With a good chunk of this year’s rally being driven by tech stocks, and in particular AI, it’s often necessary for us to dig into other sectors for growth.

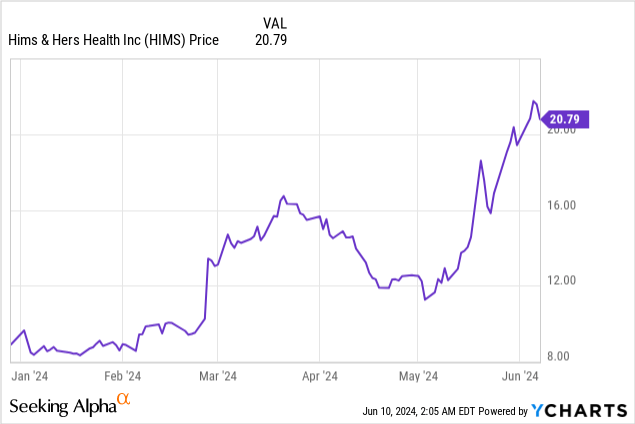

Another key trend that has dominated the healthcare space this year is the burst of popularity in Ozempic and related weight-loss drugs: and though this is only a smart part of Hims & Hers’ (NYSE:HIMS) product portfolio, the company has been a big beneficiary of that trend, with its stock up more than 2x year to date.

Despite the massive year to date rally, I’m initiating Hims & Hers at a buy rating. Broadly speaking, there are a number of factors that draw me to this company:

- Tremendous growth rates. Hims & Hers is achieving >40% in current y/y revenue growth, even as it expects to reach over $1 billion in revenue in 2024.

- Huge gross margins. The company’s focus on generics means that it’s selling high-margin drugs that are cheap to manufacture (plus, the company doesn’t take on much R&D spend of its own).

- Customer-centricity and personalization offerings are helping to build a recurring revenue base. The company is prioritizing personalized solutions, wherein customers can receive custom medications to cover multiple conditions at once. This creates Hims & Hers’ moat and recurring revenue potential.

In my view, there’s quite a bit of upside potential here as Hims & Hers continues to expand into new treatment areas. Ride the upside rally here.

Continuously expanding market opportunity

Hims started out in 2017 as a seller of generic erectile dysfunction (ED) medicine, sildenafil (more commonly known by the most common brand in the space, Viagra). The company quickly expanded into other men’s health areas, including hair loss, and in 2018 the company also launched a sister brand, Hers, to cover female health areas.

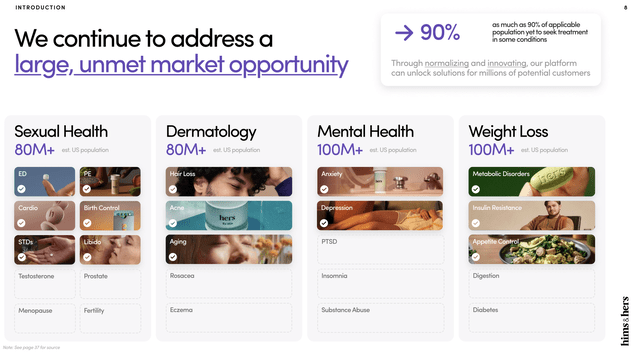

Since then, the company has expanded into a holistic healthcare company, covering a wide variety of treatment areas (see chart below):

Hims & Hers treatment areas (Hims & Hers May 2024 Investor Presentation)

Though the company sells both over the counter and prescription medicines, it’s important to note that the company focuses almost entirely on generics. (For investors new to the space: pharmaceutical patents typically last for 20 years of exclusivity, after which generics flood the market. The original drugs, however, become powerful brands that typically remain the bestsellers in their categories). So while the company doesn’t take R&D risk, there’s little chance of breakout upside either.

The company continues to launch new product offerings. Most notably, in December 2023, building on the Ozempic momentum, the company launched its own weight-loss management product starting at $79/month.

