Editor’s note: Seeking Alpha is proud to welcome Mazahir Bhagat as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Case

Interactive Brokers Group, Inc. (NASDAQ:IBKR) stands out as a promising investment opportunity among other brokers due to its impressive growth rate, with a target of about 30% long-term customer growth. The company’s emphasis on engineering and automation enables it to cater to customers worldwide, particularly those interested in trading US stocks. Compared to other brokers, Interactive has less competition and less exposure to payment for order flow (PFOF), which reduces its regulatory risks, in my view. I have a buy rating on the stock and assign an end-of-year price target of $93 based on a 16x to F24 EPS estimate of $5.83.

What does IBKR do?

Interactive Brokers is a broker dealer that caters to traders who are looking for a variety of investment options. The company offers trading services for stocks, options, futures, forex, bonds, mutual funds, ETFs, metals, and cryptocurrency across 150 exchanges. Apart from executing trades and providing custody services, Interactive Brokers also offers analytics tools, market research, bill payment, direct deposit services, margin trading, and securities lending.

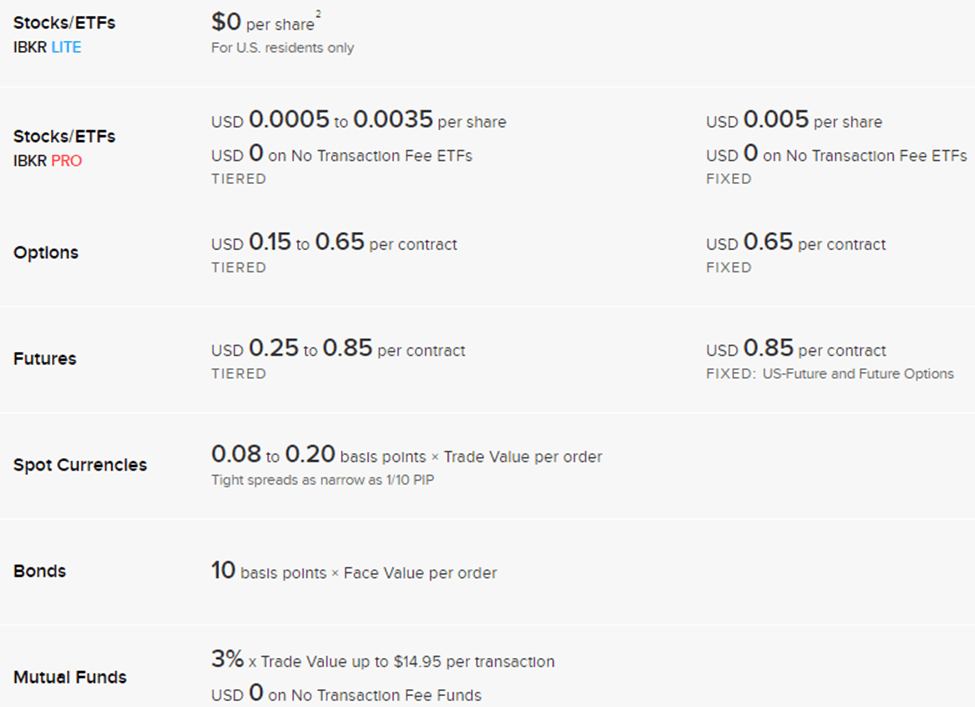

Interactive Brokers has two models for individual customers: IBKR Pro, which charges per-share commissions on trading and earns the majority of revenues, and IBKR Lite, which earns payments for order flow. The company generates revenue from commissions on trading and interest income. The company does not accept payments for order flow except for IBKR Lite orders, which contribute to less than 1% of revenues. The company claims that its smart order routing capabilities allow for a lower all-in cost to trade, including commissions, compared to competing platforms with zero commission trading, which usually have higher spreads.

Interactive Brokers Trading Commissions (Company Website)

Industry Trend

The Federal Reserve recently raised the upper bound target rate to 5.0% with a 25 basis points hike, resulting in a rise in rates in the US. This is expected to benefit all brokers in terms of interest income through at least 2023. However, despite the positive impact on interest income, brokers have experienced a slight decline in margin balances on a monthly basis, which may continue as the fed funds rate increases. In the fourth quarter, the average effective Fed Funds Rate was 3.65%, almost 150 basis points higher than the Q3 average of 2.18%.

