AXP stock trades near all-time-high prices

Stockholders of American Express Company (NYSE:AXP) have been rewarded handsomely recently. As illustrated by the chart below, the stock has enjoyed a price advancement of nearly 50% in the past 12 months alone, far outpacing the S&P 500’s (SP500) ~30% gain (which is already terrific by itself).

Looking ahead, there are certainly several reasons to keep the momentum going. The top factor in my mind is its customer base. AXP’s strong performance recently was driven by a combination of positive catalysts: a rise in revenues, increased net interest income, and also higher card member spending levels. The company continues to see strong demand from Millennial and Gen Z customers. For example, this group comprised more than 60% of new accounts acquired worldwide in the March period. A reputable brand name, combined with this affluent client base, positions AXP very well for card member spending levels. Moreover, its new digital solutions could further enhance the experience of this group of customers.

Seeking Alpha

Against this background, the thesis of this article is to caution investors about the risks under current conditions and argue for a HOLD thesis.

First, the provision for credit losses soared about 20% recently, reflecting drastically higher levels of net write-offs (see the footnotes quoted from AXP’s recent 10-Q filing). This is a very concerning sign in my view given the macroeconomic uncertainties ahead.

Total loans and Card Member receivables increased 12 percent year-over-year, as our Card Members continue to spend and build balances. Provisions for credit losses increased, primarily driven by higher net write-offs, partially offset by a lower net reserve build in the current year. Net write-off and delinquency rates remained best-in-class, supported by our premium global customer base, our strong focus on risk management and disciplined growth strategy.

With the persisting high inflation and high mortgage rates, I see good odds for higher delinquency rates and default rates in the near future.

Of course, these issues would negatively impact all credit card companies and not only AXP. However, there are a few factors in my mind that could make AXP more sensitive to credit losses during an economic downturn compared to its peers. The top one is AXP’s reliance on charge cards. Unlike traditional credit cards with a spending limit, AXP primarily issues charge cards, requiring full payment each month. This can be beneficial in normal times as it reduces credit losses. However, during a downturn, customers might struggle to pay their balances in full, leading to potential defaults. In addition, AXP cards also charge higher interest rates compared to some traditional credit cards. This can make it more difficult for customers carrying a balance to pay it down quickly, especially during periods of economic hardship.

Second, we are also seeing considerable valuation risks at the current price levels even when its projected growth is factored in, as detailed next.

AXP stock: growth outlook and valuation

AXP currently trades at an FWD P/E of around 18.2x, which is considerably higher than the median P/E of its sector (about 10~11x only). Its current P/E is also higher than its historical average. Its median P/E in the past 7 years is about 15x.

When analyzed from a GARP (growth at a reasonable price) perspective, the stock seems costly too, in our view. The chart below shows the consensus EPS estimates for AXP stock in the next 5 years. Based on the chart, its EPS is expected to reach $12.94 by the end of fiscal year 2024 and then increase to $14.92 by the end of fiscal year 2025. This translates to a compound annual growth rate (“CAGR”) of 4.6% in the next 5 fiscal years. At an FWD P/E of 18.2x, a 4.6% projected growth rate implies a PEG ratio (P/E growth rate ratio) of almost 4x, far higher than the gold-standard of a 1x PEG for picking GARP stocks.

Seeking Alpha

Other risks and final thoughts

In terms of upside risks, the use of PEG ratio can be a bit unfair for stocks like AXP that pay regular dividends. For dividend stocks, we found the following PEGY ratio Peter Lynch promotes to be more reasonable:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio below 1x.

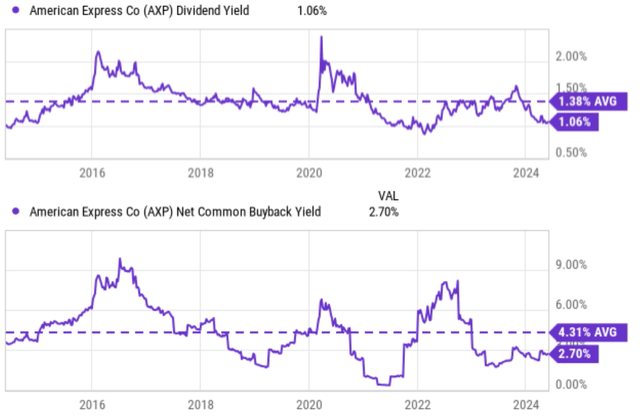

As seen in the chart below, AXP is paying a dividend yield of about 1% at this point. Once we divide the above FWD P/E by the sum 4.6% projected and CAGR and ~1% dividend yield, AXP’s PEGY ratio is about to be 3.25x, significantly lower than the usual PEG ratio but still far above the 1x threshold.

Seeking Alpha

The company’s consistent share repurchase is another upside risk. As illustrated by the chart above (bottom panel), in addition to dividends, the company also rewards shareholders generously via share repurchase. Actually, shareholders have been rewarded mainly through share repurchases. Over the past 10 years, the stock’s net common buyback yield has been on average 4.3%, more than three times higher than its average dividend yield of 1.38%. In 2023 alone, the company bought back 21.6 million AXP shares at an average price of $161.21 a share, for a total of around $3.5 billion. In contrast, it paid “only” $1.8 billion in common stock dividends. We ourselves prefer share buybacks over cash dividends, and therefore consider such a capital allocation strategy as a positive.

All told, for existing shareholders, we do not see anything wrong with holding a wonderful business like American Express Company, even at a valuation premium (especially if you factor in the tax consequence if you liquidate your shares). The stock features a well-rounded combination of steady growth, excellent financial strength, and some level of income (which is augmented substantially by the aggressive share repurchases). However, for potential investors, we are concerned about the uncertainties ahead given the recent surge in credit-loss provisions and also the valuation risks. Its current valuation has priced in yeas of growth already, in our view, judging either by the typical PEG ratio or the PEGY ratio that Peter Lynch promotes.

Read the full article here