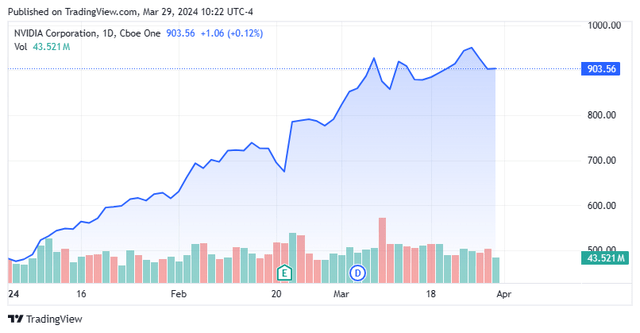

Thursday wrapped up quite a profitable first quarter of 2024 for investors. Thanks in good part to huge enthusiasm for the AI revolution and blowout earnings from AI concerns like NVIDIA Corporation (NVDA), Super Micro Computer, Inc. (SMCI), and even Advanced Micro Devices, Inc. (AMD), the Nasdaq powered to a 9.1% gain for the quarter. NVDA rose 82% during the quarter by itself and now boasts a stunning market cap of north of $2 trillion. The S&P 500 did even better than its tech-heavy brethren with a rise of 10.2%, its best quarterly performance since 2019.

Seeking Alpha

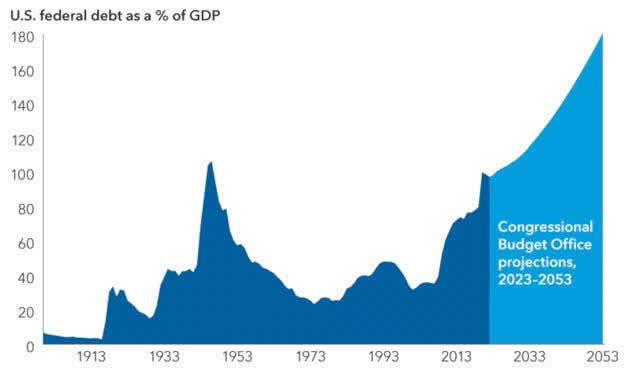

Economic growth continues to be strong with fourth quarter GDP growth being revised up to 3.4% on Thursday. However, a good portion of economic growth and I also would say market performance is being driven by roughly $500 billion in deficit spending a quarter by the federal government. With the federal debt-to-GDP ratio north of 120% and at an all-time high in the nation’s history, this is clearly non-sustainable. However, that’s a topic for a future column.

CBO, Capital Economics

As we start trading in the second quarter of 2024 this week, here are some surprises I think have a decent likelihood of happening in the second quarter that don’t seem priced into the market.

The Federal Reserve Disappoints:

At the beginning of 2024, investors projected that the central bank would cut the Fed Funds rate six times by 25bps each in the coming year, based on futures. The central bank has remained on hold throughout 2024 to this point. Futures are now pointing to just three interest rate cuts for the year, the first hopefully at the FOMC meeting in June.

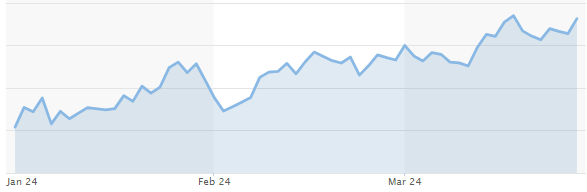

I think investors will likely continue to be let down by Chairman Powell and the central bank cuts rates by two times at the most by the end of the year. Inflation has proven to be “stickier” than hoped in 2024 as March’s CPI and PPI readings confirmed. Oil moved up some 20% in the first quarter and will continue to be a significant headwind on the inflation front.

WTI Oil Prices (MarketWatch)

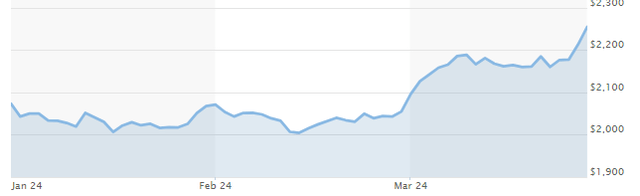

Not surprisingly, given how resistant inflation levels have been in recent months, gold surged to all-time highs during the first quarter.

