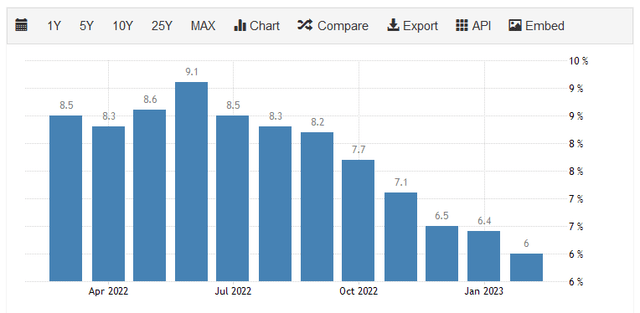

One of the biggest problems facing Americans today is the incredibly high inflation that has been dominating the economy. There can be little doubt of this as the current inflation rate is the highest that it has been in more than forty years. In fact, there has not been a single month over the past year in which the consumer price index appreciated by less than 6% year-over-year:

Trading Economics

As a result, people need to increase their incomes significantly simply to maintain their lifestyles. There are very few jobs that have delivered on this, which is one reason why real wage growth has been negative for 23 straight months. This is also a significant problem for retirees since even though Social Security did deliver a pretty large cost of living increase recently, that is hardly the only source of income for most people reading this. Thus, the total impact of the Social Security increase was somewhat muted and it is still likely that you feel poorer than you did a year ago.

As investors, one of the best ways for us to solve this problem is to put our money to work for us in the generation of income. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income. Unfortunately, these funds are not very well followed by the financial media and many investment advisors are not familiar with them, so it can be difficult to make an informed choice. This is a terrible state of affairs because these funds can typically deliver much higher yields than pretty much anything else in the market along with offering a diversified portfolio to shareholders.

In this article, we will discuss the Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE:ETY), which is one fund that can be used by investors looking for income. The fund’s 8.44% current yield certainly reflects this, although it is not the highest yield available among closed-end funds. I have discussed this fund before and was admittedly a bit underwhelmed because it shares some of the problems of Eaton Vance’s other funds. With that said though, it has been nearly six months since we last discussed it so of course a good many things may have changed in that time. As such, let us revisit this fund and see if it could be a decent addition to a portfolio today.

About The Fund

According to the fund’s webpage, the Eaton Vance Tax-Managed Diversified Equity Income Fund has the stated objective of providing its investors with a high level of current income and current gains. This is not an unreasonable objective for an equity fund. As of the time of writing, this fund’s portfolio consists of 99.19% common stock along with a small amount of cash:

CEF Connect

The reason why this objective is not particularly surprising is that common stock is usually purchased by investors in order to profit from the dividends paid by the issuing companies as well as for capital gains. That is exactly what this fund states to be targeting. However, many people purchase common stock for long-term gains, but this fund states that it is after short-term gains, although it does mention capital appreciation as a secondary objective. That is not necessarily surprising for an income fund since long-term capital appreciation does not necessarily result in money hitting the fund’s bank account that can be distributed. After all, it is necessary to sell stock in order to actually spend your profits (unless you are doing something like taking loans against stock positions). Thus, it appears that this fund is relying on trading stocks in order to achieve its objective of receiving current income.

A look at the fund’s portfolio reinforces this. Here are the largest positions in the fund:

Eaton Vance

This is obviously not a fund that is seeking dividend income. After all, with the notable exception of Chevron Corp. (CVX), nearly all of these companies have next to no dividend yield:

|

Company |

Dividend Yield |

|

Microsoft Corp. (MSFT) |

0.93% |

|

Apple (AAPL) |

0.56% |

|

Alphabet (GOOG) |

0.00% |

|

Amazon.com (AMZN) |

0.00% |

|

PepsiCo (PEP) |

2.50% |

|

Mastercard (MA) |

0.63% |

|

UnitedHealth Group (UNH) |

1.29% |

|

Procter & Gamble (PG) |

2.40% |

|

Eli Lilly and Co. (LLY) |

1.23% |

|

Chevron Corp. |

3.60% |

As of today, a money market fund is paying about 4.50% so that beats every company on this list in terms of yield. In addition, all of these companies currently have a negative real dividend yield. Thus, this fund cannot possibly be depending on dividend income as a primary source of investment return. Thus, in order to realize any distributable income from this portfolio, it must be buying and selling stocks to generate capital gains. That costs money, which we will discuss in a bit.

This fund does have another way to generate income though. The fact sheet discusses its strategy:

“The fund invests in a diversified portfolio of domestic and foreign common stocks with an emphasis on dividend paying stocks and writes (sells) S&P 500 Index call options with respect to a portion of the value of its common stock portfolio to generate current cash flow from the options premium received.”

This description states that the fund is focusing on dividend-paying stocks, but that certainly does not appear to be the case. No fund that focuses on dividend-paying stocks would include Alphabet or Amazon.com in its top ten holdings, nor would it have Microsoft or Apple. The yields are far too low, especially considering that the S&P 500 Index as a whole yields 1.58% today so all but three companies on the above list are well below the average yield of a dividend-paying stock. The options strategy, however, does work pretty well as a source of income. This is because the fund receives the premium upfront and gets to keep that premium regardless of what happens with the option. Ideally, the option will expire worthlessly, and the fund will get to simply keep all the premium that is received. It is important to note though that the fund writes index options but it does not own the index. These are therefore naked call options and thus the potential loss on any option can be unlimited. However, the idea is that the fund’s portfolio will perform at least somewhat similar to the index and thus hedge the risk. This should work well in most market conditions, particularly bear or flat markets like we have today. However, the fund’s strategy is still not as safe as a covered call strategy, which is employed by a few other option-income funds.

