There are plenty of choices for investors looking to dip their toes in the stock market, but let’s face it – nearly everyone has flocked to large-cap growth. And that’s the problem. A favorite among equity growth-minded investors is the iShares Russell 1000 Growth ETF (NYSEARCA:IWF). Now, to be clear – I think the large-cap growth theme is overdone and is overcrowded. It’s clearly worked, and yes, I know this can continue. It’s just not a part of the marketplace I favor now. Having said that, it’s still worth looking at this popular fund.

IWF tracks the Russell 1000 Growth Index, which includes large-cap U.S. companies with greater earnings and revenue growth, and price momentum than their slower-growth peers. IWF targets firms that could grow into long-term market leaders. Launched in May 2000, IWF is now one of the largest and most popular growth ETFs. Its assets under management are over a whipping $90 billion.

IWF is run by BlackRock, one of the world’s largest asset managers, and charges an expense ratio of 0.19 percent. It has a trading volume of more than 1 million shares, which makes it extremely liquid and easy to buy and sell.

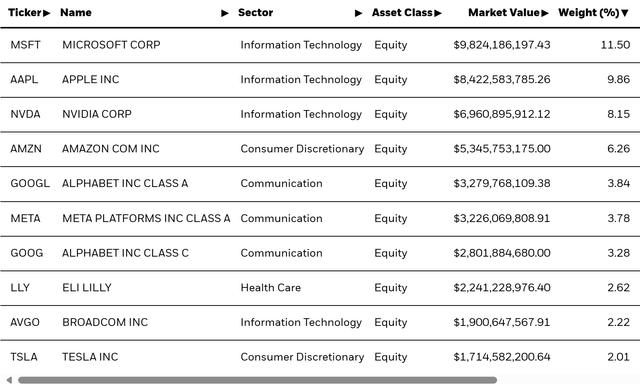

ETF Holdings

IWF currently has 440 holdings. The top positions are all the major ones you’re well aware of that have been the drivers of market momentum for the past year.

ishares.com

These are all great companies, but also crowded in terms of investor sentiment and allocation.

Sector Composition and Weightings

Of the assets in the iShares Russell 1000 Growth ETF, the technology sector is the largest at around 45 percent, followed by the consumer discretionary sector at about 14 percent. If you like growth, you better love Tech, as no sector will matter more. Again – I get worried about such a high concentration, especially given how well the sector has done for the past year and a half.

ishares.com

Peer Comparison

The Vanguard Growth ETF (VUG) and the SPDR Portfolio S&P 500 Growth ETF (SPYG) are good competitors to IWF. Expense ratios differ here – IWF comes in at 0.19 percent, while VUG and SPYG are at 0.04 percent. When we look at the performance of IWF relative to VUG and SPYG, IWF has outperformed. The larger number of holdings in IWF seems to be a plus for creating a stronger return profile overall.

stockcharts.com

Pros and Cons

On the positive side, the fund has strong exposure to large-cap growth stocks. That’s where all the action has been. Growth tilted portfolios have outperformed the value factor dramatically in the past year and a half. This is where the momentum is.

The problem? The parochial nature of technology stocks can lead to more sector-specific volatility, especially if there is a change in regulation or a technological development that shakes up the underlying companies. Because growth stocks are more highly valued, the ETF will be more volatile in a general market decline as well. And the 0.19 percent expense ratio, although inexpensive, is higher than some competing growth ETFs.

Conclusion

The iShares Russell 1000 Growth ETF is considered a go-to ETF for U.S. large-cap exposure, with an emphasis on growth-related companies. Among those stocks are some of the largest companies in the world: Apple, Microsoft, Amazon, Alphabet and Nvidia, to name just a few. Because of its sheer size, IWF allocates over 45% of its sector allocations toward the information technology sector. This has been the fund’s strength. It is also where I believe the fund is most vulnerable.

I broadly expect a shift from growth to value as momentum seekers looking for the next major uptrend. The valuation of IWF isn’t cheap – it has a Price to Earnings ratio of 36. Higher valuations mean there are higher gains to be lost if the market falls. And it will, as it always does. Sure – the ability to get better returns in rising markets is there with IWF, but we could very well be late cycle now. Great fund and one I think you can certainly tactically trade around, but this is one I would avoid until after a major market dislocation takes place.

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here