Intro

Ball Corporation (NYSE:BALL) is a well-established company that specializes in metal packaging for beverages, foods, household products as well as the aerospace industry. The company has a long history of steady revenue growth, and it has been successful in expanding its market share through strategic acquisitions and partnerships. BALL is also known for its commitment to sustainability, and it has set ambitious goals to reduce its carbon footprint and promote a circular economy.

BALL faces numerous challenges including operating in a highly competitive market, dealing with substantial levels of debt, and shifting consumer preferences. This article aims to provide an in-depth analysis of BALL’s business model and financial performance, as well as its prospects for future growth. By estimating the company’s intrinsic value using various valuation techniques, we hope to provide investors with valuable insights into whether BALL is a sound investment opportunity in today’s market.

Business Model

BALL is a leading provider of sustainable aluminum packaging solutions for beverage, food, and household products. The company’s innovative products are designed to meet the needs of its customers while minimizing their environmental impact.

BALL produces aluminum cans, bottles, and cups that are used by some of the world’s most recognizable brands. The company is committed to sustainability, and its products are infinitely recyclable, meaning that they can be recycled and reused indefinitely.

The company offers a variety of services to its customers, including can design, printing, and manufacturing. BALL’s packaging solutions are tailored to meet the specific needs of each customer, ensuring that their products are packaged in a way that is both functional and visually appealing.

BALL also provides aerospace and other technologies and services to governmental and commercial customers within its aerospace segment. The packaging side of the business is responsible for most of the company’s sales – about 87% – while the aerospace side only makes up about 13%. In 2022, BALL made a total of $15.3 billion in sales from both areas combined.

The company operates in four primary regions: North and Central America, Europe, South America, and Asia. BALL has a total of 90 plants worldwide, which are strategically located to serve its customers’ needs.

Performance

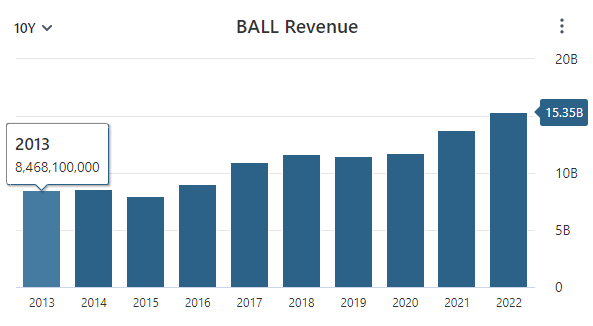

Over the past decade, BALL has demonstrated consistent growth in its revenue. In the most recent fiscal year, the company reported $15.3 billion in revenue, which is an 82.1% increase from ten years ago. Additionally, BALL has been able to increase its revenue in every year except two during the period.

Data by Stock Analysis

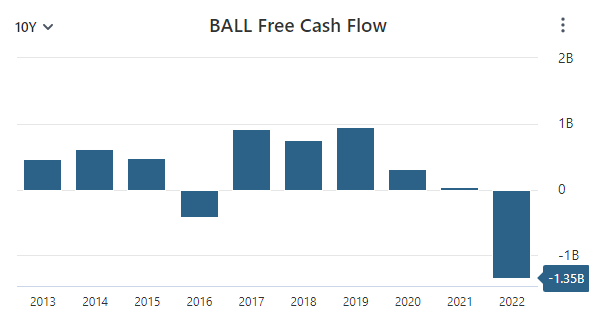

BALL’s free cash growth is a different story. In the most recent fiscal year, the company reported $1.3 billion loss in free cash flow. The company also reported negative free cash flows in 2016 as well.

Data by Stock Analysis

Negative free cash flows are usually a bad sign for investors because it shows that the company is not generating enough cash from its operations to fund its capital expenditures. It can also be a sign that the company is not generating enough revenue to cover its expenses. However, it’s not always a bad thing, sometimes it’s an indication that a company is investing heavily in future growth. As long as the company can generate positive returns on its investments and has a solid plan to generate positive free cash flow in future, negative free cash flow can be acceptable.