Interestingly, the largest positions in the fund are exactly the same as what we saw the last time that we looked at the fund, although the weightings have changed somewhat. This could simply be indicative of one stock outperforming another in the market and is not necessarily caused by the fund trading positions. This could imply that this fund has a low turnover, which would be surprising if it is relying on current gains as a source of income. The fund actually had a 55.00% annual turnover last year, which is not particularly high for a closed-end fund, but it is nowhere near as low as an index fund possesses. This tells us that the fund’s management is indeed doing some asset trading. The reason that this is important is that it costs money to trade stocks or other assets, which is billed directly to the fund’s investors. This creates a drag on the fund’s performance and makes management’s job more difficult. After all, the fund’s managers need to deliver sufficient returns to cover these costs as well as have enough left over to satisfy the fund’s investors. There are very few management teams that manage to accomplish this, which is why actively managed funds usually underperform comparable index funds.

This fund is not an exception to the rule, although it does do better than indexes in certain circumstances. Here is the fund’s performance over various periods of time:

Eaton Vance

The fund’s Performance at Net Asset Value is more important than its market price performance. This is because these figures are what the portfolio itself actually delivered. As we can see here, the fund generally underperformed the S&P 500 Index during bull market periods. However, it actually outperformed during weak markets like 2022. This is because of the options strategy. The premiums that the fund received from the option sales offset some of the losses that it suffered on the stock portfolio. It will usually be the case that the fund will outperform the S&P 500 Index during times when the market is flat or declining. However, it will also underperform during bull markets because the fund is capping its upside potential with the options strategy. We can see though that the fund returned 9.46% over the trailing 10-year period, which is roughly in line with the long-term average of the S&P 500 Index. Thus, it appears that it compares reasonably well to the index over very long periods of time.

Distribution Analysis

As stated in the introduction, the Eaton Vance Tax-Managed Diversified Equity Income Fund has the stated objective of providing its investors with current income and current gains. The call-writing strategy does reasonably well at achieving this objective, although the fund’s portfolio is not particularly good at achieving a high level of dividend income. Regardless though, the fund should be able to provide a reasonably high yield if it pays out its capital gains and options premiums to the investors. This is certainly the case as the fund pays a monthly distribution of $0.0805 per share ($0.966 per share annually), which gives it an 8.44% yield at the current price. The fund was previously very reliable with respect to its distribution, although its distribution cut back in November reduced its shine somewhat:

CEF Connect

The fund’s history will likely appeal to many investors that are looking for a safe and consistent source of income with which to pay their bills, however, the recent distribution cut will still be concerning. It is at least partially explained by the fact that the fund is heavily exposed to the mega-cap technology companies that performed very poorly in 2022, but this is probably going to be a small comfort as the fund probably could have avoided the distribution cut if its portfolio were more diversified. Fortunately, a new investor does not really have to worry about this as anyone buying today will receive the current distribution at the current yield. Thus, the most important thing for any new investor is going to be the fund’s ability to sustain the current distribution at the current yield.

Fortunately, we do have a somewhat recent document that we can consult for our analysis. The fund’s most recent financial report corresponds to the full-year period that ended on October 31, 2022. This is a much newer report than we had available to us the last time that we discussed this fund, and it should therefore give us a better idea of how well the fund handled the difficult market last year. During the full-year period, the Eaton Vance Tax-Managed Diversified Equity Income Fund received $30,061,939 in dividends and curiously no interest. Thus, these dividends comprised the entirety of the fund’s reported investment income. The fund paid its expenses out of this amount, which left it with $8,967,766 available for shareholders. As might be expected, this was nowhere close to enough to cover the $173,983,563 that the fund actually paid out in distributions to the shareholders. This certainly may be concerning at first glance since the fund paid out substantially more than its net investment income to the shareholders.

However, there are other ways via which the fund can obtain the money that it needs to pay for the distribution. For example, it might have capital gains that can be paid out. In the case of this fund, it also has received options premiums that can be paid out since that is not considered to be part of net investment income. As might be suspected from the weak market, the fund generally failed at this task, although it did not do too badly. The fund had net realized gains of $141,327,090 but this was offset by $444,326,175 net unrealized losses. Overall, the fund’s assets declined by $427,384,737 after accounting for all inflows and outflows. This is concerning, although the fund is actually up over the trailing two-year period. As of November 1, 2020, the fund had total assets of $1,759,627,639, which had climbed to $1,784,539,771 on November 1, 2022. Thus, the fund did manage to cover its distributions over the entire period, albeit barely. The distribution cut was probably meant to ensure that the fund’s assets remain around the $1.7 billion to $1.8 billion level, so we will have to see how well it can sustain the new distribution. Overall, though, it does appear that the fund’s finances are okay.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Managed Diversified Equity Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. This is the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire the fund’s shares for less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of April 6, 2023 (the most recent date for which data is currently available as of the time of writing), the Eaton Vance Tax-Managed Diversified Equity Income Fund had a net asset value of $11.67 per share but the shares currently trade for $11.45 per share. This gives the shares a 1.89% discount on the net asset value at the current price. This is much better than the 0.09% premium that the shares have averaged over the past month. Thus, the price certainly appears to be reasonable today.

Conclusion

In conclusion, this fund appears to be a reasonable option for investors looking for income. While I still do not particularly like Eaton Vance’s tendency to heavily weight the mega-cap technology companies in its income funds, this one is not quite as bad as some of the others. This fund is probably going to outperform the S&P 500 Index over the near-term unless the Federal Reserve cuts interest rates and sparks another bull market. The big question right now is what the market will do if the Federal Reserve sticks to its guns and does not cut rates, as the market is currently pricing in a rate cut. Regardless, this fund appears to be a reasonable way to earn an attractive yield and still retain some exposure to the stock market for the time being.

Read the full article here