Earnings of Bar Harbor Bankshares (NYSE:BHB) will likely remain stable in upcoming quarters. A lower average net interest margin will likely counter the effect of loan growth. Overall, I’m expecting the company to report earnings of $0.71 per share for the last quarter of 2023, and $2.94 per share for 2024. Next year’s target price suggests a small upside from the current market price. Based on the total expected return, I’m downgrading Bar Harbor Bankshares to a Hold Rating.

Economic Factors Present a Mixed Outlook for Loans

Loan growth has slowed down considerably this year after an impressive performance last year; however, this year’s growth is in line with the compounded average growth rate for the last five years. Moreover, the growth witnessed so far this year is somewhat in line with my previous expectations given in my last report, which was issued before the release of the first quarter’s results.

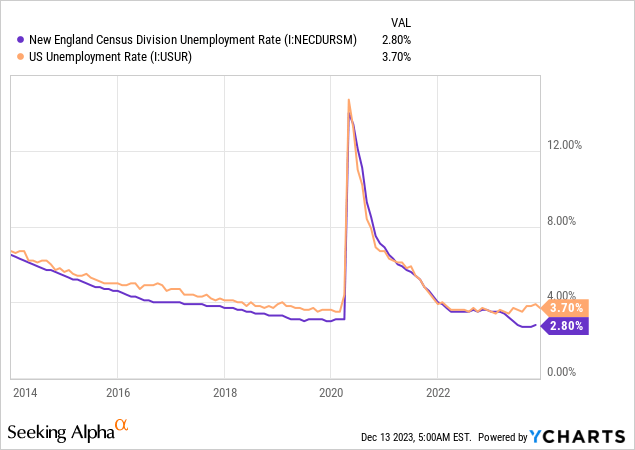

Macroeconomic factors currently present a mixed picture; therefore, I think loan growth will likely continue at the same rate as the first nine months of this year. Bar Harbor operates in the New England states of Maine, New Hampshire, and Vermont. The region’s labor market has performed very well in the last few months, which indicates a robust business environment. As shown below, the unemployment rate has dipped substantially in recent months.

Moreover, personal income is still growing at a satisfactory rate (near the 5% line in the graph below) despite a slowdown in recent months.

The Boston Fed

However, the environment for residential mortgages is still far from conducive. After stagnating in the latter part of 2022, house prices are on a steep uptrend once again, as shown below.

Considering these factors, I’m expecting the loan portfolio to grow by 1.0% in the last quarter of 2023 and 4.1% in 2024. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net Loans | 2,626 | 2,544 | 2,509 | 2,877 | 2,994 | 3,116 |

| Growth of Net Loans | 6.0% | (3.1)% | (1.4)% | 14.7% | 4.1% | 4.1% |

| Other Earning Assets | 704 | 822 | 848 | 574 | 611 | 623 |

| Deposits | 2,696 | 2,906 | 3,049 | 3,043 | 3,172 | 3,301 |

| Borrowings and Sub-Debt | 531 | 336 | 179 | 394 | 369 | 377 |

| Common equity | 396 | 407 | 424 | 393 | 411 | 428 |

| Book Value per Share ($) | 25.4 | 26.7 | 28.2 | 26.0 | 27.0 | 28.2 |

| Tangible BVPS ($) | 17.3 | 18.3 | 19.8 | 17.7 | 18.8 | 20.0 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin’s Trend to Reverse from Next Year

Contrary to my previous expectations, the net interest margin shrank by 58 basis points in the first nine months of 2023. This margin compression was largely attributable to a surge in costly time deposits, whose balance almost doubled in size over the first nine months of the year. This sudden growth spurt of time deposits was due to the rising interest-rate environment which incentivized depositors to chase yields. To avoid losing depositors to its competitors, Bar Harbor had to let its time deposits balloon.

The Federal Reserve is now projecting rate cuts next year; therefore, it is likely that time deposits will continue to remain attractive for depositors during the fourth quarter of the year as depositors will want to lock in high rates before the cuts materialize. However, starting next year, I’m expecting the attractiveness of time deposits to start waning. This is because rate cuts will reduce the difference between the rates offered on time deposits and other deposit products; thereby reducing the relative demand for time deposits.

The results of the management’s rate sensitivity analysis given in the 10-Q filing show that a 100 basis point interest-rate cut could reduce the net interest income by 1.1% over the first twelve months.

3Q 2023 10-Q Filing

Considering these factors, I’m expecting the net interest margin to dip by two basis points in the last quarter of 2023 and then rise by two basis points in every quarter of 2024. Despite the gradual rise next year, the average net interest margin for 2024 will likely remain below the average for this year. This is because I’m expecting next year’s uptrend to be less steep than this year’s downtrend.

