Thesis

Credit Suisse Asset Management Income Fund (NYSE:CIK) is a name we have covered before extensively, with the last piece on the CEF dealing with the UBS / Credit Suisse merger and implications for their funds. In this article we are going to revisit the name on the back of a vicious rally in risk assets in the past six months, rally which has seen high yield spreads tighten extensively, and names such as CIK rally to what we believe are unsustainable levels.

Loads of CCC names in this CEF

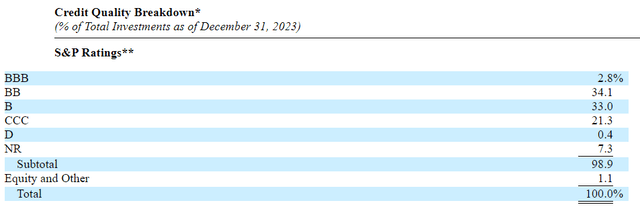

If we look at the ratings parsing for the CEF, we can see this is a very risk-on vehicle:

Ratings (Annual Report)

The CEF has a very large ‘CCC’ bucket that stands at 21.3% as of December 2023. This translates into a high volatility and sensitivity to the default cycle. When the CEF’s leverage is considered, currently at 27%, we get a better picture on how the fundamentals can move from a pricing perspective.

The fund has a rough ‘a third’ allocation to BB, B and CCC names, but to note that most funds have a cap at 10% of assets for riskier CCC debt. This type of debentures are the riskiest forms of HY debt, and S&P describes them as:

An obligation rated ‘CCC’ is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation.

Most of the names in this fund are fixed rate bonds, thus the CEF is also running a bit of interest rate risk:

Composition (Annual Report)

From that angle the fund is well set-up, with our ‘house view’ that peak rates are behind us, despite the sticky inflation picture that has materialized in the past weeks.

Eye popping rally has seen the CEF move to a premium

CIK has historically traded at a discount to net asset value:

On a 10-year look-back we can see how the name has usually traded at a rough -10% discount. There are brief periods of time however when it was trading flat to NAV, especially during the 2020/2021 zero rates environment. Shockingly, the CEF is now trading at a 3.69% premium to net asset value. We feel these levels are overextended, and HY CEFs should not trade at the top of their range when risk free rates are still above 5%.

The fund has a premium to NAV Z-statistic of 1.07, representing the standard deviations above the mean for the fund’s premium/discount to NAV. The main culprit here is the ‘soft landing’ narrative that has seen a clamoring for risk in any format (high yield, growth stocks, bitcoin). We believe in mean reversion, and the introduction of a narrative that introduce an element of doubt around an ‘immaculate’ soft landing. We are expecting a -5% underperformance here from the premium moving to slightly below net asset value in such an event.

Spreads have rallied significantly

The main risk factor for this fund is represented by CCC spreads:

CCC Spreads (The Fed)

As per the above graph, courtesy of the St. Louis Fed, CCC spreads have rallied from 11.5% to 8.5% currently. Considering Fed Funds are at 5.3%, the credit risk component is now a mere 3.2%, not sufficient in our view to compensate the fund for the risk taken.

In effect, CIK is now yielding only 8.7% which is a very low figure when leverage is considered. Think that many short dated bond funds can pass to investors over 6% these days. Should you take leveraged CCC risk for 8.7%? We think not.

In our view the CEF should pay in excess of 10% as a distribution in order to make the risk/reward package attractive. At current levels investors are better served by lower volatility options or floating rate ETFs or CEFs which yield in excess of 10% with lower risk metrics.

Defaults are climbing

The rally in CCC spreads has been mainly driven by the ‘immaculate landing’ narrative, all while fundamentals are not moving in the same direction:

Defaults (FT)

As an investor you generally want credit spreads to tighten on the back of an improving default picture. The opposite has happened here. Corporate defaults are still climbing, all while credit spreads have tightened. Something will have to give, and we believe the weakness will be in credit spreads.

Our house view is for credit spreads to widen from here, as the ‘higher for longer’ interest rate environment starts taking its toll on companies with floating rate financing or rate caps which mature. We have not yet felt the full impact of the higher rates environment because during 2020/2021 many corporates were able to lock-in cheap long term financing. After the Covid maturity wall trauma, many CFOs realized the importance of terming out their debt profiles, and ended up doing just that. It will just translate into a protracted default environment.

For many people the current vacillations in spread might be puzzling. Too many retail investors assume a linear move in credit spreads. The real world is different, and it usually relies on narratives. If the market is of the belief the economy and the consumer will be fine, it will price high yield credit for a benign default scenario, even if we still have materially higher defaults. Just like equities, credit spreads are forward looking and highlight the implied forward market view. We currently believe the market is too optimistic, and it is due for a correction.

Conclusion

CIK is a fixed income CEF from Credit Suisse. The fund focuses on fixed rate HY debt and holds a large allocation to CCC names. The CEF has historically traded at a discount to NAV but is now priced at a 3.6% premium, highlighting the violence of the risk-on move in the past six months. The vehicle has seen this pricing on the back of a substantial rally in CCC credit spreads, which now offer only 3.2% more than Fed Funds. We believe we are due for a correction in both credit spreads and the CEF’s premium to NAV, thus expecting a rough -10% sell-off in the name. We were holders of the name earlier in the year but have now sold our position.

Read the full article here