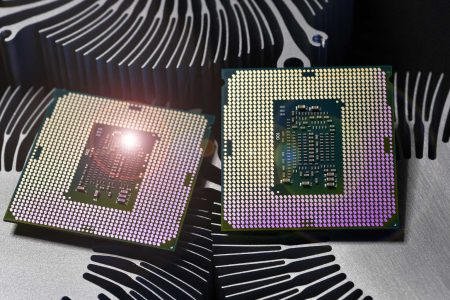

Without a doubt, one of the biggest problems facing most Americans today is the rising cost of living. For the past eighteen months or so, inflation has been at the highest levels that we have seen in roughly forty years. In fact, there has not been a single month over the past year in which the consumer price index increased by less than 6% year-over-year:

Trading Economics

This has caused many people to be forced to enter the gig economy or take on second jobs just to get the extra money that they need to maintain their lifestyles. I discussed this in a recent blog post. This is probably one reason why the job reports have been reasonably strong over the past year despite mass layoffs, although there are now signs of weakening in this area.

Fortunately, as investors, we do not have to resort to such tactics in order to improve our incomes. This is because we can put our money to work for us. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income. This is, admittedly, an asset class that is not very well followed by either the financial media or investment advisors, so it is understandable that few investors are familiar with these funds. This is unfortunate because they have a lot to offer, including the ability to pay out much higher yields than any of the underlying assets actually possess.

In this article, we will discuss the Nuveen Floating Rate Income Fund (NYSE:JFR), which is one fund that can be used for the purposes of earning income. This is reflected in the fact that this fund pays a 10.81% yield, which certainly makes it easy to put your money to work for you. This fund has a bit of an advantage over many of the other income-focused closed-end funds too, as it should have lower interest rate risk. That will likely be an advantage in today’s somewhat uncertain environment. As some readers may recall, I have discussed this fund before, but a few months have passed so naturally, some things have changed. Perhaps the most important of these changes is that the fund released an updated financial report, which we will want to examine as it is critical to the fund’s ability to sustain its distribution. Let us investigate and see if this fund could be a good addition to your portfolio today.

About The Fund

According to the fund’s webpage, the Nuveen Floating Rate Income Fund has the stated objective of providing its investors with a high level of current income. This is not particularly surprising considering that this fund is a fixed-income fund. Its website states the following:

“The Fund seeks to achieve a high level of current income by investing in a portfolio of adjustable rate senior loans and other debt instruments.

At least 80% of its managed assets will consist of adjustable rate loans; at least 65% of these must be senior loans secured by specific collateral. Other loans may include unsecured senior loans and secured and unsecured subordinated loans.”

This differs from most other fixed-income funds. In particular, the fact that these are adjustable-rate loans, as opposed to traditional bonds, provides us with a certain degree of protection against interest rate risk. As I have mentioned in numerous previous articles, bond prices have an inverse relationship to interest rates. Basically, when interest rates rise, bond prices decline. This is because existing bonds will have a lower yield than newly-issued bonds in such an environment, so their price has to buy so that a buyer will receive the same effective yield to maturity as they would with a brand-new bond with similar characteristics. The securities that the Nuveen Floating Rate Income Fund purchases have an interest rate that increases when the market rate does, however. Thus, they do not need to decline to give the buyer a competitive rate whenever the market rate goes up. As such, these securities should hold their value better than traditional bonds during periods when interest rates are rising.

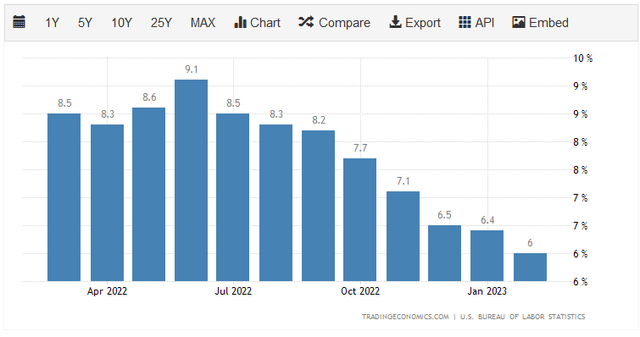

This is especially important today as the Federal Reserve has been aggressively raising the benchmark interest rate over the past year as part of its attempt to combat the incredibly high level of inflation in the economy. In March of 2022, the effective federal funds rate was 0.20% but today it is 4.65%:

