It turns out, Wall Street doesn’t think the new labor contracts are an existential problem or the Detroit Three auto makers.

Shares of

Ford Motor

(ticker: F),

General Motors

(GM), and

Stellantis

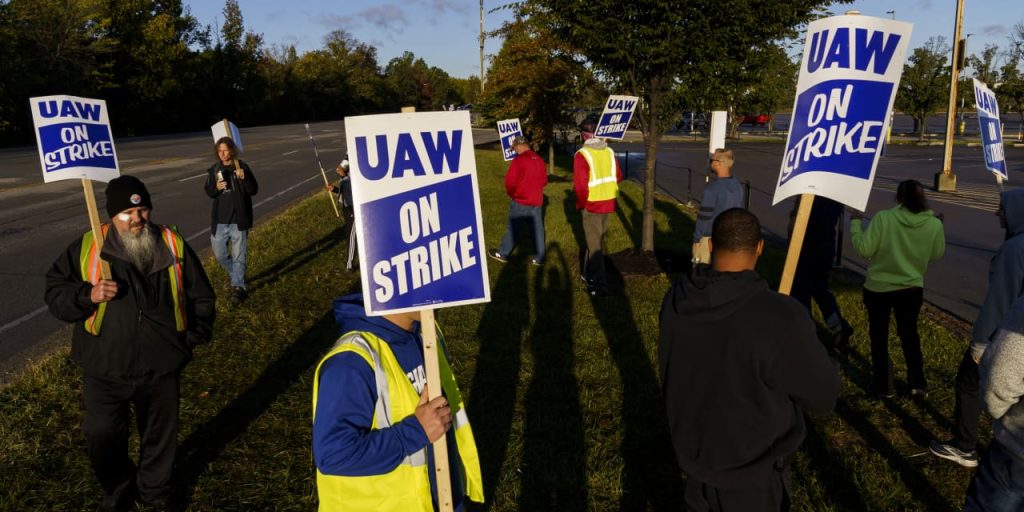

(STLA) all caught upgrades to Buy on Wednesday. The 2023 United Auto Workers strike left shares too cheap. Now that all three companies have tentative agreements with the union, the stocks can recover.

Barclays analyst Dan Levy upgraded shares of Ford and GM to Buy from Hold. His price target for Ford stock stayed at $14; it enters Wednesday trading below $10. His price target for GM stock is also unchanged at $37; it closed on Tuesday at $28.20.

It’s possible to upgrade to Buy without changing a target because the stocks are down. Coming into Wednesday trading, Ford and GM shares were down about 35% and 27%, respectively, since the start of July, when labor issues started to weigh on investor sentiment, while the

S&P 500

was down about 6%.

That leaves Ford stock trading for about 5.5 times estimated 2024 earnings. GM shares trade for 4.2 times. Levy called the valuations “historically cheap” in a research report.

Ford stock has traded closer to 7 times on average for the past few years, and GM shares closer to 6 times.

Simply, the companies’ agreements with the UAW are catalysts. Levy as well as analysts a Benchmark, RBC, and BofA Securities have pointed out that auto maker shares tend to rebound after labor deals are wrapped up. UAW negotiations, of course, are only one factor impacting auto stocks. Higher interest rates and slowing EV sales have also weighed on investor sentiment lately.

Whether or not the new labor contracts, including wage increases of more than 25% over four and a half years, will cripple auto makers versus nonunion competition have been a debate among investors for weeks.

The new contracts will cost billions of dollars more per year, and need to be offset with productivity gains and pricing. Costs go up after years of high inflation.

“Honestly none of this was really much of a surprise,” RBC analyst Tom Narayan told Barron’s recently. He rates GM and Stellantis shares at Buy, and Ford shares at Hold. His ratings were unchanged in recent days.

Bernstein analyst Daniel Roeska upgraded Stellantis shares to Buy from Hold. His price target went to $26.40 from $18.50. Like Levy, the end of the strike and labor talks was the catalyst.

Stellantis stock was up about 7% since the start of July. That’s far better than the performance of Ford and GM shares, but Stellantis is a more global company, less impacted by North American operations. What’s more, it’s a cheaper stock. Stellantis shares trade for 3.3 times estimated 2024 earnings.

With the upgrade, about 60% of analysts covering GM stock rate shares Buy. The average Buy-rating ratio for stocks in the S&P 500 is about 55%. The average analyst price target is about $45 a share.

For Ford, about 43% of analysts covering the stock rate shares Buy. The average analyst price target is about $13.60.

Stellantis is the most popular stock, but it’s covered mainly by different analysts who work from Europe. Overall, more than 90% rate shares Buy. The average analyst price target is about $25 a share.

Stellantis shares were up 0.4% in overseas trading. GM shares gained 1.6% in U.S. premarket trading. Ford shares were also up about 1.6%. S&P 500 and

Dow Jones Industrial Average

futures were both down about 0.3%.

Write to Al Root at allen.root@dowjones.com

Read the full article here