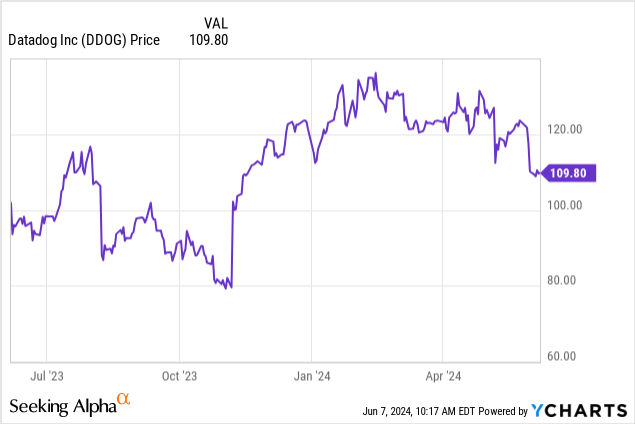

So far this earnings season, a lot of air has come out of highly prized growth stocks as investors de-risk their portfolios amid all-time market highs. Even strong quarters failed to resonate in the markets, including Datadog’s (NASDAQ:DDOG) Q1 earnings print, which not only was a beat-and-raise quarter, but also showed accelerating growth and positive commentary about normalizing macro conditions.

Year to date, shares of Datadog are down 5%, underperforming the broader market (which is fitting after a banner year in 2023). And yet, to me, the post-Q1 earnings drop for Datadog represents the stock inching closer to my buy point.

I last wrote a neutral opinion on Datadog in February, when the stock was still trading closer to $130 per share. Since then, the stock has dropped nearly 20%, which has my interest piqued. Overall, while I’m still ruling out Datadog as too expensive to jump in and buy now, the stock is now firmly on my watch list if it continues to drop further. I’m reiterating my neutral stance on Datadog, with a slight lean toward the upside if volatility continues.

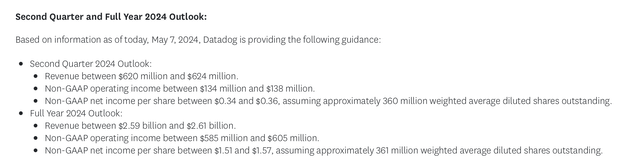

The first thing we should check in on: Datadog’s guidance has lifted for the year – which is to be expected for a company that routinely issues earnings beats and raises its forecast every single quarter. The company is now expecting $2.59-$2.61 billion in revenue for the year, or 22-23% y/y growth, from a prior view of 20-21% y/y growth. To me, a two-point lift in the growth outlook is quite substantial.

Datadog outlook (Datadog Q1 earnings release)

Note as well that for next year FY25, Wall Street analysts are expecting Datadog to generate $3.21 billion in revenue, which is 23% y/y growth on top of this year’s expected 22-23% y/y growth.

Now, a valuation checkup: at current share prices near $105, Datadog trades at a market cap of $36.29 billion. After we net off the $2.78 billion of debt and $743 million of convertible debt off Datadog’s most recent balance sheet, the company’s resulting enterprise value is $34.25 billion.

This puts Datadog’s valuation multiples at:

- 13.2x EV/FY24 revenue

- 10.7x EV/FY25 revenue

I’m a buyer of Datadog stock if it hits 9.5x EV/FY25 revenue, which represents a price target of $94 and ~10% downside from current levels. We can justify Datadog’s premium valuation multiple (though not as high as the low teens as it is currently) due to the fact that the company scores high from a “Rule of 40” standpoint and remains the clear leader in infrastructure monitoring.

The other core upside drivers for Datadog to be aware of:

- Huge $62 billion market opportunity – Datadog recently sized the observability market as a $62 billion total opportunity by 2026 (its prior sizing was $53 billion by 2025), which means that Datadog is still only single-digit penetrated into this overall market opportunity.

- Pure recurring revenue – Datadog prices its products by usage, and all of its customers deliver recurring revenue for the company, giving it plenty of room for expansion.

Be patient on the sidelines until Datadog hits the sweet spot price to buy.

