Note:

I have previously covered Bloom Energy Corporation (NYSE:BE), so investors should view this as an update to my earlier articles on the company.

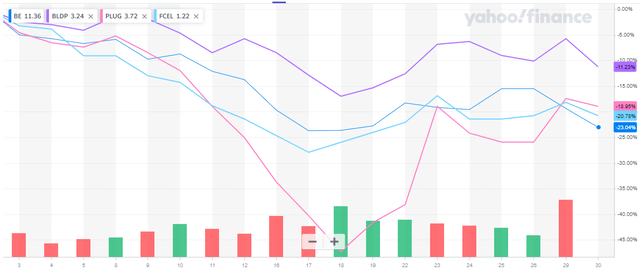

It’s been a rough start to the year for leading U.S. exchange-listed fuel cell players, with stationary power generation system provider Bloom Energy Corporation, or “Bloom Energy”, being among the worst performers:

Yahoo Finance

Year-to-date, shares are down by almost 25%, and at least in my opinion, things are likely to get much worse.

Despite mediocre results, I have given management the benefit of the doubt by sticking to a “Hold” rating over the past few years, but a closer look at the company’s third-quarter results caused me to downgrade the stock to “Sell” in early November.

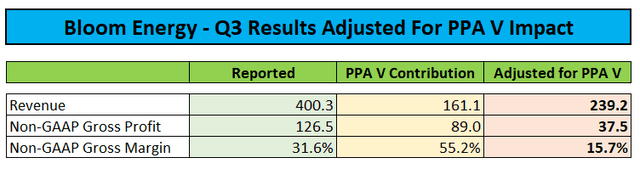

While Bloom Energy reported revenues and earnings per share well ahead of consensus expectations, more than 40% of total sales for the quarter were derived from the sale of a former special purpose subsidiary ((PPA V)) with a large portfolio of legacy Bloom Energy Servers to an affiliate of Generate Capital, a leading sustainable infrastructure financer and the subsequent replacement of the old equipment with new servers.

Adjusted for the PPA V Upgrade, Bloom Energy would have missed analyst forecasts by a wide margin:

Regulatory Filings

While management had previously projected the server portfolio upgrade to take place in H2/2023, the sheer magnitude of the benefit to Q3 revenues and gross profits came as a surprise.

As “PPA V” was the company’s last remaining legacy server portfolio, there won’t be any future benefits from similar transactions, thus providing a major revenue headwind for 2024 and beyond.

In addition, things are not going according to plan in Korea as evidenced by the most recent agreement with key customer and strategic investor SK ecoplant, a subsidiary of South Korean conglomerate SK Group (emphasis added by author):

Bloom Energy and SK ecoplant (…) today announced they have extended the terms of the Preferred Distributor Agreement the companies signed in 2021. SK ecoplant has committed to purchase 500 megawatts (MW) of Energy Servers from Bloom Energy through 2027.

The transaction is expected to generate approximately $1.5 billion in product revenue and $3 billion of service revenue over 20 years for Bloom Energy. The agreement extends the initial term from 2024 to 2027 and includes a recommitment of approximately 250 MW from the 2021 agreement with an additional 250 MW under this agreement.

Launched in 2018, the strategic partnership between Bloom Energy and SK ecoplant has strengthened their respective market leadership positions in power generation and the global hydrogen economy. SK ecoplant will be a preferred distributor globally for Bloom Energy solid oxide fuel cells (SOFC) and solid oxide electrolyzers (SOEC) in markets where SK ecoplant has a significant presence and competitive advantage. Bloom Energy and SK ecoplant have deployed 400 MW since the beginning of the partnership.

Please note that SK ecoplant already committed to purchasing “at least 500 MW of power between 2022 and 2025” in an agreement signed in late 2021 (emphasis added by author):

Since the start of their strategic partnership three years ago, Bloom Energy and SK ecoplant have transacted nearly 200 MW of projects together totaling more than $1.8 billion of equipment and expected service revenue. Over the next three years the companies will expand this existing business with contracts for at least an additional 500 MW of power between 2022 and 2025, representing approximately $4.5 billion in equipment and future service revenue.

Given the requirement to “recommit” 250 MW from the existing agreement, it seems quite clear that original deployment targets aren’t going to be met, thus likely providing an additional near-term revenue headwind.

In fact, achieving the targets outlined in the original agreement would have required Bloom Energy and SK ecoplant to deploy almost 170 MW on average each year. But based on the numbers provided in the respective press releases, the annual average has been closer to 100 MW over the past two years.

However, with revenues from the company’s Asia-Pacific region down by almost 50% during the first nine months of 2023, Korean deployments might have been closer to 65 MW last year.

In addition, following South Korea’s recent move to an auction system for the procurement of fuel cell-generated power, Bloom Energy reportedly lost the first bidding round to domestic competitor Doosan Fuel Cell with second-round results having not yet been announced.