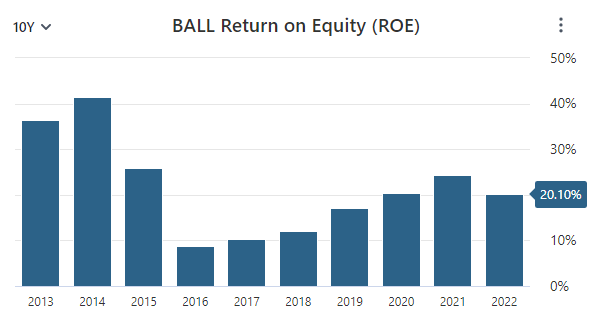

Speaking of generating high returns on investments, BALL has maintained a high level of profitability over the years. Over the past decade, the company has maintained an average return on equity of 21%, with just two years below 15%. Unfortunately, BALL achieved its highest ROE’s during the first three years of the period, but the company has reported ROE’s above 20% in each of the past three years.

Data by Stock Analysis

Turning to the company’s balance sheet, BALL has a lower interest coverage ratio than I usually like to see at 3.83. The company’s current ratio is below 0.78 which is also alarmingly low, and its debt-to-equity ratio is 2.71 which is alarmingly high. Altogether, I think the company would be best served to improve its balance sheet because companies with weak balance sheets carry significantly higher risk of bankruptcy.

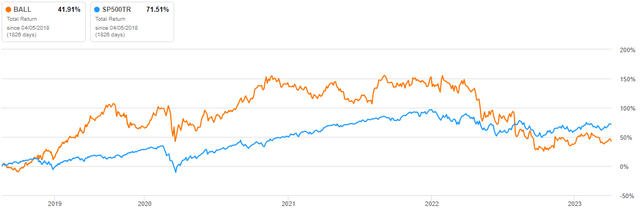

Overall, BALL’s financial performance hasn’t been the best and the performance of its stock has reflected this. Over the past five years, the company’s total return has lagged that of the S&P 500, with a total return of 42% significantly lower than the S&P 500’s total return of 71%. As a result, investors are questioning about BALL’s future prospects and potential for further growth.

Data by Seeking Alpha

Outlook

BALL’s Drive for 10 vision is its main strategy for how the company wants to grow the business. BALL has been following Drive for 10 since 2011 and it’s all about striving for perfection and working harder to ensure the company’s future success. It includes five main areas that the company believes are critical for growing its business and achieving its goals. These five areas are sometimes called “strategic levers” and they include the following.

-

Maximizing value in its existing businesses: This means BALL wants to get the most out of the businesses they already have. The company is working to improve relationships with its customers and suppliers and making strides to improve their existing processes and make them even more successful.

-

Expanding into new products and capabilities: Ball continuously seeks to start selling new products and developing new skills that it doesn’t currently have. This could help the company grow and reach new customers.

-

Aligning itself with the right customers and markets: Ball is making sure it’s selling its products to the right customers and in the right places. The company is focused on making data driven decisions to find the best customers and markets for its business.

-

Broadening its geographic reach: The company is focused on finding new markets to start selling its existing products where it makes sense. This could help BALL reach new customers and grow its business even more.

-

Leveraging its know-how and technological expertise to provide a competitive advantage: BALL has a lot of knowledge and expertise in its industry, and the company wants to use this to its advantage. BALL is focused on using its skills and technology to stand out from its competitors and be more successful.

In addition, BALL is laser focused on sustainability. Specifically, the company wants to reduce the amount of greenhouse gases it produces by 55% by 2030. The company also has the goal of completely eliminating its carbon emissions by 2050.

Furthermore, BALL believes that to be a successful business, it needs to help make the communities in which it operates healthy and strong. In 2022, Ball and its employees donated more than $8 million to over 2,800 non-profit organizations. BALL’s employees also spent over 30,000 hours volunteering to help these organizations build better, more sustainable communities.

But there are still some risks that could affect the business in the future. As of December 31, 2022, BALL has $9 billion of interest-bearing debt, which can have significant consequences for its business and investors. These consequences include making the company more vulnerable to economic, industry, or competitive challenges.

