The Clough Global Equity Fund (NYSE:GLQ) is a closed-end fund, or CEF, that income-focused investors can purchase as a method of pursuing their goals. The fund does very well at this, just like most funds from Clough Capital Partners. As of the time of writing, the fund yields an impressive 10.50%, which generally compares pretty well to its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Clough Global Equity Fund |

Equity-Global Equity |

10.50% |

|

Allspring Global Dividend Opportunity Fund (EOD) |

Equity-Global Equity |

9.20% |

|

Calamos Long/Short Equity & Dynamic Income Trust (CPZ) |

Equity-Global Equity |

11.05% |

|

Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG) |

Equity-Global Equity |

8.40% |

|

John Hancock Hedged Equity & Income Fund (HEQ) |

Equity-Global Equity |

9.79% |

|

Lazard Global Total Return and Income Fund (LGI) |

Equity-Global Equity |

7.56% |

|

abrdn Total Dynamic Dividend Fund (AOD) |

Equity-Global Equity |

8.26% |

As we can immediately see, the Clough Global Equity Fund has a higher yield than all but one of the funds shown on the comparison chart. This is something that could appeal to any income-focused investor, as purchasing this fund would provide a higher income than buying most other funds that use a similar strategy.

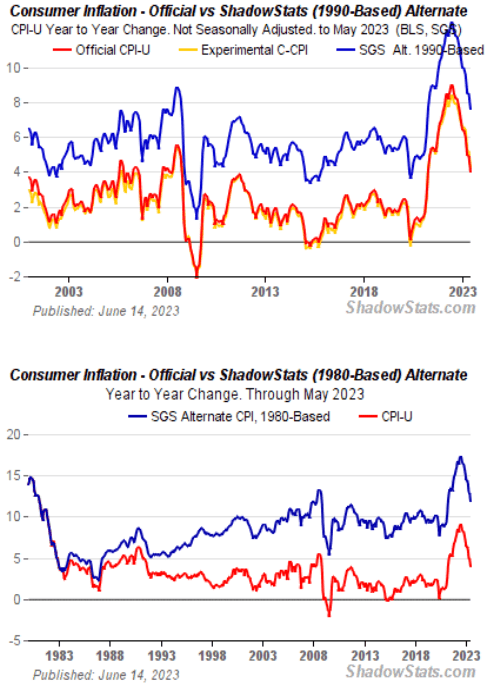

Another benefit of the Clough Global Equity Fund should be immediately apparent by the fund’s name. This fund invests primarily in equity securities as opposed to fixed-income ones. That is very nice given today’s very high level of inflation, which is arguably higher than the official consumer price index states. I mentioned this in a previous article, in which I included a chart showing that the headline inflation rate would be roughly double the reported figure if we used the same methodology as was used in the 1980s or 1990s:

ShadowStats

This morning, Jeffrey Tucker of the Epoch Times made the following observation:

Get this. Do you know what isn’t included in the consumer price index? Car and home insurance. They are simply not part of the measured basket. The CPI also excludes home prices, replacing them with a proxy called owners’ equivalent rent, which is not a reflection of reality. It also uses a crazy metric such that an increase can be registered as a decrease. In addition, the CPI can’t measure added fees and shrinkflation.

The result is that the CPI has become pure fantasy at this point. Anything happening in the housing market, from interest to insurance to prices themselves, is simply not included. Once we do include them, you can generate numbers that are easily in the double digits. Including house prices alone takes current numbers from 3.5 percent to 6 percent. Throwing in interest and insurance and more gets us very easily to double digits for fully two years.

While Mr. Tucker writes as though he has a chip on his shoulder, his observations are not incorrect. House prices have been moving upward at a much more rapid pace than the consumer price index for at least a decade or two, as anyone who has tried to purchase a house since the recession of 2009 will attest. The most recent headline inflation report also says that health insurance premiums have declined for two years, and this seems unlikely to be the case in reality. Thus, inflation is, in my view, substantially higher than the official numbers suggest.

The reason that this is important is that if the true rate of inflation is anywhere near 6% (or higher) then fixed-income securities will not be able to maintain the investors’ purchasing power on an after-tax basis. In fact, depending on how rapidly the cost is rising, they might not be able to maintain it on a pre-tax basis either, so keeping such securities in a retirement account might still result in the loss of purchasing power over time. This also applies to fixed-income funds. However, equity securities should be able to maintain their purchasing power over the long term because the companies issuing the equity securities should see their revenue and income rise due to inflation. Thus, this fund appears to be a better option than most fixed-income funds for investors who wish to both combat inflation and earn a high level of income.

