Flights were postponed, surgeries canceled, and banks disrupted. In all, 8.5 million Microsoft (MSFT) Windows devices were affected. This was all because of what CrowdStrike (NASDAQ:CRWD) called a “defect in a single content update.” Congress is calling on CEO George Kurtz to testify before a subcommittee, although we don’t know when.

This was easily the worst week in CrowdStrike’s history.

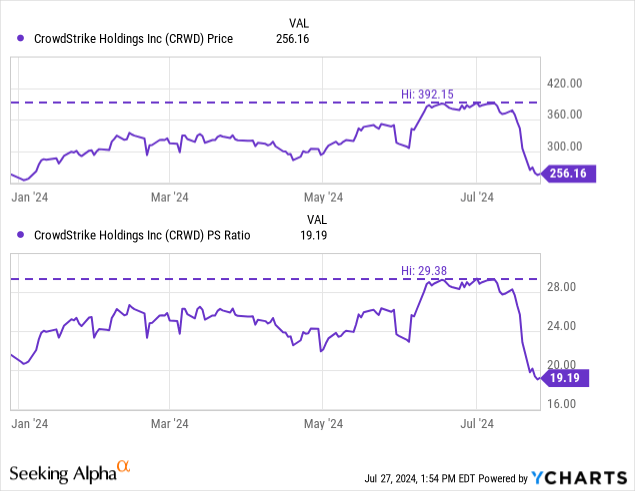

The stock dropped off a cliff, going from a record high near $400 to $250 per share, an epic 38% drop. The price-to-sales ratio fell from a nosebleed level to a more modest valuation, as shown below.

The question for investors is significant: Is this a terrific opportunity to buy shares or a stock doomed to continue falling?

Is CrowdStrike’s epic rise over?

I have been bullish on CrowdStrike for years. From mid-2022 through the beginning of 2023, I built a significant position, buying shares as high as $150 and as low as $95. This article lays out my bullish case at that time.

I became cautious as the stock and valuation exploded throughout 2023 and 2024. I began to trim as the stock crested $250 and sold the entire position at $300. In retrospect, I should have kept a small position, but selling at the top is difficult, and I deployed the cash elsewhere when the stock reached what I considered fair value.

With the Nasdaq bumping against all-time highs, CrowdStrike’s price-to-sales ratio crept near 30. This is high even for a terrific company running on all cylinders. Especially as CrowdStrike exhausted the large corporate market and turned its strategy to small and medium-sized businesses ((SMBs)). SMBs are a fertile market but likely less profitable than Fortune 500 customers.

There is panic in the air after last week’s disaster. But those panicking out of the stock may be missing something important: If a single ill-advised CrowdStrike software update can wreak such havoc, CrowdStrike must be an extremely important company.

Is CrowdStrike going to recover?

The same thing that made CrowdStrike attractive before the current problem is what makes it attractive now: Excellent results.

CrowdStrike is a global leader in the critical market of endpoint security. According to IBM (IBM), most damaging cyberattacks result from endpoint protection failures. CrowdStrike’s Falcon platform is entirely cloud-based and modular, and revenue is recurring through subscriptions – all positives for CrowdStrike investors.

Annual recurring revenue (ARR) tripled over the last three years and grew 33% in Q1 FY25, year-over-year (YOY), as depicted below.

Source: CrowdStrike. Chart by the author.

Its land-and-expand strategy is working, with 65% of customers using at least five modules, 44% using six or more, and eight-module deals growing 95% YOY in Q1 FY25. When existing customers purchase additional modules, operating leverage (profitability) increases, which shows up in long-term trends.

On a non-GAAP basis, CrowdStrike reported an operating margin of 22% in Q1 FY, up from 17% the prior year. The non-GAAP results eliminate stock-based compensation and amortization of intangible assets like patents and goodwill.

The company also achieved GAAP operating income recently, as shown below.

More importantly, free cash flow (FCF) continues to flourish, rising 42% in Q1 FY25 on an impressive 35% margin. CrowdStrike reported more than $1 billion FCF and a margin of over 30% over the past twelve months.

Because of the prolific cash generation, CrowdStrike amassed a cash hoard of $3.7 billion against $740 million in long-term debt. This allows the company to fund growth and make strategic acquisitions. The company should also consider a share buyback program now that the stock has cratered, although not until the fervor dies down. This will shore up investor confidence and offset the effects of stock-based compensation.

Is CrowdStrike stock a buy now?

The financial effects of the shutdown will affect CrowdStrike’s results in Q3 FY25 since Q2 FY25, which ends July 31st, was mostly in books when it took place. The company could see fewer deals close now as companies could be reluctant to sign contracts so soon after a major breakdown. Testifying before Congress could also damage CrowdStrike’s reputation; however, I expect both to be short-lived. This was not a breach, and memories are short in the era of the 24-hour news cycle.

Still, the stock trades near 20 times sales with a $62 billion market cap, which isn’t a significant discount given the short-term risks. When CrowdStrike reports Q2 results, all eyes will be on guidance to determine the extent of the damage.

While I have nibbled around $250 per share, I will only initiate a significant position if the valuation reaches 16 times sales, a $53 billion market cap, and a share price near $215. Given the company’s focus on achieving $5 billion in ARR by the end of fiscal 2026, this will be an absolute steal.

Investors should consider the flip side of last week’s failure: CrowdStrike is essential to many systems; few can replace it, and the switching costs are high. For this reason, the massive drop could be a tremendous opportunity for investors – but perhaps not quite yet.

Read the full article here