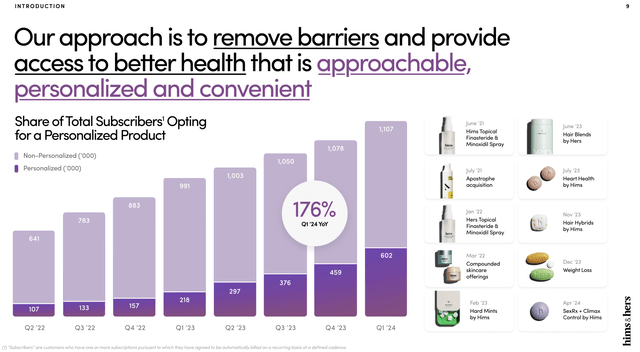

Personalized treatments are a core differentiator for Hims & Hers. The company’s core thesis is to make it easier for everyday men and women to get a quick, understandable diagnosis of their issues, and then receive personalized treatment to address those conditions.

35% of the company’s subscribers are opting in to a personalized solution. 100% of those on a weight-loss regimen are using personalized products. And note as well that in the most recent quarter, the number of users on a personalized plan grew 176% y/y, creating Hims & Hers’ recurring-revenue moat:

Hims & Hers subscription offering (Hims & Hers May 2024 Investor Presentation)

Tremendous growth, backed up consistent margin leverage

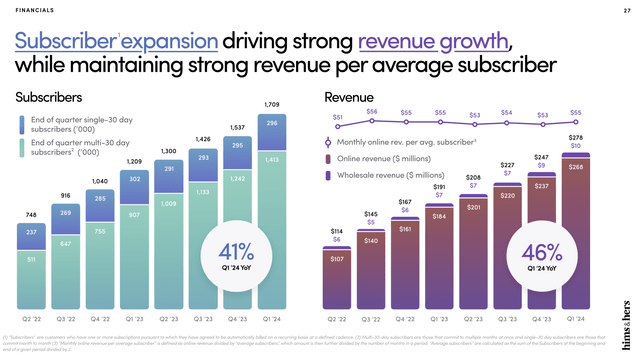

Hims & Hers’ recent product expansion and growing brand presence, meanwhile, has helped to generate enormous growth as well as leverage.

Hims & Hers Q1 top line metrics (Hims & Hers Q1 shareholder letter)

In Q1, total revenue grew 46% y/y to $278 million, well ahead of Wall Street’s $269 million (+41% y/y) expectations. Meanwhile, the company counted 1.7 million subscribers at the end of the quarter, up 41% y/y.

On top of the 172k net-new subscribers that the company signed up in Q1 (the result of a recent marketing splash, especially to advertise the personalization platform), the company believes personalized treatments will also improve retention – especially for the sheer convenience of taking fewer pills to treat all of one’s conditions. Per CFO Yemi Okupe’s remarks on the Q1 earnings call:

With this continued transition, we believe several benefits will emerge in the future. The first is improved retention. We are receiving signals across several specialties the retention for personalized products is higher alongside a stronger user preference for them relative to generic alternatives. This does not come as a surprise to us. as feedback from user interactions and behavior is one of the key ingredients and development of our offerings.

We expect continued placement of personalized treatment options at increasingly mass market prices to compound this benefit. Secondarily, we see opportunities for improved efficiency. Benefits from economies of scale with our personalized offerings are expected, similar to what we have observed in other areas of our operation in the past. We are confident that these benefits will compound as we continue to extend our portfolio of personalized offerings over the course of 2024.”