Q1 download

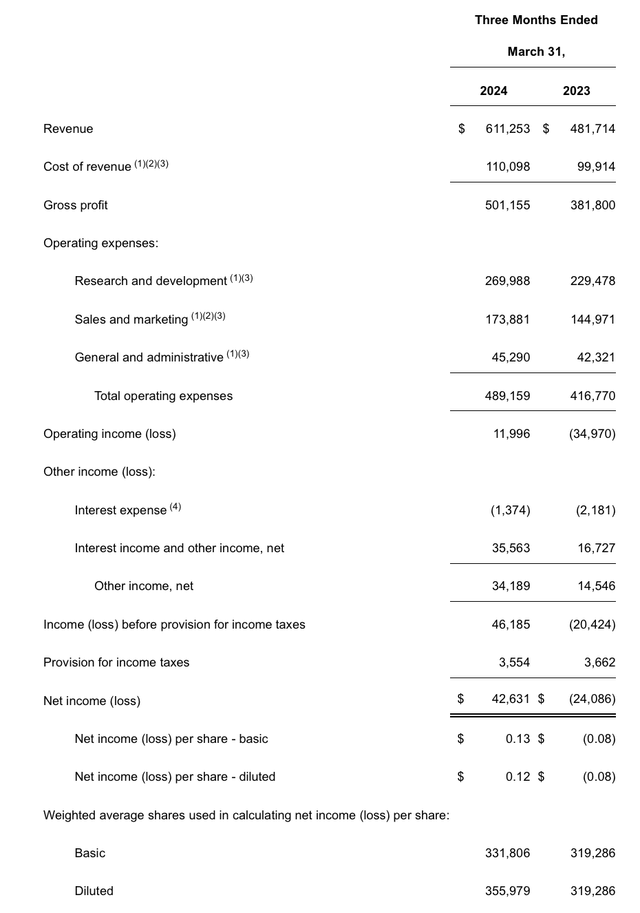

This being said, we should acknowledge that Datadog’s Q1 results were excellent. Take a look at the earnings summary below:

Datadog Q1 results (Datadog Q1 earnings release)

Revenue soared 27% y/y to $611.3 million, well ahead of Wall Street’s $591.7 million (+23% y/y) expectations and even accelerating one point versus 26% y/y growth in Q4.

Management called out that usage trends are starting to stabilize. Over the prior few quarters, the company suffered headwinds from IT leaders optimizing usage in order to incur less cost; but this trend has started to dissipate. Per CEO Olivier Pomel’s remarks on the Q1 earnings call:

In Q1, we saw usage growth from existing customers that was higher than in Q4, and this usage growth in Q1 was similar to what we experienced in Q2 and Q3 of 2022. As a reminder, that was a period when we started to see a normalization of usage following the accelerated growth we had experienced in 2021. Overall, we saw healthy growth across our product lines. And as usual, our newer products grew at a faster rate on a smaller base.

While some of our customers are continuing to be cost-conscious, we are seeing optimization activity reduce in intensity. As an illustration, the optimizing cohort we identified several quarters ago did grow sequentially again this quarter. We also see that customers are adopting more products and increasing usage with us. We think this shows that they are moving forward with their cloud migration and digital transformation plans and that we are executing on opportunities to consolidate point solutions into our platform. And finally, churn continues to be low with gross revenue retention stable in the mid-to-high 90%s, highlighting the mission-critical nature of our platform for our customers.”

Datadog also continued to excel on the profitability front, and that’s despite the fact that it has earmarked 2024 as an investment year in hiring, particularly in sales and marketing (whereas many of its peers are scaling back on headcount and making 2024 a year of efficiency).

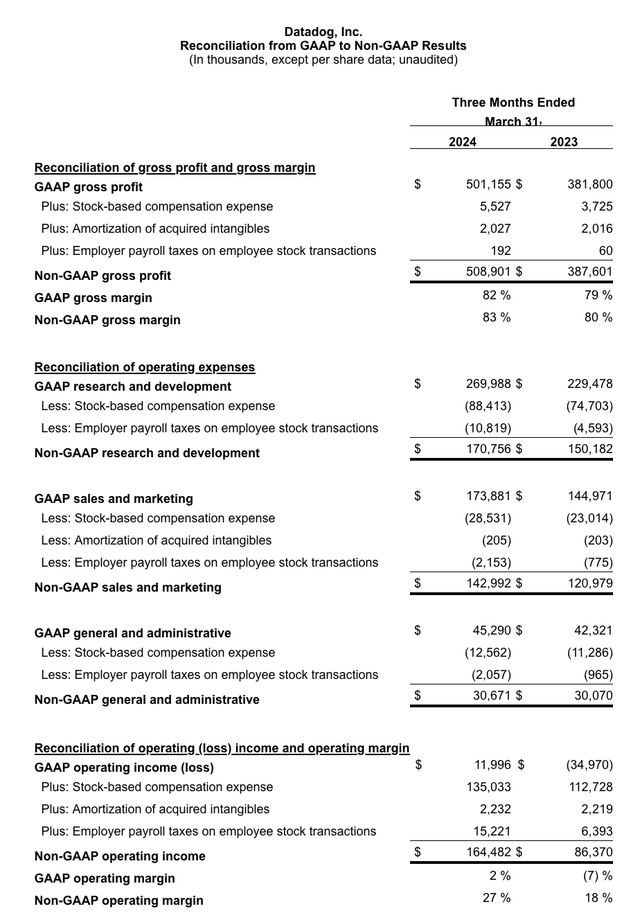

Opex grew “only” 14% y/y the first quarter, which pales behind 27% y/y revenue growth. As a result, as shown in the chart below, pro forma operating margins soared to 27%, a nine-point improvement from 18% in the year-ago Q1.

Datadog margins (Datadog Q1 earnings release)

We note that this puts Datadog’s “Rule of 40” score at 54 (27% revenue growth plus 27% pro forma operating margins), which is the biggest justification for a premium valuation here.

Key takeaways

I continue to recommend patience on Datadog as it approaches my price target of $94, but be ready to pounce on this stock on near-term volatility. Datadog’s decline this year is a function of its huge valuation unwinding, but at its core, Datadog is a fantastic business operating well above the Rule of 40, with a sticky clientele and a software subsector that has an enormous TAM.

Read the full article here