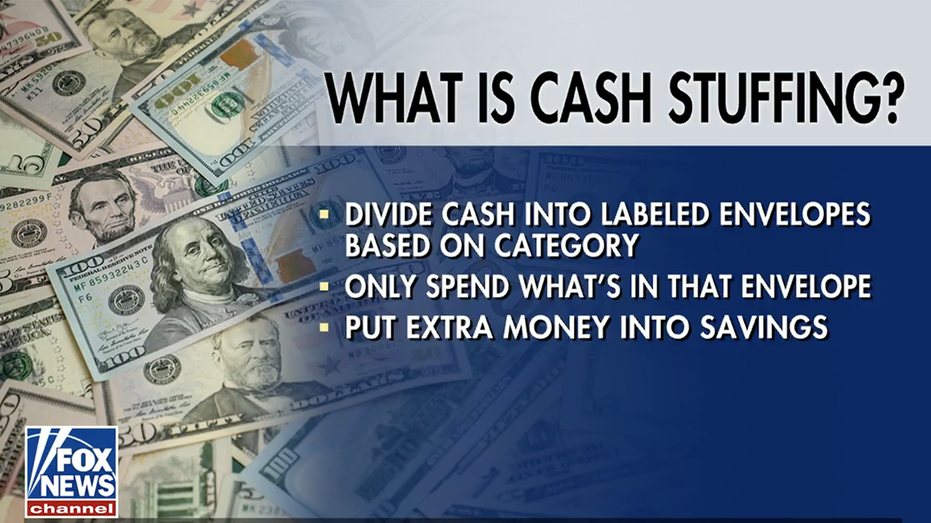

The term refers to the placing of cash into labeled envelopes and ditching credit and debit cards.

FLORIDA COUPLE PAID OFF $190K IN STUDENT LOAN DEBT IN 27 MONTHS: ‘GET A BUDGET’

Taylor joined “Fox & Friends” on Wednesday morning to discuss how she accomplished her goal — and why cash stuffing worked for her.

“I was honestly willing to try anything to start digging myself out of the hole,” she said.

After doing a YouTube search on various ways to get out of debt, Taylor settled on cash stuffing — using cash only, and separating it into specific categories based on need.

Taylor has various envelopes for critical items such as groceries, shopping and gas, she also said.

FLORIDA-BASED MOM PAYS OFF $40K IN STUDENT LOAN DEBT AFTER LIVING ‘PAYCHECK TO PAYCHECK’

Cash envelopes for special saving needs like Christmas presents, birthday presents and car maintenance expenses are also important to have, she said.

“When they come up, you typically have to dig into your savings … So you save in the short term for those big expenses,” she added.

The idea is to only spend the cash that is in that envelope, she said. And once it’s gone, it’s gone.

“We tend to overspend, to impulse spend — and cash stuffing really gives you a stopping point,” Taylor continued.

OHIO WRITER PAID OFF $48K IN STUDENT LOANS IN 14 MONTHS: IT WAS ‘AN ADVENTURE’

She credits cash stuffing with meeting her goal and achieving a debt-free life.

“It’s still surreal to me,” she said.

Taylor has even created a budgeting brand, Baddies and Budgets, in which she offers tips and tricks for budgeting.

She also has her own products for sale: budget binders, cash wallets and more.

Her number-one tip for people looking to get out of debt?

Start tracking every expense and frequently reevaluate where your money is going.

For more information on Taylor’s brand, visit baddiesandbudgets.com.

Read the full article here