I have highlighted Dynavax Technologies Corporation (DVAX) quite a bit over the past few years. The stock has been largely range bound over that time, despite the company continuing to take market share in its core market and the company moving towards profitability. Fortunately, the stock has been one of my favorite and successful “rinse, wash, and repeat” covered call trades over that time as well. The company reported second quarter results in August. Therefore, it seems a good time to check back in on this growing vaccine concern. An updated analysis follows below.

Seeking Alpha

Company Overview:

Dynavax Technologies is headquartered in Emeryville, CA. This commercial stage biopharma’s primary asset is Heplisav-B, which has become the ‘best of breed’ hepatitis B vaccine since being approved due to its higher effectiveness and much higher compliance (it can be delivered in two doses over a one-month period compared to three doses over six months like the previous standard of care Entergis-B). Dynavax had a massive burst of sales due to adjuvants used in several overseas COVID-19 vaccines, but that revenue stream has completely gone away now that the pandemic is over. The company did manage to build up a huge cash balance due to this influx of non-recurring funding, however. The stock currently trades just under $11.00 a share and sports an approximate market cap of just over $1.4 billion.

Second Quarter Results:

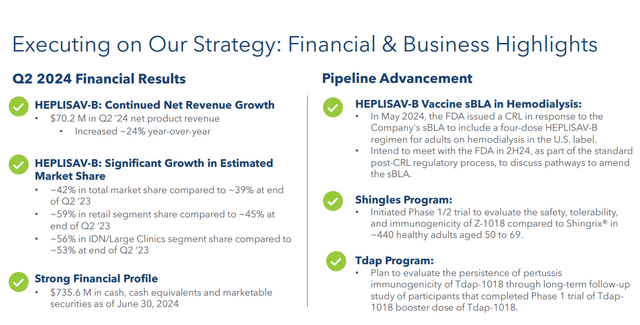

On August 6th, Dynavax posted its Q2 results. They were solid. Dynavax posted a GAAP profit of eight cents a share, two pennies a share above expectations. Revenues rose 22.5% on a year-over-year to $73.8 million, which was slightly light of the consensus. Heplisav-B sales grew 24% from the same period a year ago to $70.2 million and produced gross margins of approximately 80%.

August 2024 Company Presentation

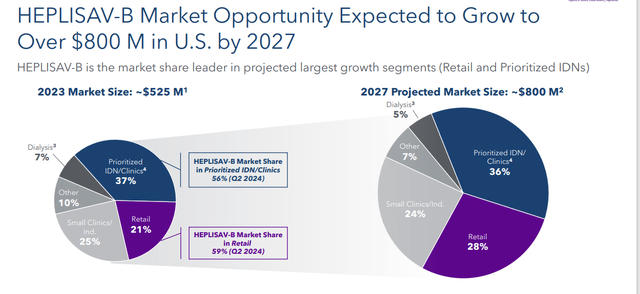

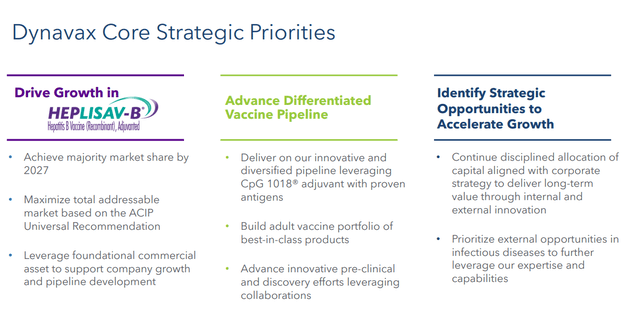

Sales continue to increase as both the size of the hepatitis B vaccine market is growing and Heplisav-B’s market share also continues to increase. It hit 42% in the second quarter, compared to 39% in the same period a year ago. Management has set expectations that Heplisav-B will have over half the market by 2027, and that market will be at least $800 million in total. Leadership reiterated FY2024 Heplisav-B sales of between $265 million to $280 million. This is solid growth over the $213.3 million of net sales this vaccine provided in FY2023.

