Today, I would like to reassess the First Trust Value Line® Dividend Index Fund ETF (NYSEARCA:FVD), a smart-beta dividend ETF that favors low volatility and financial resilience. There are a few reasons why a fresh look is necessary. First, unlike a few ETFs that I have covered just recently, FVD takes a high-turnover approach, mirroring the Value Line® Dividend Index, which is reconstituted on a monthly basis. As a consequence, the portfolio composition has significantly changed since January, when I covered FVD the previous time, so my commentary on the differences that can be spotted and the factor developments they have resulted in is necessary. Second, I would like to discuss whether the ETF is a vehicle to consider for a new market narrative based on an unenthusiastic outlook for longer-duration equities, which is seemingly entrenching on Wall Street.

What is FVD?

In short, passively-managed FVD is supposed to offer exposure to a basket of dividend-paying companies with attractive quality and low volatility characteristics. As FVD described on its website, these companies are scrupulously selected by the index provider from

the universe of stocks that Value Line® gives a SafetyTM Ranking of #1 or #2 using the Value Line® SafetyTM Ranking System.

Besides, they must have an indicated dividend yield higher than that of the S&P 500 and a market cap of at least $1 billion to qualify for inclusion. As of my previous note, there were 162 holdings in the FVD basket; this number went up to 175 as of April 18. The index is recalibrated on a monthly basis, with constituents assigned equal weights. Please refer to the prospectus for more details.

Performance review: mostly disappointing start to the year, a few nuances as well

While not being a complete disaster, FVD’s performance has hardly been a success this year, though there have been a few nuances as well.

Assuming the growth narrative was dominating the equity market through the first quarter of the year, FVD, which is heavy in old-economy stocks, expectedly lagged the iShares Core S&P 500 ETF (IVV) in January and February but delivered the exact same return in March.

| Month | FVD underperformance vs. IVV |

| January | -2.37% |

| February | -3.16% |

| March | 0% |

Created using data from Portfolio Visualizer

Overall, since the beginning of 2024, FVD has underperformed IVV by more than 4%.

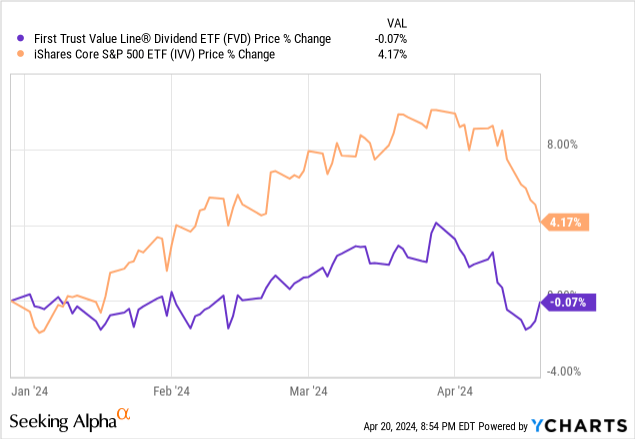

Since my previous note, which was published on January 20, FVD has also failed to beat the S&P 500.

Seeking Alpha

Comparing holdings’ prices as of January 17 and April 19, I have identified that the key detractors were the health care, industrial, and IT sectors. Overall, among 63 firms that delivered negative return over the period, the median was -5.4%. An important remark is that I analyzed only the holdings that were present in both the January and April versions of the FVD portfolio (148 companies, 84.3% of the net assets).

However, there is something much more interesting here. If we take a closer look at the YTD performance chart above, we will notice a remarkable divergence of paths that have emerged this week, as FVD rebounded while IVV continued creeping lower amid investors exiting longer-duration names. Let us zoom in on this.

To give a bit more color, I have found out that this has been driven mostly by 74 companies that have delivered positive returns in the one-week period, with the essential contributor being UnitedHealth Group (UNH), a healthcare sector bellwether, which has seen robust momentum of late as investors acclaimed its adjusted EPS surprise. Does that mean low volatility is back in vogue and FVD is about to have a boost as investors flock to defensive plays? We will return to that question a bit later.

How has the FVD portfolio evolved since January?

