Advanced Micro Devices stock fell Wednesday despite the company’s massive increase to sales guidance for its datacenter artificial-intelligence chips.

It might be a sign the boom in AI spending has been priced in, at least in the short term.

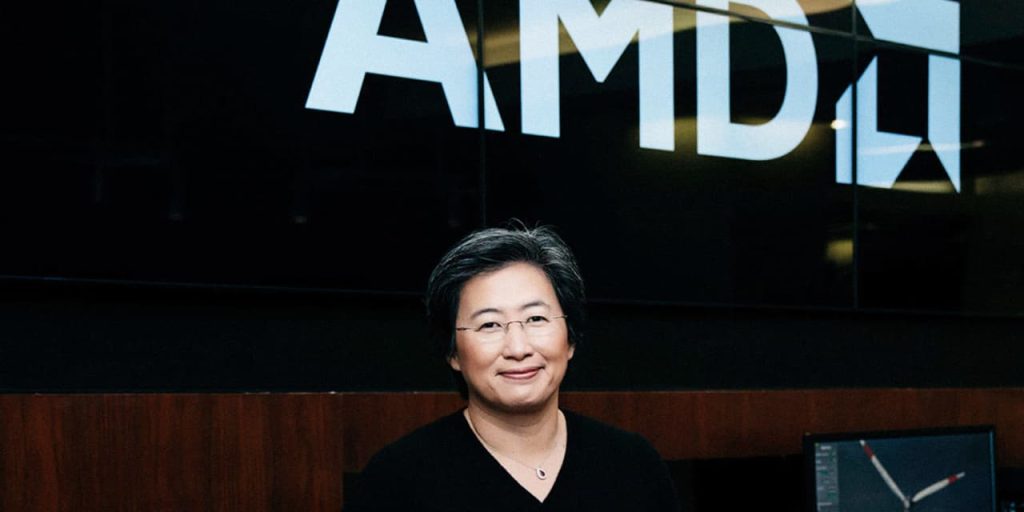

AMD

stock was down 3.7% in early trading Wednesday at $165.65. That’s a small dent in the stock’s 96% rise over the last 12 months but the context suggests a tougher road for further gains.

Coming into AMD’s earnings release, the narrative was all about the company’s flagship MI300 chip and how much market share it could win as the second choice behind

Nvidia

hardware to power AI technology.

The company on Tuesday lifted its 2024 forecast for MI300 chip revenue to $3.5 billion, up 75% from its previous guidance for $2 billion. While that was a sign of strength, some analysts had suggested AMD could forecast $6 billion or higher.

“While $3.5 billion is far lower than some unhelpful ‘whispers,’ AMD’s conviction in an [AI] accelerator total addressable market of $400 billion+ in 2027 (from $45 billion in 2023) and its confidence that it can procure more supply, seem to be more indicative of their real trajectory,” wrote Melius Research analyst Ben Reitzes in a research note on Wednesday.

Reitzes kept a Buy rating and $192 target price on AMD stock, based on a price-to-earnings multiple of 25 times its forecast 2026 earnings.

Much of Wall Street had a similar reaction. CFRA Research’s Angelo Zino raised his target price to $200 from $150 and kept a Buy rating on the stock, arguing the company is likely still being conservative on its AI chip forecasts. Benchmark Research’s Cody Acree raised his target to $187 from $145, keeping a Buy rating and calling for investors take advantage of any pullback in the price.

However, AMD stock’s drop suggests that anything less than a huge guidance raise will be treated harshly when it comes to popular AI stocks this earnings season. That is especially the case for AMD and others with high valuations; AMD trades at a forward price-to-earnings multiple of around 44 times, according to FactSet.

Intel

stock also dropped following its latest earnings report when its revenue forecast missed expectations.

Investors in the AI chip sector will now turn to

Nvidia,

which will report its fourth-quarter earnings on Feb. 21.

Nvidia shares were down 2% in early trading Wednesday, while Intel was down 0.9%.

Write to Adam Clark at adam.clark@barrons.com

Read the full article here