Introduction

I previously covered CoStar (NASDAQ:CSGP) back in January, rating the company as a ‘Strong Buy,’ something I’ve rarely assigned to the companies I’ve written about. At the time, I praised the company for disrupting the commercial real estate industry. It has created several marketplaces, building network effects and scale. It also built a huge database of information and tools that are crucial for agents to find data on a property’s construction, prior sales, market comparables, current tenants and rents, the demographics of the neighborhood, and much more.

To me, it was obvious that CoStar was poised to become a disruptor. In what’s often a very opaque industry, CoStar was aggregating millions of datapoints, spending billions of dollars to collect data to provide value to their customers. While most investors pass on CoStar because it isn’t profitable yet, I felt that the company would become the winner in the market because its peers (e.g., Rightmove plc (OTCPK:RTMVF)) weren’t investing and CSGP’s sticky revenue base with low churn was practically setting them up to become a monopoly in the space.

Since my original investment thesis in January, I’m still just as confident in the business model and outlook. With shares down 11% since, as the market has gone up 16%, I see value in the company’s shares and find the valuation quite reasonable. In this article, I’ll provide an update to my original investment thesis, dissect the latest quarterly results, and explain why now’s the time to be adding shares.

Recent Results

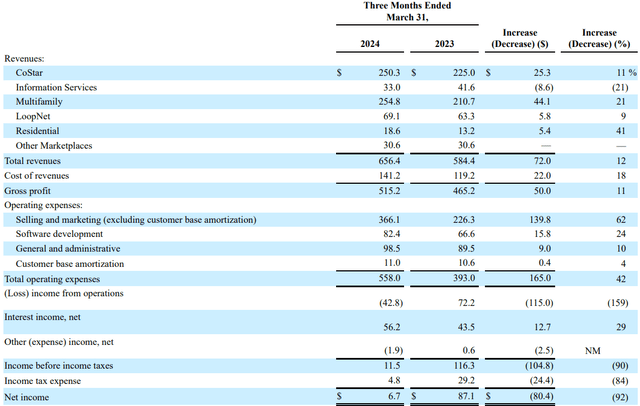

When looking at the latest quarterly results for CoStar, the company recorded revenues of $656 million, which was a 12% increase compared to Q1 last year. When we look at what drove the results, revenues across CoStar, multi-family, residential, and other marketplaces were all up double digits, with LoopNet up 9%. The only sour part of the results was in information services, which was down 21% on a year over year basis. That said, we compare this to the other segments, it represents only a small part of revenues at around 5%. With the revenue growth this quarter, the company achieved milestones at apartments.com and CoStar, as both surpassed the $1 billion sales mark in Q1’24.

Company Filings

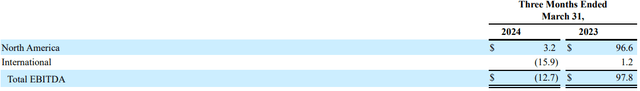

Where I think investors likely had concerns was when it came to EBITDA. Compared to last year’s EBITDA of $98 million, EBITDA dropped to negative $13 million, which may have spooked some that CoStar was about to star bleeding cash and wasn’t making progress in eventually becoming profitable.

Company Filings

What I think investors may have missed (or at least is being underappreciated by the market), is the set-up coming out of the Q1’24 print. For example, most of the additional spend this quarter was because of the ramping of a dedicated Homes.com salesforce, where the remainder of the sales force will be able to focus on their respective core products. Because of the deceleration in growth rate, I also think that revenue comps should get easier through the year.

On the topic of profitability, management is still guiding for EBITDA margins of about 15-16% as the company exits the year, even after heavy sales and market spend in the first half. With strong non-residential business fundamentals as well as better than expected traction of Homes.com (both in US and UK), I still have confidence in the business, in spite of a quarter with negative EBTIDA growth. Moreover, as Homes.com’s model becomes more appreciated by agents as well as home-buyers, management believes it stands to potentially benefit from recent legal settlements and class actions against industry participants.

One of the things that’s really underappreciated about Homes.com is that the company has really been making strides in building massive site traffic. During the quarter, Homes.com network reached 140 million quarterly average monthly unique visitors, with a 156 million unique visitors in March. This is more than double last year’s monthly unique visitors, a 102% increase. Assuming that CoStar can replicate the success it had with Apartments.com at Homes.com, this could become an even larger business than Apartments.com, given how big the total addressable market is.

Investor Presentation

Really the next part of CoStar’s journey with respect to building out Homes.com is monetization. After all, what’s a business even worth if it can’t generate profits?

If you watched the Super Bowl this year, you might remember an advertisement for Homes.com with CEO Andy Florence in the clip. With over 9,000 commercial placement in Q1’24 in an effort to compete with competitors like Zillow and Realtor.com, it’s only a matter of time before CoStar builds out a truly successful platform.

In my view, this isn’t dissimilar to what CoStar did with Apartments.com. For a business it acquired a decade ago for just $585 million in cash, the business is now doing over $1 billion of revenue and is growing 20%+ per year. So far, with the company’s unaided brand awareness for Homes.com increasing from 4% in January to 24% in March, Homes.com is becoming the site people think of when it comes to buying or selling their home. With this in place, CoStar is halfway towards its goal of reaching 50% unaided brand awareness. In discussing the success of Homes.com so far, CEO Andy Florence had this to say:

For context, we launched Apartments.com in early 2015, and it took seven years to achieve our first quarter with 40 million annualized bookings. Homes.com reach the 40 million annualized bookings, in the first quarter we launched and it wasn’t even a full quarter it was less than 2 months of selling. So as a really fast start. We’re seeing a strong continuation of sales results in metrics that they mentioned in our last earnings call in February. 90% of [indiscernible] agent members were selected in the 12-month contract option, with the rest choosing the 6-month subscription.

