The iShares MSCI South Africa ETF (NYSEARCA:EZA) tracks the MSCI South Africa 25/50 Index, targeting the performance of major large and mid-cap South African equities. With $300 million in assets under management, EZA is the largest of a handful of ETFs focused on exposure to Africa. EZA offers value in terms of earnings and price to book ratios, but a very dour economic reality makes a South African play something I would avoid for now.

Dispiriting economic backdrop

South Africa’s economic landscape remains challenged under President Cyril Ramaphosa’s administration. The official unemployment rate as Q4 2023 was hovers around 33%. Long-standing issues around energy supplies have intensified in the last year. South Africa is plagued by rolling blackouts, as energy supplies cannot meet demand for the country of 62 million. The Reserve Bank of South Africa estimates the persistent black-outs have kneecapped growth rates by as much as 0.6% in 2024.

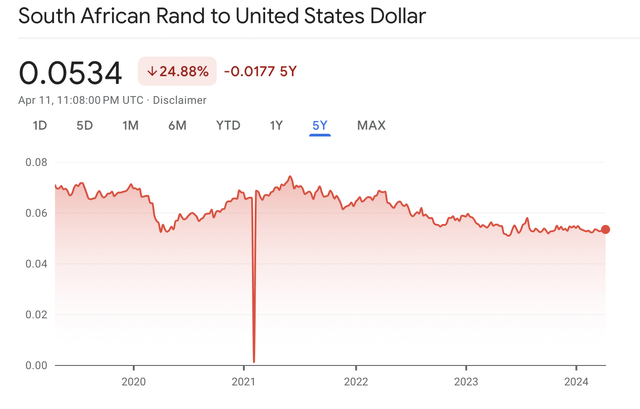

The headline story from a macro perspective is a depreciating Rand. The currency has depreciated 25% vs. the dollar over the last 5 years on the back of rampant inflation. This has a negative effect for domestic consumers, as import costs rise and purchasing power falls.

Google Finance

The benchmark interest rate has remained elevated at 8.25% after a tightening cycle began in 2022. Inflation, while climbing in February to 5.6%, is still in the central bank’s target range.

Broad exposure to South Africa’s economic drivers

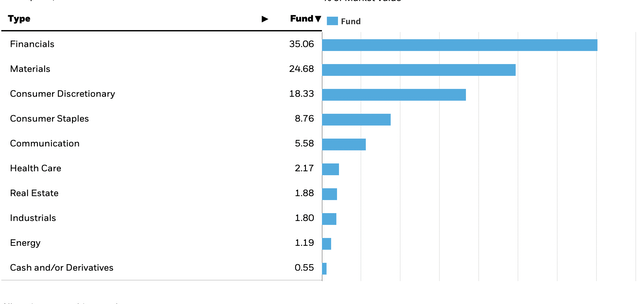

EZA is a financials and materials focused ETF, with a combined 60% of the fund allocated to those sectors. As mentioned above, currency depreciation can negatively affect the EZA’s mining-focused materials sector, as commodity prices are typically denominated in USD. A strengthened dollar against the Rand can negatively impact local suppliers. EZA is also vulnerable to boom and bust cycles associated with commodities. Given the currency situation, the combined cocktail of a supply glut or price bust in the key mining exports could challenge the fund.

iShares

EZA has a total of 39 individual holdings at the time of writing. Despite the small number of individual holdings, the fund is decently diversified, with only 62% of assets in the top 10 holdings. The largest single holding is Naspers Limited (OTCPK:NPSNY), a multinational technology and multimedia company. Naspers is perhaps most famous for its large investment in the Chinese tech giant Tencent (OTCPK:TCEHY), which has proven to be exceedingly profitable.