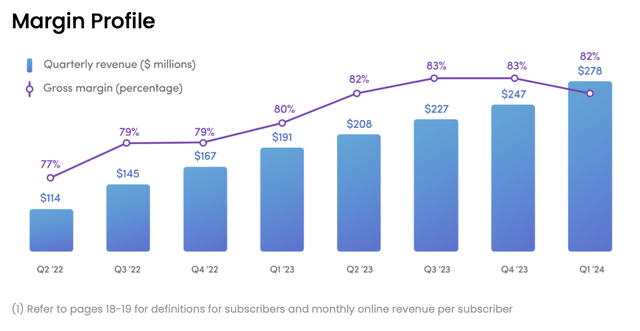

This recurring revenue stream is also coming in at incredible gross margins that rival that of software companies. Gross margins in Q1 hit 82%, which represents a 2 point y/y improvement:

Hims & Hers Q1 gross margins (Hims & Hers Q1 shareholder letter)

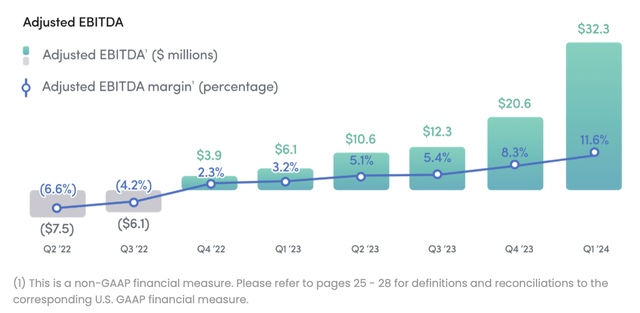

Meanwhile, operating leverage has also helped Hims & Hers notch a record adjusted EBITDA of 11.6% in the quarter, with nominal adjusted EBITDA of $32.3 million growing 57% sequentially and more than 5x y/y:

Hims & Hers adjusted EBITDA (Hims & Hers Q1 shareholder letter)

Valuation, risks, and key takeaways

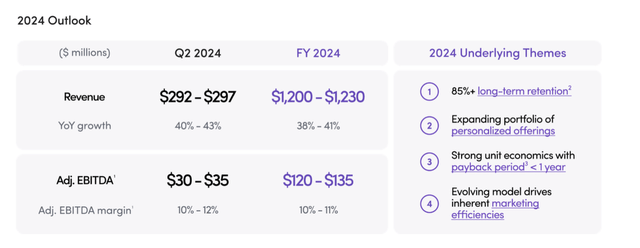

For the current year, Hims & Hers has guided to $1.20-$1.23 billion in revenue (+38-41% y/y growth), and a 10-11% adjusted EBITDA margin on that revenue profile. In the long run, the company is targeting a steady-state adjusted EBITDA margin of 20-30% (which is easy to imagine when gross margins are already at 80%+. The company is currently spending roughly half of its revenue on marketing, which should scale down over time as the company’s recurring revenue base builds).

Hims & Hers 2024 outlook (Hims & Hers Q1 shareholder letter)

Meanwhile, at current share prices just north of $20, Hims & Hers has a $4.47 billion market cap. After we net off the $203.7 million of cash on the company’s latest balance sheet, its resulting enterprise value is $4.27 billion. At the midpoint of this year’s guidance ranges, this puts Hims & Hers’ valuation at:

- 3.5x EV/FY24 revenue

- 33.3x EV/FY24 adjusted EBITDA

For a company that is still growing revenue at 40%+ and is achieving ~10 points of y/y adjusted EBITDA margin expansion (with a goal of getting up to 20 points in further expansion, up to 30% in adjusted EBITDA margins), I’d say these are still reasonable multiples.

There are risks to this story, of course. As previously mentioned: the company’s IP is limited. It’s more of a technology and sales platform to put medication into consumers’ hands, rather than a drug brand of its own. Its primary moat is its ability to personalize medications and increase consumers’ convenience, but there’s nothing stopping another generic drugmaker or distributor from eating into Hims & Hers’ customer base (especially when it’s generating such high gross margins for commoditized medications).

Still, I’d argue that there’s more upside than risk here. A good swath of the conditions that Hims & Hers treats are covered by insurance when deemed medically necessary, so customers’ price sensitivity and willingness to switch providers is lower than for pure out-of-pocket products. The company’s ability to achieve 40%+ growth at scale is a testament to the largesse and greenfield nature of Hims & Hers’ addressable market.

This is a rocket ship stock you’ll want to hold on to.

Read the full article here