grandriver

A Quick Take On Calfrac Well Services Ltd.

Calfrac Well Services Ltd. (TSX:CFW:CA) provides fracturing, coiled tubing and cementing services and products to oil & gas exploration firms in regions of North America and Argentina.

The company has produced positive revenue and earnings results in recent quarters and expects reasonably strong utilization demand for its fleets in Canada and the U.S.

However, the company expects further supply chain tightness in 2023, which may serve to elevate costs even as demand remains firm.

While I’m cautiously optimistic for Calfrac, potential risks also include a drop in macroeconomic activity, so I’m on Hold for CFW:CA stock in the near term.

Calfrac Overview

Calgary, Canada-based Calfrac was founded in 1999 to provide a range of hydraulic fracturing and related oilfield services in Canada, the United States and Argentina.

The firm is headed by Chief Executive Officer Pat Powell, who joined the firm in May 2022 and was previously president and Chairman of Producers Oilfield and Co-CEO of Mullen Transportation.

The company’s primary offerings include the following:

-

Hydraulic fracturing

-

Coiled tubing

-

Cementing

Calfrac’s U.S. presence is divided between the Marcellus Shale region and the Rockies.

Calfrac’s Market

According to a 2021 market research report by Fortune Business Insights, the global market for hydraulic fracturing was an estimated $11.7 billion in 2020 and is expected to exceed $28.9 billion by 2028.

This represents a forecast CAGR of 9.5% from 2021 to 2028.

The main drivers for this expected growth are growing energy usage in the commercial and industrial sectors, changes in global energy markets and the development of unconventional oil & gas resources in various regions worldwide.

Also, declining production from existing legacy wells will drive the need for additional exploration and production along with continued advancement of drilling technologies.

The firm’s competition includes fracturing service firms of large, medium and small sizes.

