Investment Thesis

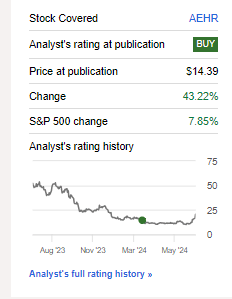

I published on Aehr Test Systems (NASDAQ:AEHR) in late March (before its fourth-quarter FY2024 results and outlook) with a positive thesis that the weakness had been priced into the stock and FY24 guidance, arguing that the stock is better positioned to outperform expectations as SiC demand picks up in FY25. I’m now updating my thoughts on Aehr post-earnings. I believe my positive thesis has played out, and now the market has priced in a lot of the good news, with the stock surging +22% after earnings. I continue to be buy-rated on the stock for longer-term investors as I think there could be more upside to come in 2025.

SeekingAlpha

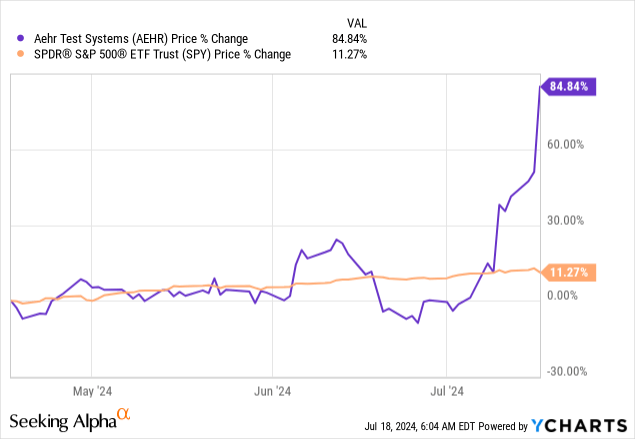

I see Aehr as an attractive pick into FY25 on two factors: the company’s acquisition of Incal Technology that’ll help solidify its venture into the AI industry, and tailwinds from EV-led SiC demand recovering in 1HFY25. I do, however, warn near-term investors of having high expectations for 2H24. The reason I recommend caution for the near-term investor is that a lot of the good news from Aehr’s better-than-expected results and new market opportunities through its acquisition have been priced in. In fact, Aehr’s stock is up ~85% over the past three months and around 64% over the past month, significantly outperforming the S&P 500 on both spreads; the three-month chart of Aehr against the SPY is shown below.

YCharts

Management noted on the earnings call:

“While most forecasters are saying that the inflection point for silicon carbide and electric vehicles is now the second half of 2025 into 2026, from our many meetings with semi-suppliers, tier-ones, and electric car companies themselves, it’s even more clear now that silicon carbide is the plan of record for electric vehicles and preferred over IGBT.”

I think this inspires confidence in the recovery of SiC and EV demand, which is a positive for EV-exposed players like Onsemi (ON), which accounts for a big chunk of Aehr’s total sales. This is most likely something that’ll play out more visibly next year rather than this year. I do think there’s more upside from here as management noted the current framing they’ve set for FY25 takes a “pretty conservative stab at the silicon carbide things” and focuses on other high-volume markets; this means the better-than-expected guidance doesn’t even account for a material rebound in auto demand, which inspires confidence in Aehr being able to diversify its revenue streams and grow its top-line simultaneously.

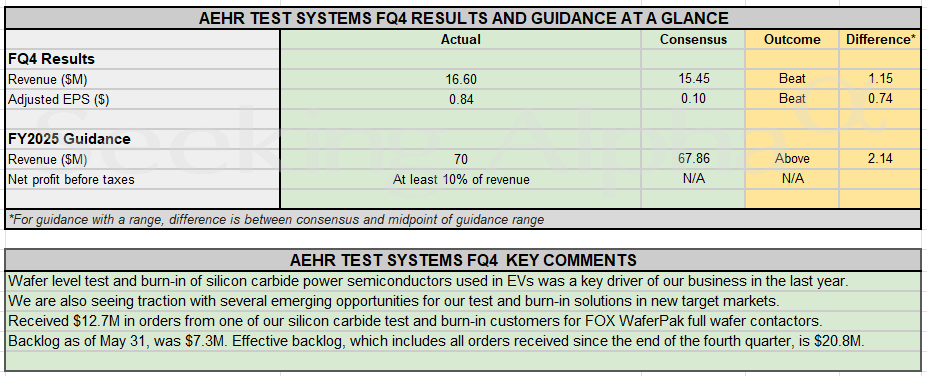

My thesis on Aehr is oriented towards more long-term investors to add on any pullbacks this quarter. I see more momentum for the company once SiC picks up in 2025 and better orders from its position in EV and AI markets. I think the stock remains a safe bet for longer-term investors due to secular tailwinds from the EV-led demand. In spite of the rough EV market this year, the company managed to report revenue of $16.6 million, down 25% year-over-year, ahead of market expectations of $15.45 million, and earned an adjusted $0.84 per share, while analysts expected $0.10. I think the beat is based on market expectations already being low, as I argued back in March, but I do see another beat next quarter. My disclaimer for investors looking to add this name is to choose their entry points wisely.

