Please note all $ figures in $CAD, not $USD, unless otherwise stated.

Investment Thesis

goeasy (TSX:GSY:CA) is an alternative lender in Canada’s financial services industry, offering loans and leases to non-prime borrowers. Over the years, goeasy has put up fantastic numbers, out pacing the TSX’s returns and earning high returns on equity. Over time it’s been able to grow its loan book and operate in what some might consider to be a more risky part of the lending market, but goeasy been able to do so with fantastic success and a disciplined strategy when it comes to managing its loan book. At its current P/E multiple of 13.6x, I think shares of goeasy represent good value, but would wait for a pullback to have more of a margin of safety.

Company Overview

goeasy is a financial services company that focuses on non-prime leasing and lending. The company has two main business segments: easyfinancial and easyhome. easyfinancial is the larger and faster growing of the two segments making up 88% of revenues. Its typical customer generally does not qualify for a typical bank loan due to credit challenges and the loans are much smaller than your typical loan, ranging from just a few hundred to several thousands of dollars. Loans are often structured as unsecured installment loans with fixed repayment schedules and are designed to help customers build or rebuild their credit scores while offering them credit that they wouldn’t otherwise qualify for at a big bank.

The smaller of the two segments is easyhome at 12% of revenues. This segment is much slower growing and focuses on leasing solutions for household goods like furniture, appliances, and electronics. In essence, easyhome allows customers to lease these products over time and purchase them outright if they chose to at the end of the lease.

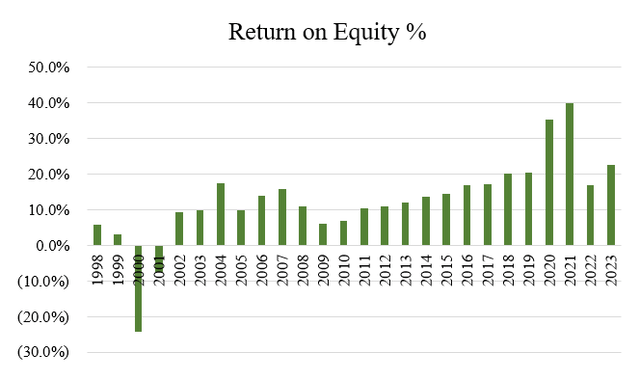

One of the first things that stood out to me about goeasy has been its high returns on equity (ROE) over time. As shown by the graph below, over the last 25 years, goeasy has had 24 years of positive ROE and in the last decade has consistently had returns above 10%. High ROE is impressive on its own, but having consistently high returns has indicated that goeasy is able to find opportunities to invest its capital at similarly high rates of return and repeat that process over time.

Return on Equity (Author, based on data from S&P Capital IQ)

Part of the reason for the consistently high ROE is that goeasy often serves individuals with poorer credit. Because they often have challenges accessing traditional credit and leasing alternatives from the big banks for example, goeasy generally charges higher rates when offering leasing and lending services, as these customers are seen as higher risk. In fact, about 8.8% of its loans are charged off every year. As such, the interest rates that goeasy charges need to be high enough to reflect these delinquencies.

And the interest rates goeasy charges are certainly quite high. As of Q3, the company had an average yield on consumer loans of 35.3%. Despite this being offset by bad debt (10.7%), operating expenses (9.1%), and finance costs (4.9%), goeasy still generates an adjusted pretax return on receivables of 10.6% and a return on equity of 26.6%. Considering that Canadian banks like The Toronto-Dominion Bank (TD:CA) and Royal Bank of Canada (RY:CA) have returns on equity of 9.6% and 13.2%, respectively, goeasy seems to get more than double the returns that the big banks seem to get on their loans (data from S&P Capital IQ).

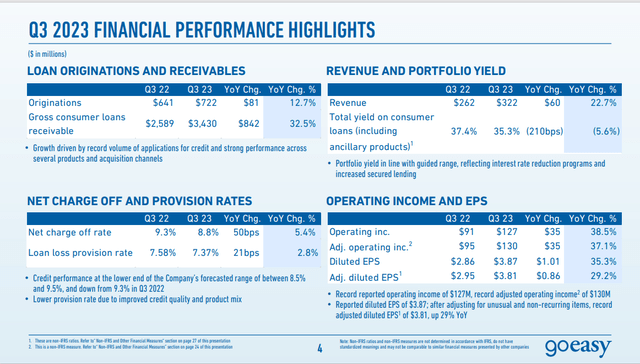

Q3 Results (Investor Presentation)

You might be thinking that with a relatively high average yield on consumer loans that goeasy would also have a high cost of debt. However, when looking at its cost of borrowing, the company’s weighted average cost of borrowing was 5.9% during the quarter. While this figure is up from its cost of borrowing during 2021 and 2022 of 5.2% and 4.9%, respectively, compared to the interest on consumer loans of 35.3%, the company earns some really great returns. In my view, this indicates that goeasy earns a disproportionately higher amount of reward for the level of risk it takes on.

On the Q3 earnings call last month, goeasy reported very strong quarterly numbers with record loan growth (particularly to higher credit-quality customers), flat credit losses, and better operating leverage.

For loan growth, loan applications were up 30% year over year to 528,000 applications and the loan portfolio in dollar terms was up 33% to $3.43 billion. With 3 quarters in for the year so far, goeasy is on track to exceed their own guidance for the year of $3.4 – $3.6 billion by year end.

On the credit front, the company had a net charge-off ratio of 8.8% vs. 9.1% for Q2 (last quarter) and 9.3% for the same quarter last year. Much of this can be attributed to underwriting enhancements and improving the quality/mix of the loan portfolio. In my view, credit losses have been surprisingly stable, especially when we consider the current macroeconomic environment and higher interest rate environment. With previous guidance for the ratio between 8% and 10%, we seem to be at the midpoint of the range and losses seem to be well managed all things considered.