Gold Prices (MarketWatch)

The federal government’s excessive deficit spending fuels inflation in and by itself and isn’t going anywhere. In addition, some $8 trillion in federal debt obligations needs to roll over in 2024 as well as another $2 trillion or so that will be added to the national debt this year. I think Chairman Jay Powell will cut rates by 25bps in June to maintain credibility, even if futures are only currently pricing 40% of this happening. Powell also took a harder line on the potential action in commentary on Wednesday.

I still think the Fed chairman would like to avoid taking any action in July (in between the RNC and DNC conventions) and in October (just before the election) to avoid any appearance of being political. That leaves December’s meeting as the most likely scenario for the second and final cut of the year, provided inflation hasn’t moved up.

I look for the yield on the 10-year Treasury to fluctuate between 4% to 4.75% in the quarter. The lack of significant interest rate cuts will add additional stress to the commercial real estate sector which already is under considerable duress. Bottom line, investors looking for three rate cuts from the Federal Reserve this year are likely to be disappointed. They may not even get two rate cuts in 2024.

Oil Tops $100 a Barrel:

Speaking of black gold, it’s getting easier to see a scenario where oil tops the $100 level at some point in the second quarter. It’s already at five-month highs of just over $85 a barrel on WTI. Russia recently cut oil production as part of the latest OPEC+ agreement. Throughput has been cut by some one million barrels a day in the country thanks to Ukrainian attacks on the country’s refinery facilities. As a result, Russia also has banned all gasoline exports for six months. The latest drone attack occurred earlier this week on Russia’s third-largest refinery complex, some 800 miles from the Ukrainian border. The current administration has tried to get Ukraine to not hit these facilities, both to prevent the war from escalating further and to prevent a catalyst for more hikes in domestic gasoline prices in an election year. These appeals seem to be falling on deaf ears at the moment.

In addition, earlier this week Israel launched its own bombing attack and took out some senior Iranian commanders in the country’s embassy in Syria. This is almost sure to bring retaliation and potentially escalate the situation both in Gaza and potentially Syria. Yemen still is using missiles and other methods to prevent Western shipping from using the Red Sea as a safe transport zone. More than 10% of the world’s crude uses this passage. This has caused considerable logistical challenges as a good portion of this tonnage is now forced to go around the Cape of Good Hope in Africa, thousands of miles away.

$100 a barrel oil would bring $4 a gallon gasoline prices with it. This obviously would be a big setback on the inflation front and undermine consumer confidence as well at a time when only 25% of the country believes it’s moving in the right direction and over 60% are living paycheck to paycheck.

Russia/Ukraine Conflict:

Finally, there could potentially be a major Russian offensive in late spring as the ground becomes hard, allowing for full mobility of armored vehicles. This could lead to a breakthrough in the conflict that largely has been stalemated for more than a year. I think most investors believe this status quo will continue and could be blindsided if the front collapses, something high-level Ukrainian officials have warned about.

Russia’s armed forces enjoy air superiority and have increased the use of aerial bombs on the front dramatically in 2024. They also have a large manpower and artillery advantage. After more than two years of fighting, the Ukrainian armed forces are low on ammunition, manpower, and morale. The recent loss of the fortress city of Avdiivka took with it the last/best defensible line in the Donbas. In short, the conditions are right for a potentially significant breakthrough that could alter the situation in Ukraine.

Conclusion:

None of these scenarios are conducive to stocks moving higher. In fact, if any of them play out as projected, equities will likely have at least a “hiccup” if not a significant decline. It’s hard to see any scenario where peace breaks out in Ukraine in the second quarter. Now, oil and interest rates could move down contrary to my projection. However, for that to happen, the economy would have to slow drastically. This also would likely lead to a pullback in stocks.

Given this, my portfolio remains positioned very conservatively awaiting lower entry points. Roughly half is in short-term Treasuries yielding around 5.4%. Almost all the rest is within covered call positions that provide downside risk mitigation. I also continue to be overweight the energy sector even as it provided a 10.7% gain in the first quarter.

Read the full article here