What do 4Q24 results & FY25 outlook tell us?

Aehr reported its last quarter of FY24 earlier this week, beating expectations and guiding for better-than-expected revenue in FY25; the big takeaways from the earnings call are two, in my opinion.

The first is management’s guidance for FY25 which boosted investor confidence in the stock, and piggybacking on this is management’s plans to diversify its business. CEO Gayn Erickson noted: “Our full-year revenue and net income results exceeded our previously provided guidance and surpassed analyst consensus.” Indeed, the company guided for total revenue of at least $70 million and net profit before taxes of at least 10% of revenue compared to a consensus of $67.86 million, as shown in the image below.

SeekingAlpha

The second is management’s acquisition of Incal Technology, a company that manufactures computer peripheral equipment. Aehr plans on acquiring Incal for $21 million, including $14 million in cash. The reason this is good news for Aehr is because it strengthens its position in the AI industry; this is what Erickson had to say about the benefit of the acquisition on the call:

“They [Incal] have a particularly strong new product family of ultra-high-power test solutions for AI accelerators, graphics and network processors, and high-performance computing processors. Their ultra-high-power package for our test capabilities, combined with Aehr’s industry-leading lineup of wafer-level test and reliability solutions, uniquely position us to fully capitalize on the rapidly growing opportunity within the AI semiconductor market as a turnkey provider, a reliability and test that spans from engineering to high-volume production.”

I like the acquisition for Aehr as it provides leverage for the company to penetrate new target markets for test and burn-in and wafer-level burn-in for artificial intelligence processors, flash memory devices, hard disk drive magnetic read/write heads, data centers, solar power conversion, and integrated circuits used for optical IO Communication between chipsets and processors. For reference, these are the new target markets mentioned by management on the call; Erikson noted that hard disk drive application could be a 10% customer, production forecast for AI is a 10%, and GaN or gallium nitride could be a 10% customer as well. This translates to three different 10% customers aside from SiC, and that’s what gives me optimism in Aehr even if the near-term outlook on EV remains mixed. This quarter already proved that Aehr can outperform in spite of slower EV demand in the second half of their FY24.

There’s a third thing that this quarter told us about Aehr, which is that a lot of the positives have been factored into the stock price and outlook after earnings, but there remains no clear near term trigger for the EV market to rebound. I’d more bullish on Aehr had we seen indication of a turnaround moment for EV demand post-inventory correction because that would translate into tailwinds for SiC demand and Aehr. I don’t think this an issue for Aehr alone but a broader industry wide cyclical downturn pressuring auto and industrial markets. SiC remains “crucial for EV power systems operating in environments with elevated temperatures due to energy dissipation and thermal cycling.” What SiC offers is “higher breakdown voltage, faster switching speeds, lower on-resistance, and better thermal conductivity” enhancing the performance of EVs. The functionality of SiC in this market makes me more confident about the longer term secular tailwinds at play for Aehr. Nonetheless, there remains a very real near term risk on the stock price performance considering the recent run up.

Part of the reason I continue to be positive on Aehr now is because I think management will be discipline in diversifying their footing after their vulnerability to the auto market and largest customer, Onsemi, weighed on earnings in 1H24.

Valuation

Aehr stock is still not cheap but I think it has the growth drivers that’ll enable the company to achieve the forecasted growth. Aehr’s Price/Earnings ratio is 30.8, and its EV/Sales ratio is 7.8 for CY2024 compared to a peer group average ratio of 33.3 and 7.5, respectively, based on data from refinitiv. I think Aehr has more secular tailwinds working in its favor than its valuation gives it credit for particularly when contextualizing the company in the semiconductor peer group and after the Incal acquisition. Aehr remains a growth stock in my book, and I think it’ll see more upside as its serviceable available market expands into next year.

What’s Next?

I think Aehr still has more to benefit from into 2025, and I remain confident that management’s strategic efforts to diversify into new target markets could support outperformance. The key to making this happen for Aehr is its recent Incal acquisition, which will provide support through its ultra-high-power capabilities for AI accelerators, GPUs, and high-performance processors. AI is leading the industry outperforms this year so far and the market seems to be pricing in AI exposure to Aehr after the acquisition. I’m watching to see how management’s diversification impacts top-line growth and gross margins next quarter.

Read the full article here