Expecting Flattish Earnings in Upcoming Quarters

I’m expecting earnings in upcoming quarters to be close to the earnings reported for the second and third quarters of 2023. While loan growth should lift earnings, a lower average net interest margin will restrict earnings growth. Further, I’m expecting operating expenses to grow at a normal rate, which will also constrain earnings growth.

Overall, I’m expecting the company to report earnings of $0.71 per share for the last quarter of 2023, which will take the full-year earnings to $3.00 per share. For 2024, I’m expecting the company to report earnings of $2.94 per share. The following table shows my income statement estimates.

| Income Statement Summary | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net interest income | 90 | 99 | 96 | 114 | 118 | 120 |

| Provision for loan losses | 2 | 6 | (1) | 3 | 3 | 3 |

| Non-interest income | 29 | 43 | 42 | 35 | 36 | 36 |

| Non-interest expense | 90 | 95 | 91 | 91 | 93 | 97 |

| Net income – Common Sh. | 23 | 33 | 39 | 44 | 46 | 45 |

| EPS – Diluted ($) | 1.45 | 2.18 | 2.61 | 2.88 | 3.00 | 2.94 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report, I estimated earnings of $3.24 per share for 2023. I’ve reduced my earnings estimate because the margin has already performed much worse than I anticipated.

Risks Appear to be Manageable

Bar Harbor has two main sources of risk, as discussed below:

- Gross unrealized losses on the available-for-sale securities portfolio stood at $95.8 million at the end of September 2023, which is about 24% of the total equity balance. I’m expecting most of these losses to start reversing next year when interest rates start declining.

- Only a very small part of the deposit book is uninsured; therefore, deposits appear to be very low risk. As mentioned in the 10-Q filing, the estimated uninsured and uncollateralized deposits, excluding intercompany deposits, were just 8.7% of total deposits on September 30, 2023.

As a result, I think Bar Harbor’s overall risk is low.

Downgrading to a Hold Rating

Bar Harbor Bankshares is offering a dividend yield of 3.8% at the current quarterly dividend rate of $0.28 per share. The earnings and dividend estimates suggest a payout ratio of 38% for 2024, which is close to the five-year average of 42%. Therefore, I’m not expecting any change in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bar Harbor. The stock has traded at an average P/TB ratio of 1.34 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | FY22 | Average | |

| Tangible BVPS ($) | 23.8 | 17.3 | 18.3 | 19.8 | 17.7 | |

| Average Market Price ($) | 28.1 | 24.9 | 20.2 | 27.7 | 28.1 | |

| Historical P/TB | 1.18x | 1.44x | 1.10x | 1.40x | 1.59x | 1.34x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $20.0 gives a target price of $26.8 for the end of 2024. This price target implies an 8.1% downside from the December 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.14x | 1.24x | 1.34x | 1.44x | 1.54x |

| TBVPS – Dec 2024 ($) | 20.0 | 20.0 | 20.0 | 20.0 | 20.0 |

| Target Price ($) | 22.8 | 24.8 | 26.8 | 28.8 | 30.8 |

| Market Price ($) | 29.2 | 29.2 | 29.2 | 29.2 | 29.2 |

| Upside/(Downside) | (21.8)% | (15.0)% | (8.1)% | (1.3)% | 5.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.0x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | FY22 | Average | |

| Earnings per Share ($) | 2.12 | 1.45 | 2.18 | 2.61 | 2.88 | |

| Average Market Price ($) | 28.1 | 24.9 | 20.2 | 27.7 | 28.1 | |

| Historical P/E | 13.3x | 17.1x | 9.3x | 10.6x | 9.8x | 12.0x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.94 gives a target price of $35.3 for the end of 2024. This price target implies a 20.9% upside from the December 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.0x | 11.0x | 12.0x | 13.0x | 14.0x |

| EPS 2024 ($) | 2.94 | 2.94 | 2.94 | 2.94 | 2.94 |

| Target Price ($) | 29.4 | 32.3 | 35.3 | 38.2 | 41.1 |

| Market Price ($) | 29.2 | 29.2 | 29.2 | 29.2 | 29.2 |

| Upside/(Downside) | 0.7% | 10.8% | 20.9% | 30.9% | 41.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $31.0, which implies a 6.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.2%.

In my last report, I adopted a target price of $32.4 for the end of 2023 and gave a buy rating. Since then the stock price has rallied strongly. As a result, my new target price for the end of next year has only a small upside from the current market price. Based on the updated total expected return, I’m downgrading Bar Harbor Bankshares to a Hold rating.

Read the full article here