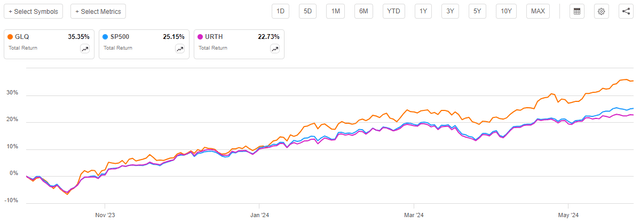

As regular readers can likely remember, we previously discussed the Clough Global Equity Fund in October 2023. The global equity markets have generally been strong since that time, and equities in general have not suffered much from the Federal Reserve’s “higher for longer” policy that has prevented market participants from receiving the interest rate cuts that they expected in 2024. As such, we might expect this fund to have delivered a strong performance since the publication of that previous article. This is certainly the case, as shares of the fund have appreciated by 23.92% since that article was published:

Seeking Alpha

We can see that the fund barely underperformed the S&P 500 Index (SP500) over the period. While this may not be the ideal situation for all investors, many of those who pursue income generation are willing to accept a small amount of underperformance in exchange for a higher yield. This fund probably did well enough to satisfy those investors.

With that said, investors in this fund actually did better than investors in the S&P 500 Index over the period. As I stated in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we include the distributions that the Clough Global Equity Fund paid out over the period, we get this alternative chart:

Seeking Alpha

This chart shows us how investors in this fund actually did during the nine-month period since our previous discussion. In this case, we can clearly see that investors were better off purchasing this fund than they would have been had they purchased either the S&P 500 Index or the MSCI World Index (URTH). This could win the fund some fans, despite its risks.

As roughly nine months have passed since we last discussed the Clough Global Equity Fund, we might expect that a number of things have changed. Perhaps most importantly, the fund released an updated financial report that will give us a much better understanding of the fund’s performance during the second half of last year. We will be sure to consult this report over the course of this article.

About The Fund

According to the fund’s website, the Clough Global Equity Fund has the primary objective of providing its investors with a very high level of total return. This makes sense given the fund’s strategy, which is explained thus:

The Fund intends to invest primarily in a managed mix of global equity securities. The Fund is flexibly managed so that, depending on the Fund’s investment adviser’s outlook, it sometimes will be more heavily invested in equity securities in U.S. markets or in equity securities in other markets around the world. Investments in non-U.S. markets will be made primarily through liquid securities, including depositary receipts and exchange-traded funds.

This description mostly just says that the fund will invest mostly in equity securities, which befits its name. However, the fund can vary its investments between the United States and internationally, pretty much however it wants. The fund has occasionally used this ability in the past, as back in 2021 it was mostly exclusively invested in the United States (see here). The fund’s ability to do this therefore means that it might not be as good a choice as some other funds for those investors who are seeking to diversify their assets abroad. For example, the Eaton Vance Tax-Advantaged Global Dividend Income Fund states in its annual report:

Under normal market conditions, the Fund will invest (i) at least 25% of its total managed assets in the securities of U.S. issuers; (ii) at least 30% of its total managed assets in securities of non-U.S. issuers, including issuers located in emerging market countries; and (iii) in issuers located in at least five different countries.

With a fund such as that one, investors can be sure that they are getting at least some international exposure, even if it is not as much exposure as we might prefer. However, the Clough Global Equity Fund makes no such statement and at times it may have no exposure to foreign stocks at all. As one of the biggest problems American investors have is that they have too much exposure to the United States, this fund may not be as good a solution as some of its peers.

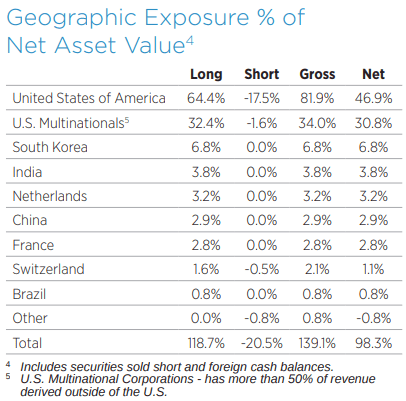

With that said, the Clough Global Equity Fund does currently have some international exposure, but it is not much compared to the American exposure:

Clough Capital Partners

The net exposure to the United States here is 77.70%, which is considerably higher than most of the fund’s peers:

|

Fund Name |

U.S. Exposure |

|

Clough Global Equity Fund |

77.70% |

|

Allspring Global Dividend Opportunity Fund |

~65%* |

|

Calamos Long/Short Equity & Dynamic Income Trust |

6.7% |

|

Eaton Vance Tax-Advantaged Global Dividend Income Fund |

~45%* |

|

John Hancock Hedged Equity & Income Fund |

41.33% |

|

Lazard Global Total Return and Income Fund |

~56%* |

|

abrdn Total Dynamic Dividend Fund |

~60%* |

* Figure is approximate, as the fund sponsor combines the United States and Canada together into one country. Figures in the table assume that the fund is holding 1% to 3% exposure to Canadian securities.

