Among the biggest pieces of news to come out of Berkshire Hathaway Inc.’s (BRK.A, BRK.B) earnings is the announcement that the company sold half of its stake in Apple Inc. (NASDAQ:AAPL) stock over the past several months, or roughly $80 billion with (more than 2.5% of the company). After Apple’s recent fiscal Q3 earnings announcement, we understand why Berkshire Hathaway sold its stake.

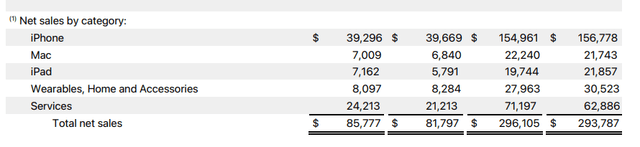

Apple Segment Performance

Apple saw strong performance in certain segments, but growth remained modest.

Apple Press Release

The company saw $39.3 billion in iPhone sales showing a 2% YoY decline, as the segment appears to balance out. Mac saw 2% growth, as it remains a dominant computing platform. iPad especially outperformed with double-digit growth, not surprising given the lack of new iPad launches in 2023.

It’s also worth noting that for the last 3 quarters, iPad continues to underperform versus the prior year. Overall, for the past 9 months, the company’s revenue has only increased by less than 1%.

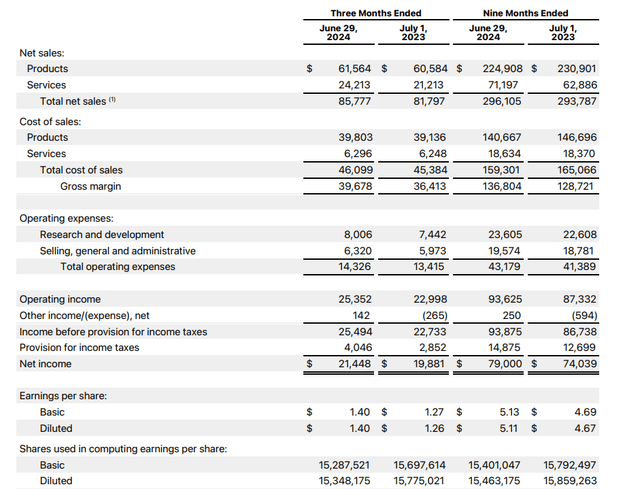

Apple Financial Results

The company’s financial results show it has a strong business generating massive profits, but without the profits to justify its valuation.

Apple Press Release

Specifically, the company’s cost of net sales has managed to go down even while revenue has grown as the company has improved its margins. Revenue went down by 1% while the cost of sales went down by roughly 3.5%. While it’s great the company can keep reducing costs, these low single-digit movements show how optimized the company’s existing business is.

The company also did see some increase in operating expenditures, as it’s continuing to invest both in general and administrative functions and research and development. The growth in these segments increased by roughly 5% for the company, it’s the largest source of expensive growth. Still, lowering the cost of products helped it net overall.

At the end of the day, the company remains a profitable powerhouse with an operating income of $94 billion (annualized at $120 billion accounting for the holiday quarter). That’s annualized EPS for the company of ~$6.5 up from ~$6, which does look like a fairly impressive 8% growth. However, it’s worth noting that this comes with a 3% reduction in outstanding shares.

The company continues to spend virtually all of its cash flow on reducing shares outstanding, which drives EPS growth, but is artificial since it’s effectively your shareholder returns from current years being reinvested.

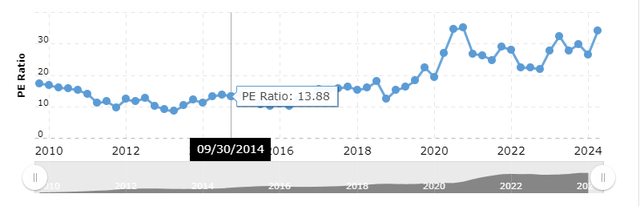

Apple Valuation

Apple has generated strong returns recently. However, most of that has been an expansion in the company’s multiples.

Macrotrends

The company spent much of 2010 to 2020 trading at a P/E ratio of ~13. Since then, the company’s P/E ratio has expanded to more than 30 (~34). That means that the company is trading at a 3% FCF from historic trading of ~8-9%. This is fine if the company is growing, but as growth slows down, we expect the company’s valuation to contract.

That’s a risk because it shows how the company’s share price can decline substantially without its profits changing, just from a shift in the opinion of the market. It’s a risk that’s worth paying close attention to.

Apple’s Conundrum

At the end of the day, Apple’s earnings show why Berkshire Hathaway sold.

Berkshire Hathaway and its famed investor CEO have long discussed their interest in investing in a wonderful company at a fair price. However, Apple has been trading above a fair price. The company, at a P/E of ~34, is trading at a 3% yield. That cash is going to a paltry 0.5% dividend and share buybacks.

The company’s size means it can announce record buybacks, like its $110 billion share buyback, however, that’s still just a few %, and it no longer has the massive cash position to buy back shares at a larger scale. The company managed to grow net income supported by lower product costs, but we don’t see costs as being able to be reduced forever.

Trading at a 3% yield with mid-single digit growth isn’t an appealing investment versus the S&P 500.

Thesis Risk

The largest risk to our thesis is that Apple is a strong and stable giant. The company continues to generate massive cash flow, improve its operations, and grow. In a market with fear, the company represents a stable opportunity. That could result in the company’s share price remaining higher for longer and driving strong shareholder returns.

Conclusion

We’re not surprised that Berkshire Hathaway took the opportunity to sell Apple. At today’s market prices, you can earn a higher return on your cash by investing in U.S. Treasury bonds versus investing in Apple with its paltry dividend and share buybacks. The company has continued to grow profits, but they don’t justify its lofty valuation.

We’re not surprised that Berkshire Hathaway sold, and it’s clear why Berkshire Hathaway did. The company is raising cash in an expensive market. We discussed here its success with that cash position and ability to drive resulting returns. As a result, we recommend against investing in Apple at this time and valuation.

Read the full article here