Overview

Capstone Copper (OTCPK:CSCCF) is a copper mining company with almost all of its revenues coming from copper and very little production of other metals. This makes it rather unique in the market as a pure play copper producer. I covered the company earlier this year. That article can be found here.

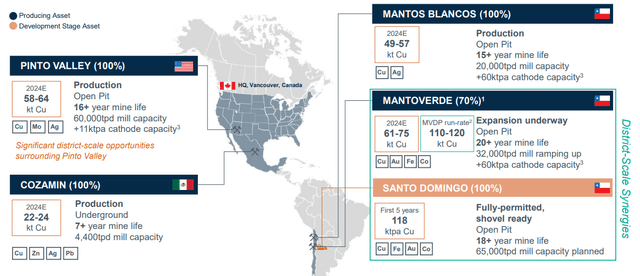

This is an Americas-focused company with producing operations in the U.S., Mexico, and Chile. Just over half of the production in 2024 is expected to come from Chile and that number is likely to increase further in the future.

Figure 1 – Source: Capstone Presentation

Capstone has over the last few years had a modest profit margin, except for 2021 when the copper price was stronger. The profit margin and EBITDA looks set to improve substantially going forward due to a combination of a stronger copper price, increased production, and lower production costs.

Figure 2 – Source: Annual Reports & Koyfin

The stronger copper price in 2024 is naturally a tailwind for the company, but the main catalyst for Capstone in 2024 is the expansion project of the Mantoverde mine. This will allow Capstone to process sulphide ore in addition to the mine’s current oxide ore processing capabilities. A couple of weeks ago, the company announced that first saleable copper concentrate was produced at its Mantoverde Development Project (“MVDP”) and the ramp up to nameplate capacity is expected to occur during Q3 2024.

Figure 3 – Source: Capstone Press Release

The stock price has done well over the last year, up 70%, and it is up as much as 132% from the lows seen in November last year. So, at least part of the expected improvements in 2024 and beyond have already started to get priced in.

Figure 4 – Source: Koyfin

Q1 2024 Results

Since my last article on Capstone, the company has reported its Q1 2024 result that was mostly in line with expectations. The company reported $340M in revenues, $18M in earnings from mining operations, and $-5M in net income attributable to shareholders.

Figure 5 – Source: Capstone Quarterly Reports Figure 6 – Source: Capstone Quarterly Reports

Q1 was not a spectacular quarterly result and the company continues to invest more than 100% of operating cash flow into the growth projects, so the free cash flow is substantially negative. However, it is worth remembering that most of the recent strength in the copper price happened in Q2 first, so the margins will improve in Q2 and likely even more so in the second half of 2024 with MVDP reaching nameplate capacity.

The consolidated C1 cash cost during the first quarter was $2.88/lb, on par with what we saw last year, but the full year C1 cash cost is expected to improve substantially to $2.40/lb, where most of the improvements will happen in the second half of the year.

Figure 7 – Source: Capstone Quarterly Reports

Balance Sheet & Capital Allocation

Capstone has a substantial amount of debt on its balance sheet, which is a consequence of a lot of growth capital investments over the last couple of years. With that said, the net debt decreased slightly in the most recent quarter, to $740M, but that was primarily because of the C$431M bought deal that closed during Q1.

Figure 8 – Source: Capstone Q1 2024 Presentation

Even with the recent bought deal, the net debt to 2023 EBITDA is around 2.8, which is relatively high. However, it is worth remembering that EBITDA could increase by as much as 4-5x in the next couple of years compared to what we saw in 2023, which would take the net debt to EBITDA down below 1. So, based on the stronger copper price and the progress made with MVDP, I am not particularly concerned about the balance sheet at this point.

When it comes to capital allocation, Capstone doesn’t pay a dividend nor buy back shares. All the capital will at least in the near term go towards the growth projects. So, shareholders should not expect to see any substantial distributions over the next few years.

Figure 9 – Source: Capstone Presentation

Conclusion

The below figure is based the latest share price, financials as of Q1 2024, and estimates from Koyfin on the 7th of July.

Figure 10 – Source: Koyfin

Capstone is expensive based on reported 2023 figures and doesn’t look particularly cheap based on 2024 estimates either, where the EV to 2024 EBITDA is 9.1. Looking further out into 2025 and 2026, things get a lot more interesting, where the EV to EBITDA is around 5, which is relatively cheap.

With that said, for the 2025 and 2026 estimates to materialize, you have to assume a relatively seamless ramp up of MVDP, a number of other cost improvements the company is guiding for, and a somewhat constructive copper price. So, I wouldn’t call the 2025 and 2026 estimates conservative. There is still some execution risk for the ramp up of MVDP.

Capstone has a good chance of doing well if the copper price continues to be strong, but the risk/reward doesn’t feel all that compelling following the good recent stock price performance, even if the company has some interesting near-term and longer-term catalysts. I am neutral on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here