The Calamos Long/Short Equity Fund is an outlier here. Its long exposure to North America (United States and Canada) is 75.3%, but this is almost completely offset with a 68.6% short position. Thus, its net exposure appears much lower than the fund’s exposure really is.

In any case, we can see that the Clough Global Equity Fund has much higher exposure to the United States than any of its peers. This is lower than what the fund had the last time that we discussed it, but it is still far too high for any investor who was hoping to use the fund as a way of reducing their exposure to the United States. With that said, though, the United States accounts for 71.85% of the MSCI World Index, so this fund is not completely out of line with the index.

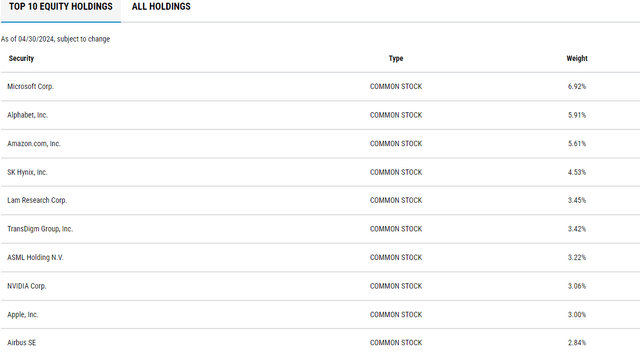

At least some of the fund’s largest positions are the same as they were the last time that we discussed it:

Clough Capital Partners

There are four companies that have been removed from the fund’s largest positions list since the last time that we discussed it. These companies are DraftKings (DKNG), General Dynamics (GD), Boeing (BA), and HDFC Bank (HDB). The four new additions are SK Hynix, ASML Holding (ASML), NVIDIA (NVDA), and Apple (AAPL).

I must admit that I am somewhat surprised to see Nvidia among the new additions. Nvidia has been a high-flying stock for quite some time now due to the excitement surrounding generative artificial intelligence and the company’s strong position in the industry for the semiconductor chips needed for that technology. Charles Clough tends to behave very much like a swing trader, so I would have expected him to jump on that stock much earlier than he did.

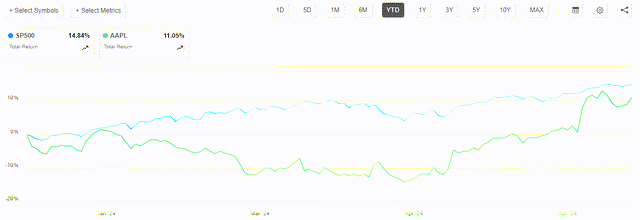

At the same time, the addition of Apple is rather surprising. Apple has underperformed the S&P 500 Index year-to-date:

Seeking Alpha

It did jump a bit recently due to the company’s announcement of its partnership with OpenAI and Meta Platforms (META) to provide generative artificial intelligence for the iPhone, but overall, it has been an underperformer. It is difficult to see how Apple will actually make enough of a profit from that development to justify the recent surge in the stock price, but once again this fund’s strategy seems to be swing trading as opposed to anything resembling fundamental valuation. This fund will frequently take positions, earn a profit as the stock price rises, and then realize its gains. Its 122.00% annual turnover rate is evidence of that.

It is not surprising, meanwhile, that the fund sold out of its Boeing stock. Boeing is down 31.52% year-to-date due to the revelations that emerged following the January 2024 incident in which the door of an Alaska Airlines aircraft came off in mid-flight. Following that incident, the Federal Aviation Administration began investigating reports of safety and quality control problems involving Boeing’s planes. The market responded, and the company has been a terrible performer in the market year-to-date. Hopefully, this fund managed to get out of its Boeing position before it suffered any significant losses.

Leverage

As is the case with most closed-end funds, the Clough Global Equity Fund employs leverage as a method of boosting the effective total return that it earns from the assets in its portfolio. I explained how this works in a number of previous articles. To paraphrase myself:

Basically, the fund borrows money in order to purchase common stocks. As long as the purchased asset provides a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective total return of the portfolio. The Clough Global Equity Fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

However, it is important to note that the use of leverage is less effective as a method of boosting returns today than it was a few years ago. This is because it is much more expensive to borrow money when interest rates are at 6% than it is when they were at 0%. As such, it is much more difficult to generate the returns needed to justify the use of leverage than it used to be.