Finally, with respect to operating leverage, goeasy is seeing better profitability metrics with operating margins and efficiency ratios improving year over year. With operating margins in the 40% range, management expects that they should be able to expand it further as they cut out back office and corporate expenses. With a more renewed focus on expense management, goeasy should be in a good position in a more challenging macroeconomic environment going forward.

Outlook

Looking out longer term, I think goeasy looks to be on an upwards trajectory. Analysts are predicting $13.40 and 16.28 of EPS for 2023 and 2024, respectively, which puts the forward P/E multiples at 10.8x and 9.1x. I think there’s a reasonable chance that goeasy overshoots analysts’ estimates, given the fact that we saw 30% more loan applications this quarter. If that translates over to 2024 as well, I wouldn’t be surprised to see a loan book over $4 billion for the company, or about 25% higher than we are today. As long as applications are going up, we can use this as a key performance indicator to assess how loan book (and hence interest income from easy financial) should grow over time).

While I do think bad debt expense and net charge-offs have a decent chance of outpacing interest income growth, goeasy should still be growing net income per share year on year for the foreseeable future and maintain returns on equity above 15%. With management becoming more prudent with debt and focusing on higher quality credit customers, I think the company is making the right steps to manage its business long-term.

Valuation

Based on the 6 equity research analysts with one year price targets on goeasy, the average price target is $165.35, with a high estimate of $183.90 and a low estimate of $144.14 (data from TD Securities). From the average, this implies about 3.0% upside, not including the dividend of 2.4%. With 6 buys and 1 hold, the limited upside suggests that shares of goeasy have likely ran up a little too fast lately and could be due for a pullback.

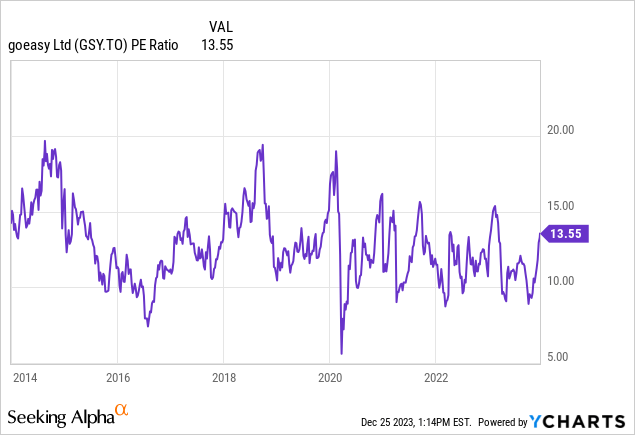

When looking at the historical range for goeasy’s Price to Earnings ratio over the last decade, the company currently trades at 13.6x P/E, closer to the higher end of the historical range. Given how quickly shares have shot up, I’d probably be inclined to wait for a dip in the share price before concluding the valuation was adequate and that an entry price was attractive.

To me, the 12x earnings range seems like good value. Slightly above that of the Canadian banks, this is also a good range at the midpoint of its historical valuation. With earnings expected to pick up, I do believe that the forward multiple on P/E is under 10x one year out. This would put the company at the low end of its range if the share price doesn’t move at all. Hence, at 12x earnings, I feel like this would be a fair price to pay for shares of goeasy.

When it comes to risks for valuation and the investment thesis here, one obvious one would be the macroeconomic risk goeasy faces with respect to having lower quality credit customers compared to the average lender. Going back 2 years ago, goeasy sort of saw this coming as it became stricter on who it decides to give out loans and leases to, in anticipation of a worsening macroeconomic environment and many experts predicting a recession. While we haven’t seen a recession just yet, the company has reduced their exposure to non-prime borrowers by introducing more secured rather than unsecured loans and raising the minimum level of credit score needed in order to qualify for a loan. These small changes are a testament to goeasy always looking ahead and making sure it doesn’t take on undue risk in its loan book. Right now, consumer confidence is pretty solid and is projected to increase next year, so I’m not too worried right now. That said, I’d watch the net charge off rate, bad debt expense, and loan loss provisions quarter to quarter to monitor the health of the loan book going forward.

The second risk to the investment thesis is a new law that was passed in Spring of this year that brought down the maximum interest rate to 35%, down from 47% previously. The Canadian Lenders Association has said that the new government policy will disproportionately impact 12.3% of Canada’s population, i.e. those who are generally non-prime borrowers. They say that the move will impact these Canadians access to credit, push them to unsafe payday loans, and also push them towards the black market if they are unable to get loans from alternative lenders. In my view, this is a concern to goeasy given that its average interest rate is 35.3%, so I think it’s almost inevitable that its returns on equity will come down going forward. That said, I do believe that it’s not all bad news if goeasy is simultaneously going after better quality credits, as this will have the effect of lowering risk too.

Conclusion

I like goeasy’s business model. While some might feel that its lending practices are predatory with such high interest rates, for many Canadians, this a way for them to access credit and build their credit scores. Over the last decade, the company has proven it can maintain high returns on equity while keeping its cost of debt low, benefitting from the delta in what it charges for loans and what it costs to borrow. While the Canadian government has made it more difficult to have a wider spread for goeasy, I do believe that the company should still be able to maintain returns on equity above 15% and continue to steadily grow their loan book. With fantastic growth seen during its most recent quarter, we’ve seen loan loss provisions and net charge offs remain steady, so it seems that previous fears about a recession and the impact to the Canadian consumer were over blown. While there are still risks to investing in goeasy that need to be watched, I’d feel comfortable taking a position in goeasy shares, given the great track record of the company. To limit risk, I’d wait for a pullback closer to the 12x earnings range before pulling the trigger.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here