Calfrac’s Recent Financial Trends

-

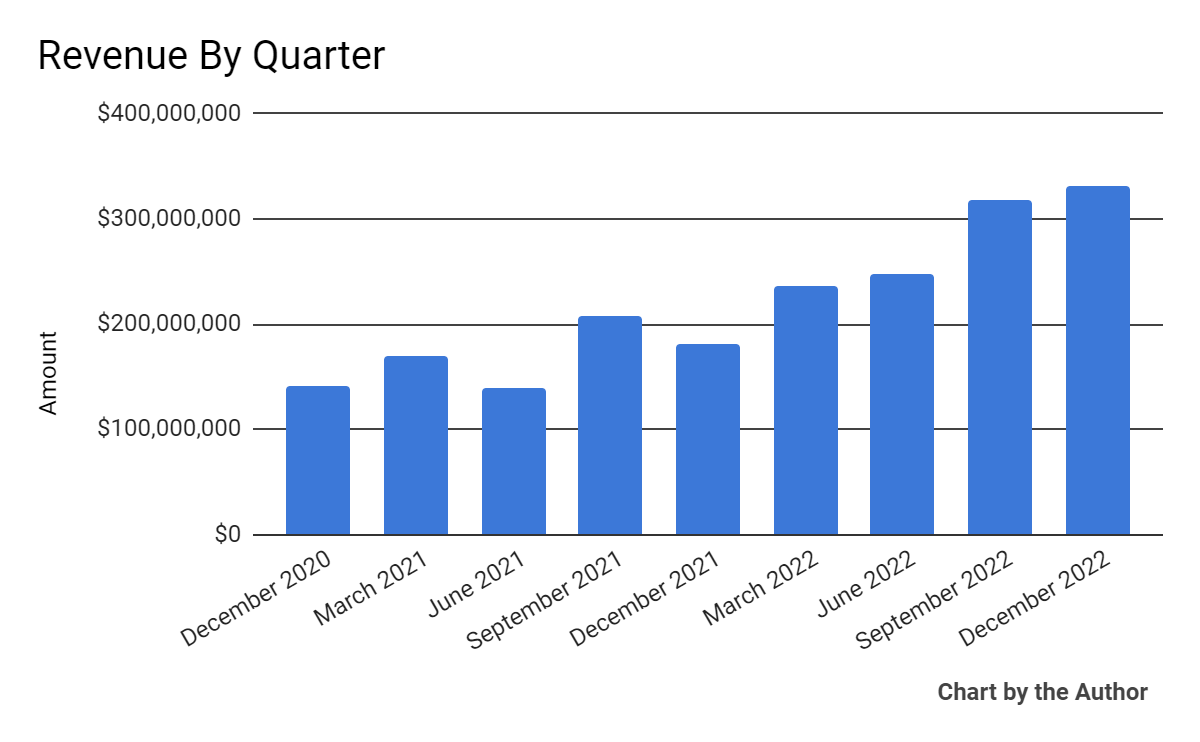

Total revenue by quarter has risen per the following chart:

Total Revenue Trend (Seeking Alpha)

-

Gross profit margin by quarter has grown markedly in recent quarters:

Gross Profit Margin Trend (Seeking Alpha)

-

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower more recently:

Selling, G&A % Of Revenue Trend (Seeking Alpha)

-

Operating income by quarter has risen significantly more recently:

Operating Income Trend (Seeking Alpha)

-

Earnings per share (Diluted) have moved well into positive territory in the two most recent quarters:

Earnings Per Share Trend (Seeking Alpha)

(All data in the above charts is IFRS)

In the past 12 months, CFW:CA’s stock price has dropped 17.3% vs. that of Oilfield Services ETF’s (IEZ) rise of 2.05%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

As to its Q4 2022 financial results, total revenue grew by a whopping 82.2% year-over-year and gross profit margin rose 16.7 percentage points.

SG&A expenses as a percentage of total revenue have been trending lower, a positive sign, while operating income has been improving, as has EPS.

For the balance sheet, the company ended the quarter with CAD8.5 million and CAD329.2 million in total debt.

Over the trailing twelve months, free cash flow was CAD27.7 million, of which capital expenditures accounted for CAD79.8 million. The company paid only CAD2.8 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Calfrac

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.5 |

|

Enterprise Value / EBITDA |

3.4 |

|

Price / Sales |

0.1 |

|

Revenue Growth Rate |

70.3% |

|

Net Income Margin |

78.0% |

|

IFRS EBITDA % |

13.2% |

|

Market Capitalization |

$240,290,000 |

|

Enterprise Value |

$497,780,000 |

|

Operating Cash Flow |

$79,420,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.55 |

(Source – Seeking Alpha)

Future Prospects For Calfrac Well Services

In its last earnings call (Source – Seeking Alpha), covering Q4 2022’s results, management highlighted the ‘considerable progress’ it made in 2022 on increasing its free cash flow, reducing its debt load and rationalizing its cost and capital structures.

Leadership also has announced a ‘multiyear fracturing fleet modernization program’, likely due to improving industry dynamics after the pandemic-induced downturn.

The firm is also upgrading its IT systems to obtain better job data and provide improved services to clients.

The company’s financial position has partially improved due to the conversion of its 1.5 Lien Notes, reducing its outstanding indebtedness by CAD44.8 million.

Looking ahead, management views the various supply chain networks as operating at full capacity and expects some cost inflation, although not at 2022 levels.

For 2023, leadership expects ‘steady demand’ in the U.S. and consistent utilization in Canada in the second half of 2023 as the weather improves.

Also, as the company modernizes its North American fleet, it is shifting some of its Tier 2 equipment to Argentina, where it sees an additional opportunity to improve returns.

Regarding valuation, it is difficult to determine an appropriate valuation of the firm’s activity as it has recently turned EPS positive.

The primary risk to the company’s outlook is continued supply chain tightness, costs and a macroeconomic slowdown.

While I’m cautiously optimistic about Calfrac’s prospects, the risks ahead leave me on Hold for the stock in the near term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here