Unfortunately, the use of debt in this manner is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally prefer that a fund’s leverage be under a third as a percentage of its assets for this reason.

As of the time of writing, the Clough Global Equity Fund has leveraged assets comprising 28.69% of its assets. That represents a substantial decrease from the 39.73% leverage that the fund had the last time that we discussed it, which is certainly nice to see. After all, the reduction in leverage should result in much lower risk for investors.

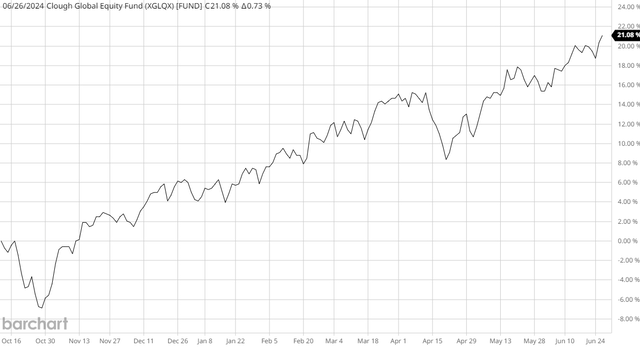

It is not astounding that the fund’s leverage declined to such a significant degree over the period. This chart shows the fund’s net asset value from October 11, 2023 (the date of our previous discussion of this fund) until today:

Barchart

As we can immediately see, the fund’s net asset value increased by 21.08% since the date that the previous article was published. Thus, assuming its outstanding borrowings remained stable, the leverage will now represent a much smaller proportion of the overall portfolio. That appears to have been the case.

The fund’s leverage is now below the one-third level that we would ordinarily prefer to see. However, this alone does not mean that it is using a safe level of leverage. Here is how the fund compares to its peers in this respect:

|

Fund Name |

Leverage Ratio |

|

Clough Global Equity Fund |

28.69% |

|

Allspring Global Dividend Opportunity Fund |

16.80% |

|

Calamos Long/Short Equity & Dynamic Income Trust |

25.42% |

|

Eaton Vance Tax-Advantaged Global Dividend Income Fund |

19.00% |

|

John Hancock Hedged Equity & Income Fund |

0.00% |

|

Lazard Global Total Return and Income Fund |

31.40% |

|

abrdn Total Dynamic Dividend Fund |

5.37% |

(All figures from CEF Data.)

As we can clearly see, the Clough Global Equity Fund is using more leverage than most of its peers. While this alone does not mean that it is employing too much leverage, it is a sign that risk-averse investors should exercise caution, as this fund may be more volatile than would be preferred.

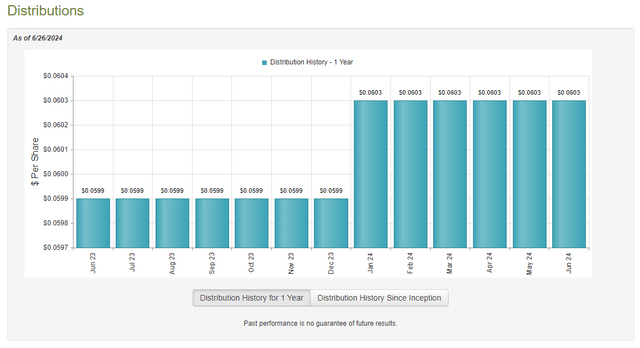

Distribution Analysis

The primary objective of the Clough Global Equity Fund is to provide its investors with a high level of total return. However, as with all closed-end funds, the fund delivers the bulk of its returns via distributions paid to its investors. To this end, the fund pays a monthly distribution of $0.0603 per share ($0.7236 per share annually). This gives the fund a 10.50% yield at the current price, which compares pretty well with its peers.

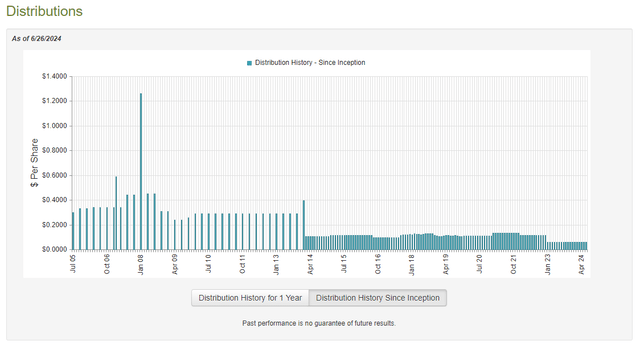

The fund’s current distribution is higher than the $0.0599 per share monthly that it was paying out the last time that we discussed it. This is due to a distribution increase back in January of this year:

CEF Connect

Despite this nice development, though, the fund’s distribution history overall is not particularly attractive:

CEF Connect

As I stated previously:

This considerable variation in the fund’s distribution over time will almost certainly reduce its appeal in the eyes of those investors who are seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. It is not really surprising to see this from an equity fund though, as many of them do alter their distributions with the passage of time in order to reflect the investment performance of their underlying portfolios. After all, the goal here is to keep the fund’s net asset value relatively stable over time while paying out the investment profits to the shareholders. Equity investors typically tolerate fluctuating returns from indices and such so there is no reason why a fluctuating distribution from a fund following the above strategy should be an instant rejection.

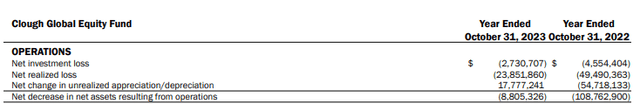

As I mentioned in the introduction, the fund released its annual report for the full-year period that ended on October 31, 2023, a few months after the publication of my previous article on this fund. Thus, this report should be useful for an update on the fund’s ability to sustain its distribution, even though it is already several months out of date.

For the full-year period that ended on October 31, 2023, the Clough Global Equity Fund received $2,398,785 in dividends and $2,507,180 in interest from the assets in its portfolio. When combined with a small amount of income from other sources, the fund had a total investment income of $4,945,802 for the full-year period. This was not sufficient to cover the fund’s expenses, and it reported a net investment loss of $2,730,707 for the period. Obviously, that was not enough to pay any distributions.

The fund distributed a total of $15,858,657 to its shareholders over the course of the year. However, it was unable to cover this through either net investment income or capital gains. As we already saw, the fund reported a net investment loss of $2,730,707 for the full-year period. It also reported net realized losses of $23,851,860, which were partially offset by $17,777,241 in net unrealized gains:

Fund Annual Report

Overall, the fund’s net assets declined by $26,350,467 after accounting for all gains and losses during the period. Thus, the fund failed to cover its distributions. This was the second year in a row during which this was the case.

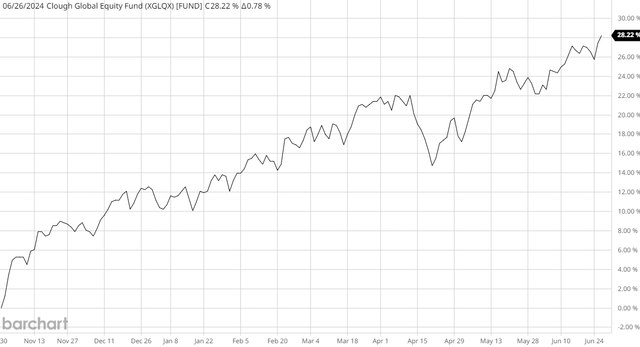

Fortunately, it appears that the fund has managed to resolve this problem so far in the current fiscal year. This chart shows the fund’s net asset value since October 31, 2023 (the last day of the previous fiscal year):

Barchart

As we can see, the fund’s net asset value has increased by 28.22% since the closing date of the most recent financial report. This tells us that the Clough Global Equity Fund managed to cover all the distributions that it paid out since October 2023 and still had a substantial level of excess returns.

Overall, this fund should be fine as long as we do not get a market collapse. While I, personally, do not see a downside catalyst in the near term, Zero Hedge stated yesterday that somebody is making considerable bets that the Federal Reserve will cut interest rates by at least 300 basis points before March. In order for that to occur, a very severe recession will have to set in, and such a recession would almost certainly cause a severe stock market decline. It is uncertain why the institution in question is making this bet though, and until we see bad data, a severe recession seems unlikely. Thus, at least for now, there does not appear to be a reason to worry about this fund’s ability to sustain its distribution.

Valuation

Shares of the Clough Global Equity Fund are currently trading at a 15.72% discount to net asset value. This is a considerable discount, but it is not as good as the 16.75% discount that the shares have had on average over the past month. However, the current price is probably pretty reasonable to get in.

Conclusion

In conclusion, the Clough Global Equity Fund looks better than it did a few months ago, but it is still not as good as some of its peers regarding its international diversification. The fund continues to have a very high exposure to the United States relative to its peers, which should be considered when determining how to allocate your assets across various countries. The fund as a whole continues to engage in a great deal of trading rather than simply employing a buy-and-hold strategy, but it seems to have worked recently, as the fund has outperformed the market on a total return basis over the past several months. Overall, the fund seems okay, but it might still be riskier than its peers due to its high leverage.

Read the full article here