Investment Thesis

Chewy, Inc. (NYSE:CHWY) is the ”go-to” online pet food delivery service. Given its scale and customer loyalty, this has opened up Chewy’s available product line up beyond just pet food to non-discretionary categories, such as pet treats and pet healthcare.

What’s more, given that the majority of its revenues come from its Autoship program, this demonstrates how habitual buying from Chewy has become to its loyal customers.

Simply put, there’s a lot of positive about investing in Chewy. My argument is that paying more than 100x forward free cash flow doesn’t compel new potential investors to chase after this stock.

Follow the Customer

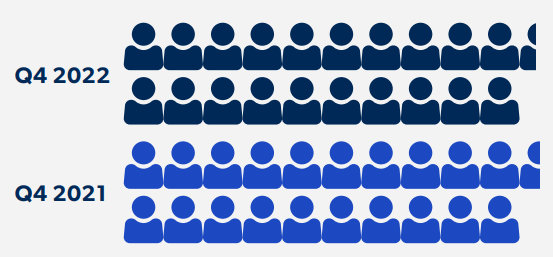

CHWY Q4 2022

I’ve you’ve read my work before you’ll have seen me declare that there’s probably a no better indication of the vitality of a business than its customer adoption curve.

The best example is Apple Inc. (AAPL) and customers queueing for their next iPhone. When the business is seeing customers rapidly flock to embrace a company’s product, that shows pricing power and loyalty.

When customer growth starts to stagnate, that means that in the near term, customers are not overly enthusiastic about the company and the company doesn’t have a lot of pricing power.

And if the company doesn’t have much pricing power, investors will need something else to get enchanted by the stock. And that’s solid and consistent and predictable free cash flows. And I’m not sure that’s what Chewy has to offer.

But I get ahead of myself. Let’s in the first instance turn to discuss Chewy’s revenue growth profile.

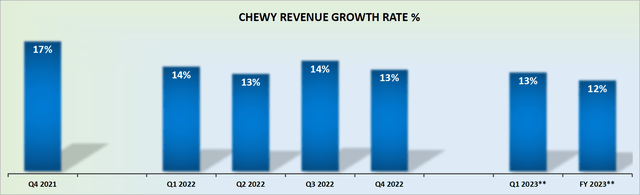

Revenue Growth Rates Stabilize

CHWY revenue growth rates

I want to make something absolutely clear. It’s not all bad with Chewy. Indeed, the good news is that Chewy’s growth rates are stable.

However, the bad news is that the growth rates are rather modest. Hardly enough to get investors barking after this stock.

That being said, there are other positive considerations, too. Case in point, Chewy’s business model is about delivering convenience to pet owners. And through its Autoship, which now makes up nearly three-quarters of all sales, Chewy delivers repeat purchases.

The point that I’m driving at is that the business model is now a lot more stable and predictable and that clearly supports a premium valuation on its stock. But how much of a premium is justified? That’s really the key question.

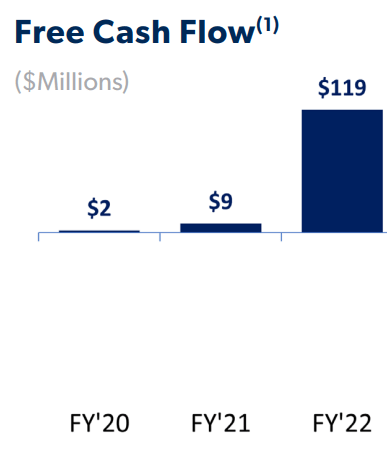

Fiscal 2023 Free Cash Flows to Remain Steady

CHWY Q4 2022

Everyone can recognize that fiscal 2022 saw Chewy’s free cash flow profile massively jump from the prior year. However, looking ahead to fiscal 2023, the core issue is not only that the free cash flow profile will moderate.

But there’s even the suggestion that Chewy’s free cash flow could compress slightly. To be clear, Chewy’s balance sheet holds no debt and has approximately $675 million of cash and equivalents. So, Chewy clearly can continue to invest in its operations and expand Internationally.

But let’s keep something in mind, the U.S. consumer has the deepest pockets. There’s no scenario where Chewy’s overseas expansion will see a similar profitability profile as in the US. To substantiate my assertion you can look at the Amazon.com (AMZN) International segment’s profitability.

The Bottom Line

As I noted throughout, there are ample reasons to be compelled by Chewy, Inc. It’s clear that Chewy has delivered tremendous top line growth on the back of minimal investment.

However, when interest rates were close to 0%, it made all the sense in the world to aggressively expand operations at any cost. But now that interest rates are likely to stay above 4% for a while, investors are increasingly demanding growing free cash flows before investing in a company’s prospects.

Ultimately, I’m not convinced that paying more than 100x forward free cash flows for Chewy, Inc. provides me with enough margin of safety.

Read the full article here