Seeking Alpha

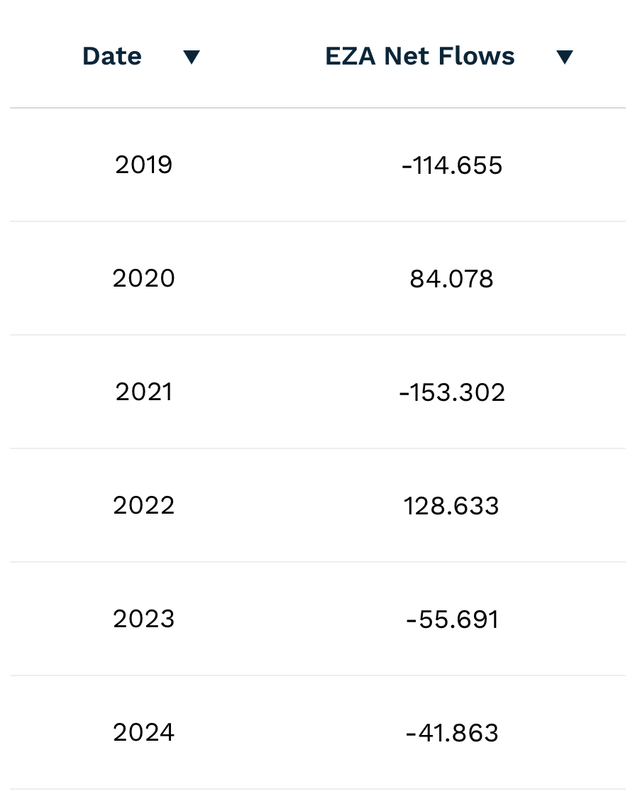

Outflow pattern in 2023 and 2024

EZA’s flow pattern has been inconsistent. We saw large net inflows as recently as 2022, following the large net outflows that ensured in the COVID period. Given the level of concentration in the fund, it seems possible that another period of large outflows like those we saw in 2021 could put negative price pressure on South African equities, causing a further sell-off.

ETF.COM

Persistent volatility

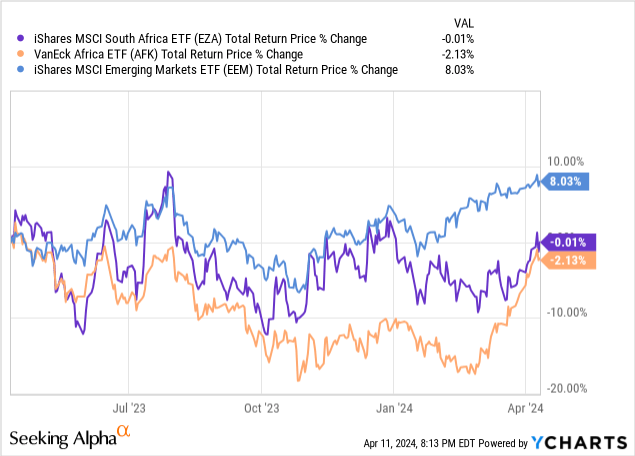

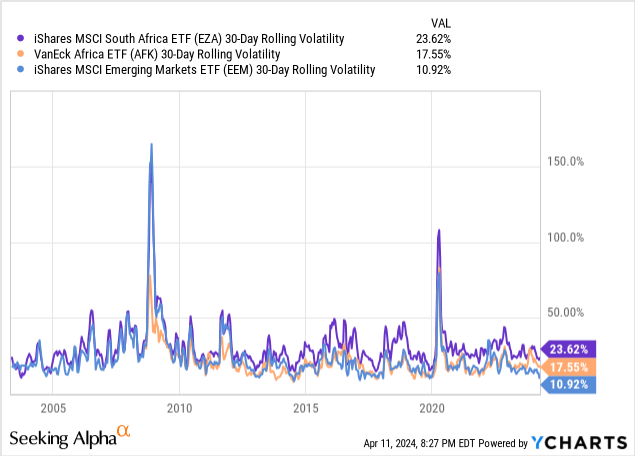

When comparing EZA to the broader African market, represented by the VanEck Africa ETF (AFK), it has performed better in the last year; however, it has underperformed broader emerging markets (EEM) considerably. South Africa represents around 3% of EEM, which is heavily tilted towards China, and 36% of AFK’s allocation.

I want to look at the volatility story here to get a more comprehensive picture of EZA’s risk outside what was outlined above. EZA has a rolling volatility of a whopping 23%, which far outpaces both the African region and broader emerging markets.

Attractive multiples, a bright spot

EZA is relatively cheap, trading at a 1.6x PB and an earnings multiple of close to 12x. Its dividend yield for the TTM period is around 3%, which is on the lower side of many emerging markets focused ETF, especially one with the level of allocation to the financials sector.

Risks and closing thoughts

South Africa faces significant economic headwinds including high unemployment, energy supply issues, and a depreciating rand which, among other things, can erode the profitability of EZA’s holdings. Political uncertainty under President Ramaphosa’s administration raises governance risks around the long-term stability of the country. EZA itself is a volatile ETF, and when examining its return profile, and forward-looking prospects, that level of volatility is hard for me to stomach.

South Africa is the most advanced economy on the continent. There remains a long runway for future growth as personal incomes rise, and domestic consumer demand picks up. Structural economic reforms, infrastructure build outs, and rising trade with partners in Europe, China, and beyond should all act as powerful tailwinds for South African equities in the decades ahead. However, I find this difficult to justify as a buy at the moment.

Read the full article here