Investment Thesis

Carvana Co. (NYSE:CVNA) is a deeply unpopular stock, but that hasn’t stopped it from being a terrific investment.

What’s more, in the same vein as I was unpopular in recommending CVNA to you, with unshakable bullishness in the past year, I’m now no longer willing to ride this rocket any further.

I believe that when it comes to investing, it’s never about how much you make. It’s about how much you keep. Today, I no longer believe my risk-reward is as attractive.

There may still be some juice left in this stock, but for all intents and purposes, I now believe this stock is fairly valued. Therefore, I’m downgrading this stock to a hold.

Outperformance Doesn’t Come Easy

Looking back, I went from neutral to bullish on CVNA at a time when very few investors could see what I saw.

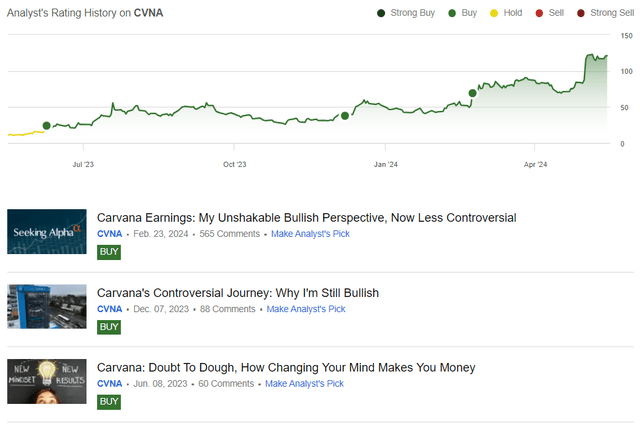

Author’s work on CVNA

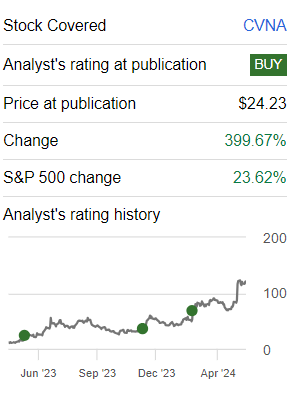

My extremely unpopular view saw this stock jump nearly 4x in 12 months.

Author’s work on CVNA

This trade taught me a lot about investing. And so, now I’ll distill 3 important takeaways you can get from my experience with CVNA.

- The difference between an accountant and an investor. The accountant is always right. While the investor makes money. Both look at the same value proposition, but the accountant gets caught in being precise while the investor is content to be vaguely right.

- To get this sort of outperformance is not easy. It’s easy to talk about in hindsight and tell you a story. But this stock had many periods of significant draw-downs that look like nothing more than a bump in the road right now.

- Inflection investing is about taking a view of where the company will be next year, when investors are still latching on to an outdated narrative. And successful inflection investing is about knowing not to overstay your welcome. Get your return and go. Otherwise, the market will take your return and go.

Carvana’s Near-Term Prospects

Carvana strives to make buying and selling cars easier. Instead of going to a car dealership, you can do everything online. They want to make getting a car more convenient. That’s the appeal.

However, the thesis today is less than straightforward. For instance, inventory constraints are impacting the selection availability for customers. Indeed, despite robust customer demand, the smaller inventory pool is restricting sales volumes, posing a hurdle to sustaining growth momentum. Carvana’s response entails ramping up production across the country to bolster selection levels, emphasizing the need to swiftly address inventory limitations to optimize customer retention. But tackling this will take some time.

Another challenge for Carvana revolves around scalability in reconditioning operations. While the company boasts substantial capacity in its inspection and reconditioning centers, expanding this infrastructure to accommodate its ambitious growth targets presents a logistical headache.

Reconditioning, a pivotal aspect of Carvana’s business model, requires extensive physical space, construction, and zoning approvals, making scalability a complex endeavor.

These are some of my concerns when it comes to Carvana. Next, let’s delve into its financials.

Revenue Growth Rates Require Interpretation

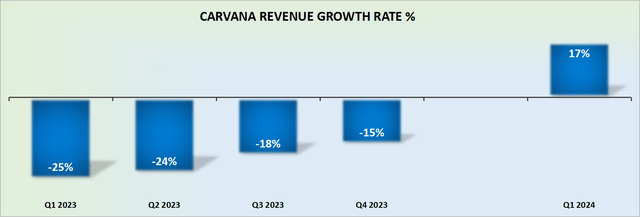

CVNA revenue growth rates

Carvana delivered a strong and unexpected beat on the top line. However, we have to think about the fact that the comparables with the prior year were particularly easy.

Furthermore, with each passing quarter of 2024 and 2025, Carvana’s comparables will become rapidly more challenging. Therefore, I believe that Carvana’s Q1 2024 quarterly revenue growth rates are likely to be a near-term high-water mark for the company.

Or to put it more succinctly, Carvana’s recent results are as good as it’s going to get, at least for now.

With this line of thought in mind, let’s now discuss its valuation.

CVNA Stock Valuation – 35x Forward EBITDA

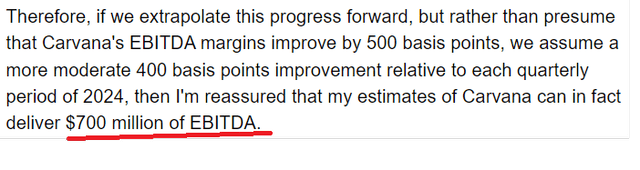

In my previous analysis, back in February, I said:

Author’s work on CVNA

I concluded at the time that CVNA could get to $700 million of EBITDA at some point in the coming year.

Now, this is where the plot thickens. CVNA delivered $235 million of adjusted EBITDA in Q1 2024. Furthermore, its guidance for Q2 2024 points to a sequential increase in adjusted EBITDA. This means that, for all intents and purposes, CVNA will have delivered close to $500 million of adjusted EBITDA in H1 2024.

However, we also have to think about the fact that H1 is often stronger than H2 2024. Therefore, it would be foolish to extrapolate this profitability into H2 2024.

Consequently, one way or another, I believe that approximately $700 million of EBITDA could be reported in 2024. But the problem now is that the bulk of the right sizing of the businesses has already taken place.

Consequently, in 2025, there won’t be the same amount of quick wins for Carvana to improve its underlying profitability. Therefore, in the coming months, investors will once again be eyeing up Carvana’s more than $5.5 billion of debt and asking all sorts of difficult questions.

The Bottom Line

In conclusion, my journey with Carvana has been both exhilarating and instructive. From recognizing its potential at a time when few did, to navigating its ups and downs, I’ve learned invaluable lessons about being an inflection investor.

However, as the landscape evolves and challenges emerge, I’ve decided to step back. While the stock may still hold promise, I believe it’s time to reassess the risk-reward dynamics in this name.

Today, I bid farewell to Carvana, acknowledging that in investing, knowing when to exit is as crucial as knowing when to enter.

Read the full article here