FED target rate (Ycharts)

Compelling customer growth story

IBKR is one of the most impressive customer growth stories among brokers. The company has set a long-term goal of growing its accounts by 30% in the long term and ultimately hopes to reach a goal of 80 million accounts, which would represent approximately 1% of the world’s population. In my view, the company has continued to execute well on its growth strategy and has been growing at ∼30% for some time now, even in recent months, despite challenging year-over-year comparisons due to the pull forward in 2021 caused by COVID. I believe IBKR is well-positioned for account expansion at a high growth rate in the medium term as well, given the company’s strong focus on engineering and automation and its ability to serve customers worldwide.

However, it’s important to note that account growth doesn’t necessarily translate into revenue growth at a 1:1 ratio. New accounts tend to be less active and profitable initially, which can cause account growth to outpace revenue growth. Additionally, IBKR’s revenue contribution from net interest income has been inconsistent historically, ranging from 40% to as high as 70% of revenues, making it highly subject to changes in rates. Despite this, account growth is likely to be a good indicator of revenue growth over a longer timeframe.

IBKR’s account growth (Ycharts)

Automation leading to growth and high margins

The company places a strong emphasis on automation, which provides numerous benefits. Despite the increasing regulatory and compliance requirements in the wake of the Global Financial Crisis, Interactive’s advanced automation capabilities allow it to comply with local regulations and calculate reserve buffers effectively. This gives the company an edge in the market, as there is a high demand from retail and institutional investors outside of the US to own US stocks and few good options through which to do so.

The company’s focus on automation also leads to a significantly high margin profile. Interactive has consistently maintained a pre-tax margin of over 60% in recent years. Additionally, the company’s gross profit margin on trading revenues has significantly improved, from the low-60s in 2016-17 to the mid-70s/low-80s more recently. I believe it is likely that this margin will remain at 80% or higher going forward.

IBKR is focused on automation (Company Presentation)

Minimal exposure to PFOF

Payment for order flow (PFOF) has been a longstanding practice in retail trading. However, the surge in retail trading activity in 2020 and early 2021 brought it into attention in recent times. Rather than charging commissions and routing trades to exchanges, brokerages receive rebates from market makers and wholesalers such as Virtu and Citadel Securities for executing the trades. The SEC Chair, Gary Gensler, has been vocal about this issue. In 2021, he mentioned that the SEC was assessing whether PFOF requires reform or prohibition, as it is already banned in several countries, including Canada, the UK, and Australia.

I believe it is uncertain when or how regulatory actions on payments for order flow (PFOF) will take place. However, Interactive has minimal exposure to PFOF. The company charges commissions on the majority of customer orders and only earns revenue from order flow on trades made by IBKR Lite customers, which represents a low-single-digit percentage of commission revenues and even less as a percentage of total revenues. Interactive has explained that despite charging low commissions on stock trading, the overall execution cost is lower due to their advanced automation tools and smart order routing technology.

Interactive Brokers primarily generates revenue from commissions on trading and interest income

Interactive Brokers does not rely heavily on payment for order flow for its trading revenue. Instead, the company charges commissions on orders and uses advanced smart order routing capabilities to keep all-in trading costs, including commissions, lower than competing platforms that offer zero-commission trading. Although the number of accounts and trading volume has grown, revenue has been somewhat volatile, particularly in recent years, due to spikes in trading activity during periods of high market volatility in early 2021. However, trading activity has recently slowed down as the company faces tough comparisons and onboards more individual investor clients who tend to be less active than prop traders and hedge funds. Interestingly, IBKR’s customer base and revenue are mainly derived from outside the U.S., which sets it apart from other U.S.-based brokers like Robinhood (HOOD) and The Charles Schwab Corporation (SCHW) which generate most of their revenue domestically.

