Summary

In our opinion, Flagship Communities Real Estate Investment Trust (TSX:MHC.UN:CA/OTCPK:MHCUF) is one of the most attractively priced, high-growth residential REITs. It operates in the highly attractive and resilient residential submarket of manufactured housing and maintains a conservative balance sheet. Given its long-dated, fixed-rate debt profile, it is well hedged against rising interest costs, improving the outlook for FFO and AFFO growth. With the unit price off ~8% from our last report, we see a significant margin of safety and maintain our Strong Buy rating.

Earnings Update

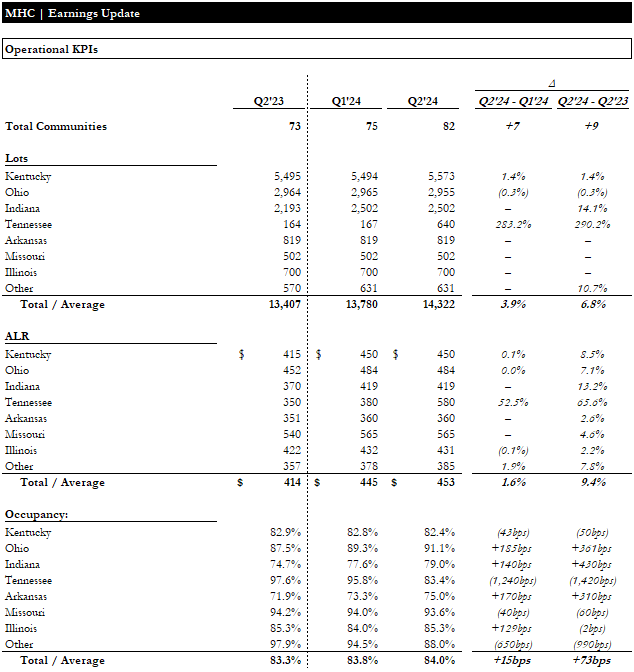

Flagship’s portfolio grew by 7 communities as a result of its largest acquisition to date. These communities added +1,200 lots in several new markets for the REIT (Nashville, TN and West Virginia). Sequential ALR growth was muted across the portfolio, except for Tennessee, which increased due to the higher ALRs in Nashville compared to Knoxville. Recall that ALR increases are passed through annually, so this muted growth is not worrisome. Occupancy changes were mixed within the portfolio but increased 15bps overall.

Earnings Update | Operations (Empyrean; MHC)

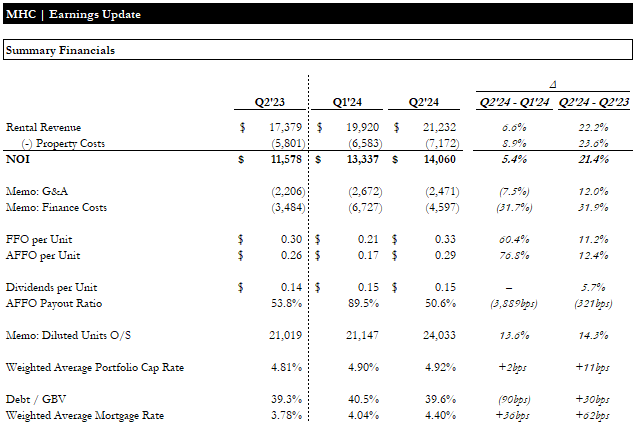

The addition of the new communities drove the majority of the ~7% revenue growth. Property opex offset some of this, leading to 5% NOI growth. QoQ declines in corporate-level G&A and interest costs drove +60% and +77% growth in FFO and AFFO per unit, respectively. Unit issuances were utilized to finance the expansion acquisitions and led to a ~14% increase in the unit count. Leverage remained conservative at ~40% D / GBV.

Earnings Update | Financial (Empyrean; MHC)

Operationally, this was another strong quarter for Flagship. We like the diversity the newly acquired communities bring to the portfolio, though we believe the large equity issuance has weighed on the unit price.

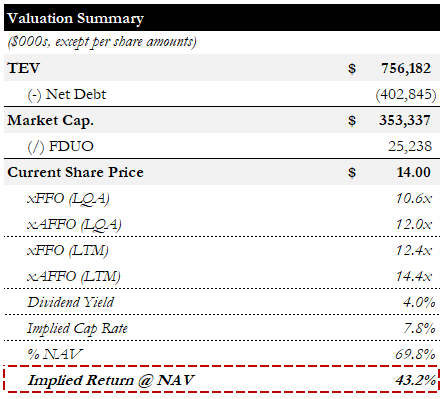

Valuation

Flagship is trading for ~12x and ~14x LTM FFO and AFFO, respectively, and ~70% of our revised NAVPU estimate (n.b., ~43% upside to NAV; ~7.8% implied cap rate). It yields ~4%.

Valuation Summary (Empyrean)

While the unit issuance was dilutive to NAVPU in the short term (n.b., we revised our NAVPU down to ~$20/unit vs ~$21 previously), we believe the market has overreacted. The implied return today is ~43% vs ~39% in our previous report. Over time, we expect the positive fundamentals to drive NOI growth in the new assets, which will make the acquisitions accretive.

Risks & Catalysts

Low Trading Liquidity

Due to its small size, MHC’s units are relatively illiquid, increasing trade execution risk and transaction costs. MHC’s conservative capitalization, the resilience of the asset class, and attractive valuation provide a sufficient illiquidity premium to mitigate this risk. We expect MHC’s liquidity to improve as the investor base grows, and more units are issued to fund future acquisitions.

Reliance on Equity Funding

MHC’s goals of inorganic growth and maintaining a D/GBV of ~40% make it heavily reliant on equity issuance. We gain comfort in this from the REIT’s track record of accretive acquisitions, and management’s disciplined approach to M&A in recent quarters. While the depressed unit price could put the REIT in a negative-reflexivity scenario (i.e., discount to NAV leads to either 1) dilutive equity issuances to fund growth or 2) a slower pace of reinvestment, either of which could contribute to a weak share price, perpetuating the cycle), we see management’s ability to be patient as an adequate mitigation.

Falling Rates & Pickup in Acquisitions

These two go hand in hand. Like many areas of real estate, private MHC transaction volumes are depressed. This is largely a function of the wide bid/ask spread driven by the rise in interest rates. Should interest rates come down, we expect this bid/ask to narrow and transaction activity to pick up. This will reignite MHC’s growth engine and contribute to a re-rating.

Value Creation Initiatives

MHC has four primary value-creation initiatives:

- Improving occupancy rates for the existing portfolio and for new acquisitions in certain Midwest states.

- Adding amenities, such as playgrounds and resident clubhouses, to improve leasing demand.

- Improving NOI margins through the water and utilities sub-metering and the sale of rental homes to owner-occupiers.

- Excess land that could allow for future asset intensification developments.

We consider all of these as upsides to our valuation.

Conclusion

Flagship reported Q2 earnings on August 8, 2024. The results reflect the resilience and strong performance of the manufactured housing asset class. In addition to strong financial performance, MHC completed its largest-ever acquisition of 7 MHC communities, expanding its portfolio into Nashville and West Virginia. We have updated our valuation, decreased our target price (due to the unit issuance used to finance the expansion acquisitions) to ~$20/unit, and maintained our Strong Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here