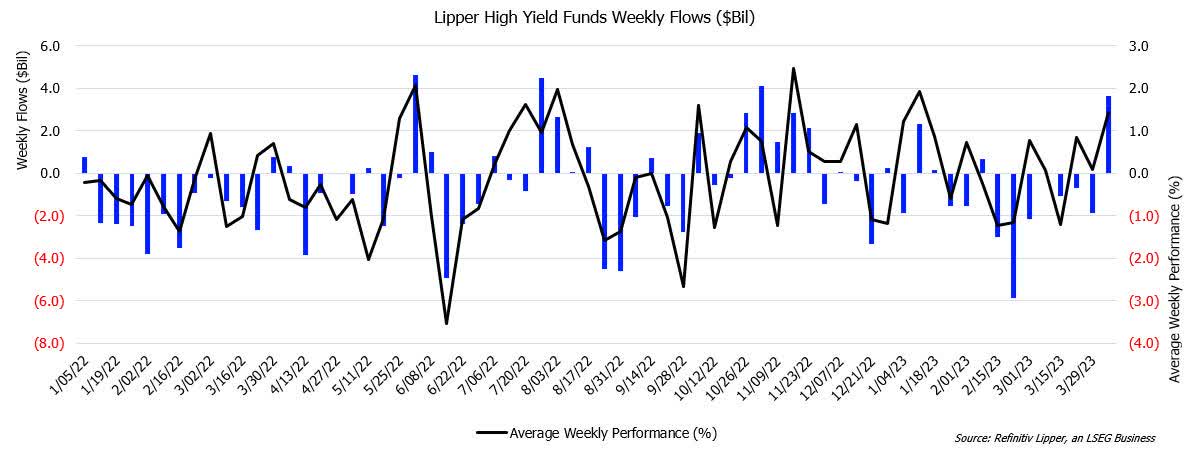

The Lipper High Yield Funds classification attracted its first weekly inflow in seven weeks (+$3.6 billion), marking the largest inflow this year. Those prior seven weeks saw $14.6 billion walk out the door.

This classification has suffered four straight quarters of outflows, but with a strong first week in March, that trend may change. High Yield Funds have also returned plus-side performance in five of the last six weeks.

This classification has returned 3.23% over the last quarter, which slots them as the third largest returner under the General Domestic Taxable Fixed Income macro group – behind Corporate Debt A-Rated (+3.71%) and Corporate Debt BBB-Rated (+3.59%). For comparison’s sake, the overall taxable fixed income fund return during the first quarter of 2023 was positive 2.42% on average.

A few weeks ago, we talked about the massive outflows from Lipper Equity Income Funds, those same income-seeking investors may be flowing into high-yield funds.

Job numbers this past week reported that there was continued strong hiring in March (nonfarm payrolls increased by 236,000), and the unemployment rate fell from 3.6% to 3.5%.

With the unemployment figures remaining low, even in the face of this historic rate-hiking cycle, investors could be seeing this as a positive sign for below-investment-grade companies’ overall creditworthiness.

The other headwind for high-yield funds may be the slowing pace of rate hikes. Michael Feroli, the chief U.S. economist at JPMorgan said, “There was certainly nothing in today’s report to raise concerns about near-term recession risks.” He added, “We continue to look for a 25-basis point hike in the May meeting, followed by an extended pause.”

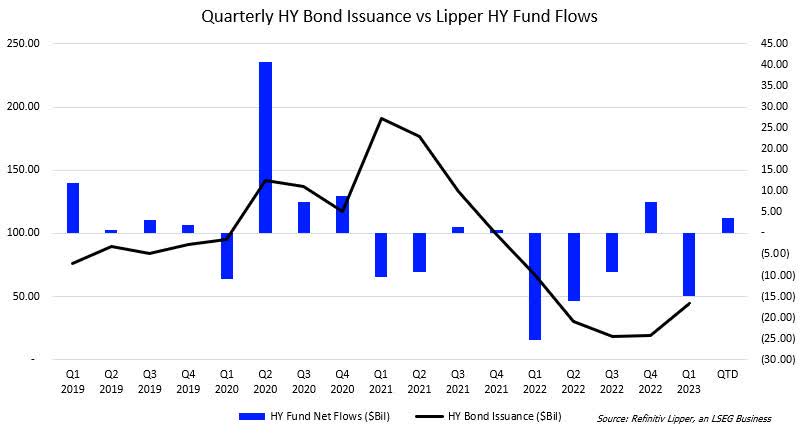

This “extended pause” appears to be forecasted by more than just those at JPMorgan. Quarterly high-yield bond issuance fell off a cliff since Q3 2021 and has fallen each quarter since last.

In Q1 2023, we saw $44.6 billion in high-yield bonds issued, marking the largest quarterly total since Q1 2022 and the largest quarter-over-quarter gain since Q1 2021.

If interest rates pause, newly issued high-yield debt becomes increasingly valuable, which can lead to inflows for the funds within the classification as long as corporate debt balance sheets remain strong.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here