IBKR’s historical margins and rev growth (Ycharts)

In addition to commission revenue, Interactive Brokers generates interest income from several sources, including customer cash, margin lending, and securities lending. In the fourth quarter of 2022, net interest income accounted for more than half of the revenue generated, and it is expected to increase further as the Federal Reserve continues its hiking cycle. Historically, interest income on segregated cash and securities has been the largest contributor to net interest income, although this was not the case in recent years due to low-interest rates. The revenue comes from short-term government securities with an average duration of 45 days. The company generally holds these investments until maturity, resulting in a 45-day lag before it realizes the benefits of a rate hike.

IBKR also generates revenue from securities lending, where the company lends shares to customers who opt-in or for stocks bought on margin. Customers who participate in securities lending receive 50% of any interest earned. The revenue from securities lending is mainly driven by the supply and demand of hard-to-borrow stocks, rather than market interest rates. Overall, IBKR’s interest income from various sources is a significant contributor to the company’s revenue.

Key risks

Interactive Brokers offers five different types of accounts, including individual customers, introducing brokers, hedge funds, prop trading firms, and financial advisors. While individual customers have contributed significantly to growth in individual accounts, these accounts are generally less productive and less profitable than IBKR’s professional investor clients, such as hedge funds and prop traders. The annualized cleared average DARTs per account has come down from 300-400 several years ago to 200-300 more recently, although there was a surge during the COVID pandemic. Moreover, IBKR may face some near-term pressure on account growth due to the withdrawal of customer accounts by long-time introducing broker partners to their own clearing firm and another introducing broker moving to a custodial bank. Despite this, IBKR expects to report robust account growth in the medium term as several large global financial institutions plan to onboard their clients later this year.

IBKR is also exposed to regulatory risks, particularly given its global focus. While the company has a world-class risk engine, it paid an aggregate $38 million in 2020 across the SEC, FINRA, and CFTC due to charges that it failed to file Suspicious Activity Reports for US microcap securities. While IBKR is least at risk from potential changes to payment for order flow (PFOF) regulation in the US, it is not immune to other regulatory concerns.

Valuation

I use a relative valuation methodology – i.e., PE ratio – to value IBKR. Interactive Brokers is an established company, profitable on a net income basis and has a history of posting stable earnings and will continue to generate consistent profits in the future, which is why I believe this methodology is appropriate.

I look at the historical and current valuation levels for US-based brokers, excluding HOOD due to its shorter operating history and lack of valuation based on PE ratio. SCHW and IBKR are currently trading below their median P/E ratios over the last 7 years and are also undervalued compared to the S&P, which is a departure from its historical premium. During the past 13 years, IBKR’s median PE ratio was 24.86x, which means the company’s current multiple is a 55% discount from its median level. With the company growing customer accounts at ~30%, IBKR looks attractive to me at current PE level. Interactive Brokers currently is trading at a forward price to earnings ratio of 13.9. Additionally, IBKR’s price to sales ratio of 3.35x is also at a significant discount to its historical multiple (median of 6.24 over the past decade).

Although the company is trading at a higher multiple than the sector median, which is justified in my view given the growth trajectory of IBKR. I remain bullish on IBKR given the company’s strong competitive positioning (particularly outside the US) and robust continued account growth, which is why I expect that the stock will be trading at a higher multiple in the future and re-iterate towards its historical median. I have an end-of-year price target of $93 based on a 16x to F24 EPS estimate of $5.83. My assumed forward PE is at a premium to the group average, which I believe is warranted based on IBKR’s growth profile and technological capabilities.

IBKR Valuation Multiple vs Peers (Ycharts)

Investors Takeaway

Interactive Brokers stands out as a promising investment opportunity among other brokers due to its impressive customer account growth rate of about 30%. Interactive Brokers’ focus on automation helps drive global growth, high margins, and other benefits. The company’s high degree of automation enables it to more effectively comply with local regulations and calculate reserve buffers, among other things, in a highly effective manner. Compared to other brokers, Interactive has less competition and less exposure to payment for order flow (PFOF), which reduces its regulatory risks. I assign a buy rating to the stock and keep an end-of-year price target of $93 based on a 16x to F24 EPS estimate of $5.83.

Read the full article here