So far, Homes.com has reached 8,000 memberships (average selling price of between $475 and $500 per month range) and as of the most recent quarter, 85% of CoStar sales representatives have successfully sold at least one Homes.com membership. It’s still early days for Homes.com but assuming CoStar can triple the size of the size of Homes.com over the next few years, this could become a $140 million a year business.

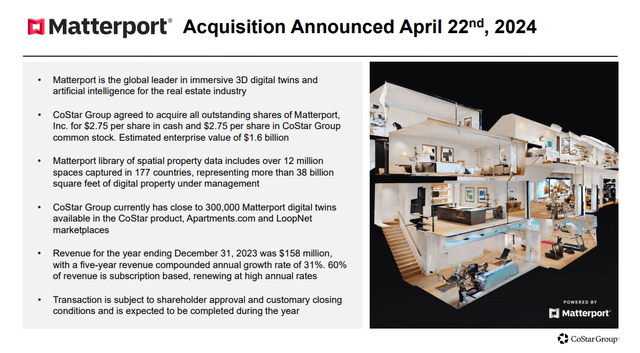

Finally, the last piece investors should be excited about is the Matterport acquisition, a $1.6 billion deal where CoStar acquired the company for cash. Matterport is a technology company that does 3D digital twins of physical spaces by using sensors and cameras so the properties can be explored and navigated virtually. What’s unique about Matterport is that the business has significant operating leverage and has been growing at a 31% CAGR for the last five years. Just like CoStar, Matterport has a subscription based model that has high-recurring revenues (60% of revenues) and high renewal rates, indicating that sales are quite sticky, just like CoStar’s business.

Investor Presentation

Overall, I think the Matterport acquisition is a good fit for CoStar. The cross-selling opportunities presents significant room for revenue synergies, which is likely why CoStar was willing to pay a near 200% premium to the share price prior to the announcement of the deal. With almost 300,000 digital twins on Matterport’s platform, I see this as a great opportunity to integrate the company to current operations, particularly for Homes.com. For prospective buyers and tenants looking to explore a property virtually before seeing it in person, Matterport provides a solution. Rolled out across CoStar’s platform, this acquisition makes a great deal of sense.

Valuation

As I alluded to in my prior write-up on CoStar, valuing the company is difficult because of how negligible earnings are at present. For example, on an LTM basis, CoStar trades for 81.5x EV/EBITDA and 100.8x P/E, numbers that aren’t very meaningful when we consider that CoStar invests most of its cash back into R&D and sales and marketing spend. Because of all of the expenses related to the development of Homes.com, most of these show up as expenses on the income statement, rather than capex (which would later be capitalized on the balance sheet).

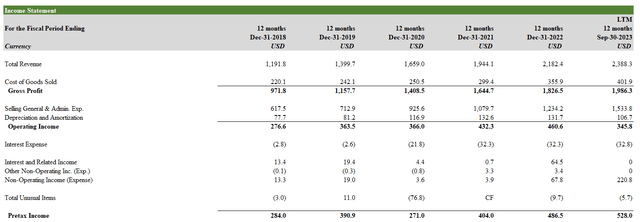

As shown from the income statement below, 77% of gross profit gets eaten up through SG&A expenses, a large portion of which is likely discretionary for CoStar. I feel confident in making that assumption as peer Rightmove invests very little into SG&A and is able to maintain 71% EBITDA margins (source: S&P Capital IQ).

Author, based on data from S&P Capital IQ

Assuming 80% of SG&A is discretionary, I would estimate that EBITDA would be close to $1.6 billion without discretionary investments through the income statement. With an enterprise value of $29.88 billion, this would put a multiple on the company of about 18.7x, which seems to be much more reasonable and a better estimate for what investors are paying for the company. With just $1.1 billion in long-term debt and a cash balance of $5.0 billion, the balance sheet looks to be strong and in a good position to fund CoStar’s future growth.

When it comes to risks for investors to consider, investors should be mindful that CoStar is exposed to what goes on in the broader real estate market. Extremely low vacancies or lack of spending on CoStar’s platforms would be risks to monitor. There’s also the risk that the Matterport acquisition isn’t integrated successfully or synergies don’t materialize as expected. I would assign a low probability to such an outcome, given CoStar’s track record of successful M&A.

Another risk, and perhaps the most important risk I’d watch, is on the regulatory front. Previously, CoStar had been sued in court over claims that the company holds a monopoly that prevents brokers from sharing their data with rival firms. CoStar has fended off several lawsuits before; one ongoing one includes a proposed consumer class action accusing it and a group of luxury hotel operators of conspiring to keep room rental prices artificially high in a price fixing strategy. Overall, I’m not worried about the impacts of lawsuits. CoStar has dealt with them before and won. When you have a moat around your business, there’s always someone else trying to break into the castle.

In summary, CoStar continues to be one of my top investment ideas. It’s a name that’s often misunderstood with a strategy that’s sometimes underappreciated by the market. For investors who can take a longer view to see what CoStar’s building, acquiring and developing marketplace websites in the real estate industry, I think CoStar will emerge a winner as they eventually build an informational advantage that will be unrivaled by current peers. As total monthly unique visitors across its platforms continue to climb, once more monetization opportunities are implemented, earnings should improve materially. For these reasons, I’m a buy of CoStar’s shares at current prices.

Read the full article here