FREYR Battery (NYSE:FREY) went public in 2021 during the golden age of blank check companies. The company would land in the embrace of investor euphoria and untamed animal spirits for EVs, battery manufacturers, and companies intrinsic to the green energy transition. Almost two years later and a macroeconomic environment characterized by high inflation and an elevated Fed funds rate has worked to sap investor enthusiasm even as the underlying climate economy looks set for a generational boom.

Norway-based lithium-ion battery manufacturer FREYR has ambitions to install 50 GWh of annual battery cell capacity by 2025, then 2X this capacity by 2028, rising again to 200 GWh of capacity by 2030. It’s a crowded field with large, mostly Chinese players competing with a plethora of public and private companies for market share in the fast-expanding industry to supply energy storage solutions (“ESS”) to utility-scale green energy production and the rapidly growing number of EVs. Interest in the industry has really blossomed since the pandemic and FREYR is joined by SES AI (SES), Microvast (MVST) and more speculative solid-state battery plays QuantumScape (QS) and Solid Power (SLDP) in fighting for a role in a climate economy about to boom. FREYR describes its batteries as SemiSolid, with the lithium-ion battery technology licensed from 24M, a spinout from MIT.

FREYR And The Climate Economy

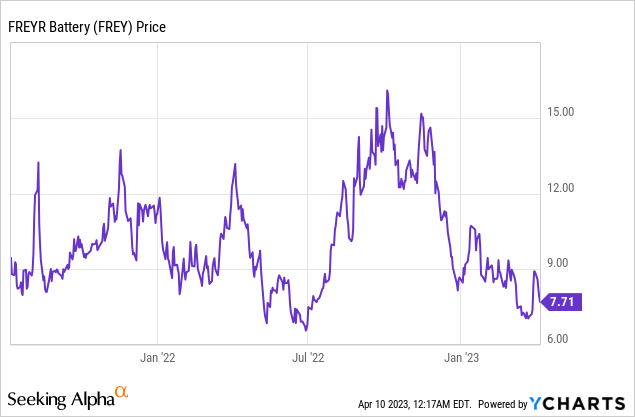

FREYR currently trades on a market cap of $1.08 billion with its commons currently swapping hands at $7.71 per share, around 23% below their $10 SPAC reference price. There is a degree of latent opportunity here albeit with significant risk. The company’s investment pitch is straightforward and built around being a pick-and-shovel play for the climate economy. This describes the infrastructure and technologies like EVs, solar PV, and wind turbines, that are required for the low-carbon future now being built on the back of countries racing to avert anthropogenic climate change. However, this is a broadly pre-revenue company operating in a fast-moving space that’s likely to be privy to significant creative destruction in the years ahead.

FREYR’s global offtake and long-term sales agreements through 2030 has grown to around 130 GWh of battery production across both ESS and E-Mobility. The company is yet to commence sales so the core two points from its last reported fiscal 2022 fourth-quarter earnings were cash flows and liquidity. FREYR reported a cash burn from operations of $17 million with capital expenditure at $103.1 million. Free cash outflow for 2022 stood at $270.8 million with the construction of its first battery gigafactory, Giga Arctic, underway in Norway. Production and sales are slotted to start next year with cash, cash equivalents, and restricted cash of $563.0 million left on the balance sheet exiting the fourth quarter. This is around 52% of its market cap and against total debt of just $14.4 million.

Hence, the current liquidity is sufficient to meet outflows through to 2024 with the company also able to tap non-dilutive debt if required to further expand its runway. This is one of the most important factors facing FREYR as a raft of climate economy companies that went public via blank check during 2021 are facing different levels of a liquidity crisis. For example, the Texan EV manufacturer Canoo (GOEV) has less than a year of runway left and UK-based EV van manufacturer Arrival (ARVL) just announced a cash rescue deal.

Batteries, Subsidies And War

FREYR stock now just needs to execute its timeline whilst optimizing its cash outlay. The company faces a wall of structural demand as EVs and utility-scale renewable projects ramp up. Indeed, solar power constituted 50% of all new electricity-generating capacity added in the US in 2022. This was roughly 20.2 gigawatts of utility-scale solar PV capacity added and was enough to power 25 million US homes. The company has announced plans for a 34 GWh US gigafactory in Georgia to take advantage of the production tax credits provided by the 2022 Inflation Reduction Act (“IRA”). Management stated during their fourth-quarter earnings call that they intend to bring Georgia’s start of production into 2025 from 2026.

The EU and Canada recently released their own version of the IRA, underscoring the marked level of government support companies in the industry are set to receive. These subsidies will form a critical pillar of growth with the IRA set to see zero-carbon energy grow up to 80% of US electricity production as soon as 2030, up from 20% of production currently. Crucially, Russia’s invasion and war on Ukraine has added an urgency to previously lagging attempts to transition away from fossil fuels. The subsequent energy crisis has sparked an almost visceral need for green energy in Europe and battery manufacturers like FREYR stand to be critical facilitators of this need. Battery storage, especially for ESS is an often overlooked but necessary part of the broader transition as it’s required to smooth the inherent intermittency of renewables. FREYR is one to watch on the buildout of Giga Arctic and on a clear roadmap of financing to bring its $1.7 billion Georgia gigafactory to life.

Read the full article here