However, according to a recent Hydrogeninsight article, the 2023 auctions will only result in approximately 200 MW of new fuel cell capacity being added:

Only 157 MW of new fuel-cell generators were installed in 2023, a slight increase from the 142 MW installed the previous year. Meanwhile, the most recent hydrogen power auction, which tendered 1,300TWh a year from 2023 to 2025, only represents around 200 MW of new fuel-cell capacity.

Even in the unlikely case of Bloom Energy winning the vast majority of the second round auction, the company’s deployments in Korea wouldn’t gain much if any near-term traction.

Consequently, I would expect revenues derived from Korea to remain depressed and potentially come down even further next year.

But the company is not only facing obstacles overseas, the domestic market has also proved more challenging than anticipated as proposed large-scale deployments of Bloom Energy Servers at new Amazon (AMZN) AWS data centers sites in Oregon have experienced increased scrutiny, thus reducing the odds for the projects to move forward in the near term.

On the Q3 conference call, management admitted to lengthening sales cycles due to, among other things, permitting issues, interconnection timing, and uncertainties around IRA incentives as well as headwinds resulting from the current interest environment.

Please note also that the company terminated Chief Commercial Officer Guillermo Brooks earlier this month and replaced him with Aman Joshi, who joined the company from General Electric’s (GE) Vernova (formerly GE Power) business unit.

While consensus expectations for this year have come down quite meaningfully in recent weeks, analysts on average still expect more than 20% top line growth in 2024 and the company to turn profitable.

Earlier this week, Bank of America (BAC) analyst Julien Dumoulin-Smith downgraded Bloom Energy’s stock to “Underperform” from “Neutral” and reduced his price target from $16 to $10 based on expectations for revenue to remain roughly flat over the next two years.

The deterioration in profitability and cash generation we forecast counters the consensus narrative that Bloom Energy could be less exposed to risk of compression and lower margins in 2024 and beyond relative to other cleantech equipment names. (…)

In addition, the analyst sees a

Clear overextension in expectations and consensus estimates for near-term growth, and therefore assess there to be meaningful shortfall risk to meeting Bloom’s long-term growth guidance.

Last week, Truist also downgraded the company’s shares to “Sell” from “Hold” and reduced the price target from $12 to $9 on concerns regarding near-term deployments and the volume ramp of Bloom Energy’s new Series 10 product offering as well as the likely requirement to reduce multi-year growth expectations:

Street estimates for 2024 and 2025 remain too aggressive given the reduced shipment pace implied by the company’s recent SK Ecoplant partnership extension, continued uncertainty surrounding Amazon volumes, and minimal line of sight to a Series 10 volume ramp, the analyst tells investors in a research note. The firm believes the “sluggish pace” of hydrogen development will ultimately lead Bloom to have to reduce its multi-year guidance.

Quite frankly, I couldn’t agree more with these takes and actually wouldn’t be surprised to see the company missing Q4/2023 expectations quite meaningfully.

In addition, given the above-discussed issues, I would view a flat revenue performance as sort of a best-case scenario for this year.

With the revised SK ecoplant agreement a clear indicator of major headwinds in the company’s key overseas market and management likely being required to reset both near- and long-term expectations quite meaningfully next month, I am downgrading Bloom Energy’s stock from “Sell” to “Strong Sell“.

Consequently, I would advise speculative investors to consider a short position in the common shares going into the company’s Q4 results currently scheduled for February 15.

At the time of this writing, Interactive Brokers has more than one million shares available for borrowing at negligible rates.

Risk Factors

With markets hovering near all-time highs, risk appetite among market participants has increased quite meaningfully in recent months. For example, Plug Power’s (PLUG) stock is up by more than 100% from recent lows despite ongoing liquidity issues and abysmal preliminary Q4 results as many speculative investors appear caught on the wrong side of the trade after the company entered into an up to $1 billion open market sales agreement with a subsidiary of B. Riley Financial (RILY) last month.

Similar to Plug Power, short interest in Bloom Energy’s common shares seems to be material, however a meaningful part appears to be related to the company’s $550 million convertible notes offering last year with certain noteholders employing delta-neutral arbitrage strategies requiring a corresponding short position in the shares.

Should the company’s 2024 outlook come even remotely close to the current analyst consensus, I wouldn’t be surprised to see shares staging a major rally.

In addition, while unlikely, strategic investor SK ecoplant might also decide to take advantage of the depressed share price by making a move for Bloom Energy at a significant premium.

Bottom Line

Based on available data points, I would expect Bloom Energy to report disappointing Q4 results and provide abysmal 2024 guidance next month, with the potential for shares dropping to new multi-year lows well below $10 in reaction.

Consequently, I am downgrading Bloom Energy’s stock from “Sell” to “Strong Sell” and would advise speculative investors to consider a short position in the common shares going into the company’s Q4 results on February 15.

As always, don’t bet the farm on short positions, and adequately manage your risk.

Read the full article here