Additionally, BALL’s substantial debt means there’s less cash flow available for investing in its operations, acquisitions, and returning cash to shareholders. The company’s leverage can also limit its flexibility in responding to changes in the business or market conditions, which can put BALL at a disadvantage compared to competitors.

Other risks that BALL needs to navigate moving forward include intense competition in the packaging and aerospace industries. Many companies are competing to sell their products within these industries, and this can force prices to go down. BALL also faces competition from many types of materials that can be substitutes for its aluminum packaging products, especially plastic bottles for soda, glass containers for beer, and other types of containers made from different materials. This competition is particularly intense in the U.S. and Europe for plastic soda bottles and in Brazil for glass beer bottles.

Valuation

To evaluate BALL’s intrinsic value, we will conduct a comparative analysis and a discounted cash flow (DCF) analysis. Firstly, we will use Ball Corp’s historical highest, lowest, and median price-to-earnings (P/E) ratios over the past five years, as well as the sector median P/E ratio, to determine its fair value based on the market’s past valuations. We will apply these ratios to Ball Corp’s next year’s consensus EPS estimate to calculate its potential value under different scenarios.

We will analyze three scenarios: a bear case, a base case, and a bull case. The bull case implies a larger increase than the bear case’s downside, with a 350.13% gain vs a 6% loss. However, investors will see a significant loss of 26% if BALL is valued at the sector median multiple. The base case scenario, based on the 5-year median P/E ratio, suggests investors could potentially receive a lucrative 119.83% return on investment at BALL’s current share price. Overall, the comparative analysis indicates that BALL is undervalued with far more upside than risk at its current market price.

| Scenario | P/E | Next Year Earnings Estimate | Intrinsic Value Estimate | % Change |

| Bear Case | 16.03 | $3.11 | $49.85 | -6.26% |

| 5Y Median P/E | 37.59 | $3.11 | $116.90 | 119.83% |

| Bull Case | 76.97 | $3.11 | $239.38 | 350.13% |

| Sector Median Valuation | 12.63 | $3.11 | $39.28 | -26.14% |

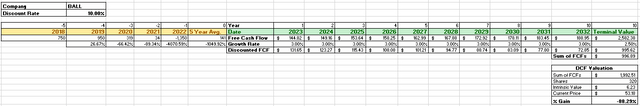

For the DCF analysis, we will use the average free cash flows of Ball Corp from the previous five years, which is $141 million. We will use a growth rate of 3% per year for the next ten years, considering the analysts’ predictions of limited growth in BALL’s revenue and earnings in the next few years. We will assume a growth rate of 2.5% per year following the 10th year to find the company’s terminal value. The discount rate used to discount the cash flows will be 10%, which is based on the long-term return of the S&P 500 when dividends are reinvested.

Author’s Work

Based on these inputs, the DCF analysis suggests an intrinsic value per share of $6.23 for BALL. This suggests that investors could experience a catastrophic loss of 88%. These discounted cashflow results are heavily skewed by the company’s $1.3 billion loss in free cash flow last year but this does highlight the importance of using multiple different valuation techniques to estimate the intrinsic value of a business.

The results of the comparative analysis and DCF analysis are drastically different making it difficult to pinpoint the company’s intrinsic value. The bottom line is that BALL is not obviously undervalued at its current share price.

Takeaway

BALL is a well-established player in the packaging industry. The company has a track record of impressive revenue growth, with strong revenue growth and a focus on generating free cash flow. Ball’s business model emphasizes the importance of innovation and sustainability, which has helped it establish a strong reputation in the market.

However, BALL is operating in a highly competitive market, dealing with substantial high levels of debt, and shifting consumer preferences. The company has demonstrated its ability to navigate these risks, but they remain a key challenge to the company’s growth prospects.

A comparative and discounted cash flow analysis suggests that the current market price of BALL may be overvalued or at least not undervalued enough to make it an attractive investment opportunity. With that said there are more appealing companies to invest in other than BALL. Therefore, investors should exercise caution when considering an investment in this company at its current valuation.

Read the full article here