Since my January analysis, FVD has made rather notable changes to the portfolio as it removed 14 and added 27 companies, with the newcomers now accounting for roughly 15.4% of the net assets. Using financial data from Seeking Alpha and holdings’ weights from FVD, I have prepared the following table with the factor parameters I believe matter most:

| Metric | Holdings as of April 18 | Holdings as of January 16 |

| Market Cap | $77.088 billion | $79.398 billion |

| EY | 5.10% | 5.12% |

| P/S | 3.11 | 3.04 |

| EPS Fwd | 7.07% | 8.22% |

| Revenue Fwd | 3.74% | 4.92% |

| ROE | 28.12% | 50.86% |

| ROA | 7.41% | 7.31% |

| NI Margin | 14.66% | 14.37% |

| Quant Valuation B- or better | 16.35% | 16.39% |

| Quant Valuation D+ or worse | 51.89% | 56.25% |

| Quant Profitability B- or better | 84.69% | 84.92% |

| Quant Profitability D+ or worse | 5.83% | 5.28% |

Calculated by the author using data from Seeking Alpha and the ETF. Financial data as of January 17 and April 19

The key takeaways are that despite a high-turnover approach, FVD’s factor mix is exceptionally stable. No major deviations in the growth/value/quality triumvirate might be spotted except for a decline in the weighted-average forward growth rates, which, however, is hardly surprising for a growth-agnostic fund pursuing quality and low volatility. Besides, the difference in the Return on Equity values is attributable to the removal of Oracle (ORCL), which had a ROE of around 3,368% as of January.

On the volatility front, we see similar stability, with the current version of the portfolio having a WA 24-month beta of 0.7 vs. 0.69 in January, as per my calculations.

Dividend characteristics are also surprisingly stable, as illustrated by the weighted-average figures below.

| Month | DY | Div Growth 3Y | Div Growth 5Y |

| January | 2.83% | 8% | 7.69% |

| April | 2.87% | 7.89% | 7.56% |

Calculated by the author using data from Seeking Alpha and the ETF. Financial data as of April 19

Final thoughts

It seems the S&P 500 is about to break its 5-month-long winning streak that started in November 2023, unless something miraculous happens in the next couple of weeks. A legitimate question here is whether defensive and/or quality and value strategies, with FVD being one example, should be considered to protect portfolios from a deeper correction going forward. While there is good reason to exercise caution as the inflation-is-over narrative that detracted from FVD’s performance in 2023 and earlier this year now looks less justified, I believe adding this ETF even for tactical protection is not necessarily a good choice. Truly, it offers a nicely balanced assemblage of less volatile, fundamentally sound companies with a footprint in the defensive stock universe (i.e., a 43.3% allocation to consumer staples, health care, and utilities) that theoretically should make it even more appealing. However, the biggest risk here is that the ETF will only slightly protect on the downside and then lag significantly on the upside. There is another theoretical scenario when FVD lags behind IVV or a similar S&P 500 ETF both during the correction and recovery phases. A meticulous investor would likely ask here how this is even possible for a low-volatility ETF, as low-beta stocks are less sensitive to bearish periods. It is possible, and there is ample evidence. Even though FVD’s strategy worked excellently during the global financial crisis and the pandemic, there was a period when it delivered a deeper maximum drawdown than IVV. It was during the January 2023-March 2024 period. I have added the Schwab U.S. Dividend Equity ETF (SCHD) for a better context:

| Portfolio | FVD | IVV | SCHD |

| Initial Balance | $10,000 | $10,000 | $10,000 |

| Final Balance | $10,888 | $13,948 | $11,161 |

| CAGR | 7.04% | 30.50% | 9.18% |

| Stdev | 12.20% | 13.47% | 13.39% |

| Best Year | 4.59% | 26.32% | 6.73% |

| Worst Year | 4.10% | 10.42% | 4.57% |

| Max. Drawdown | -9.76% | -8.32% | -9.35% |

| Sharpe Ratio | 0.2 | 1.68 | 0.34 |

| Sortino Ratio | 0.29 | 3.72 | 0.56 |

| Market Correlation | 0.9 | 0.99 | 0.87 |

| Upside Capture | 44.51% | 100.24% | 49.68% |

| Downside Capture | 110.54% | 94.67% | 109.12% |

Data from Portfolio Visualizer

As it can be seen, FVD captured more downside and less upside than IVV and SCHD. In the event of a similar scenario materializing this year, I believe there is a risk of FVD again capturing more downside and underperforming during the rebound. So my conclusion here is that the ETF is an interesting low-volatility, mostly defensive play that might surprise in a correction, not living up to investors’ expectations, and a Hold rating should be maintained.

Read the full article here