August 2024 Company Presentation

Analyst Commentary & Balance Sheet:

Since Q2 numbers hit the wires, Goldman Sachs maintained their Hold rating and lowered their price target to $15 a share from $20 previously. However, JMP Securities ($29 price target), TD Cowen ($25 price target) and H.C. Wainwright ($29 price target) all have reissued their Buy ratings after perusing results.

Dynavax ended the quarter with $735 million of cash and marketable securities on its balance sheet, and leadership expects the company to be free cash flow positive in FY2024. The company listed $223 million in convertible notes on the 10-Q it just filed for the second quarter. There has been minimal insider selling of the shares in 2024 to date (less than $500,000 collectively).

Dynavax’s Cash Dilemma:

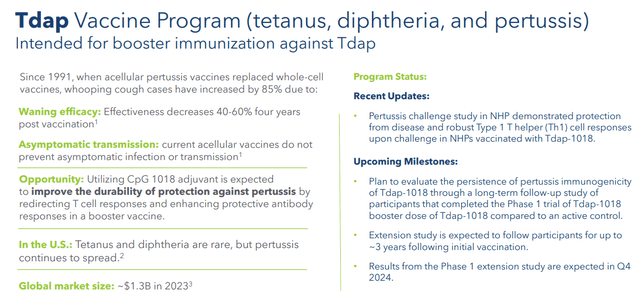

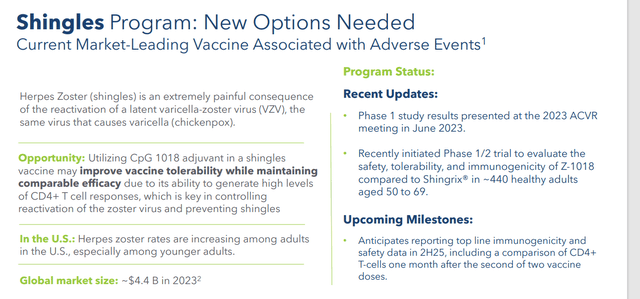

The company is advancing a pipeline of differentiated product candidates that leverage the same CpG 1018® adjuvant that was utilized in several COVID-19 vaccines. This includes Z-1018, which is an investigational vaccine candidate that is being developed for the prevention of shingles in adults aged 50 years and older. Dynavax just initiated a Phase 1/2 study in June. Top-line immunogenicity and safety data is expected out in the second half of 2025.

August 2024 Company Presentation

The company is also developing Tdap-1018 for active booster immunization against tetanus, diphtheria, and pertussis, or Tdap. Some Phase 1 study data around this candidate should be posted before the end of the year. Finally, Dynavax is developing a plague (rF1V) vaccine candidate that is being fully funded by the Department of Defense. Some mid-stage data should be updated before yearend. There is no current vaccine for the plague.

August 2024 Company Presentation

These candidates have some potential, especially the Shingles effort. The company is spending $60 million to $75 million in R&D costs annually to advance its pipeline. Dynavax would make an attractive M&A candidate, trading at approximately three times revenues minus the net cash on its balance sheet, even with a decent buyout premium. Dynavax was mentioned as a logical buyout target on a list in February of this year. The company would be accretive to a larger player in a similar space.

The company has already reached profitability, which should continue to increase in the years ahead along with sales growth. The management at Dynavax could also look to purchase a company with a product approved on the market in the vaccine market or that has late-stage candidates with significant potential given the cash it has on its balance sheet. Leadership has hinted at the possibility in the past.

August 2024 Company Presentation

Conclusion:

Unfortunately, until Dynavax Technologies Corporation moves its candidates into late-stage development or purchases other strategic candidates, the shares could remain range bound and undervalued. Obviously, if DVAX is bought out itself, that dilemma resolves itself. The good news is, there seems to be little downside to the shares, and the stock is also trading at near the floor of a range that has held firm for some three years now.

The options against the equity usually have decent liquidity, and I have executed some recent covered call orders to add to my position. It is also a good level to add some Dynavax Technologies Corporation shares via straight equity as well, in my opinion.

Read the full article here