Federal Reserve Bank of St. Louis

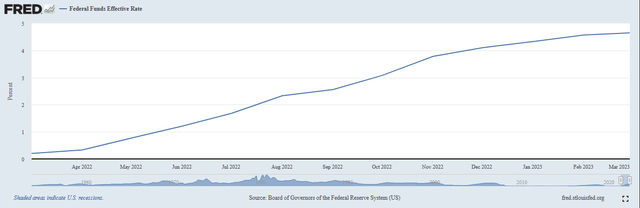

This is the reason why most bond funds have declined. The Bloomberg U.S. Aggregate Bond Index (AGG) is down 4.58% over the past year, which is surprising since the steep increase in interest rates would normally be expected to cause it to have declined much more. It actually was down much more at the end of last year, but has increased this year due to some market participants believing that the Federal Reserve will pivot and start cutting rates again:

Seeking Alpha

Chairman Powell has stated that the Federal Reserve will not cut rates this year. Realistically, if the central bank does cut rates, it will cause inflation to surge once again so it is likely that Powell’s comments are likely to prove true. Once the market realizes this, we will probably see the bond index fall quite a bit.

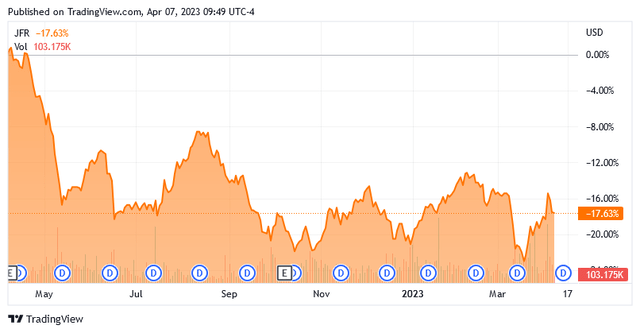

Curiously, the Nuveen Floating Rate Income Fund has declined by a much greater 17.63% over the same period:

Seeking Alpha

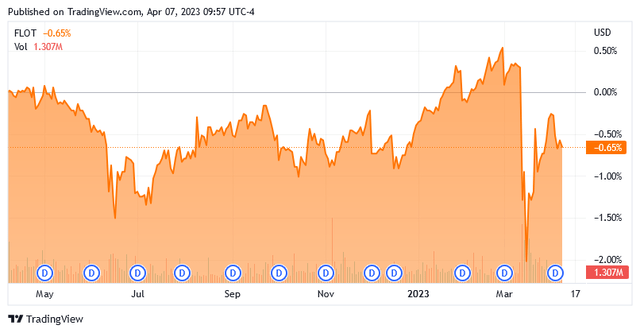

This is in stark contrast to the Bloomberg Floating Rate Note <5 Years Index (FLOT), which is almost perfectly flat over the period:

Seeking Alpha

We can see though that the Nuveen Floating Rate Income Fund was relatively flat after its steep decline in May of last year. It is still a rather strange performance considering that the fund did not cut its distribution. In fact, the fund has been increasing its distribution over the past year. We do frequently see funds like this perform very differently to the broader market for no reason though, so this is probably nothing that we need to worry about. This is especially true when we consider that this fund is currently very cheap relative to the value of the notes in the portfolio. We will discuss this later in this article.

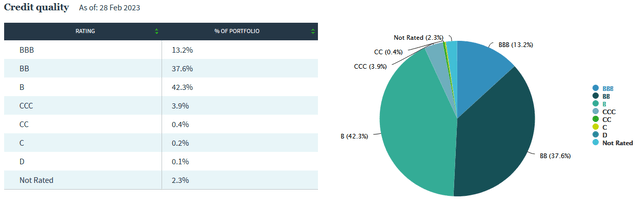

One concern that more conservative investors may have is that floating-rate securities are typically issued by companies that already have significantly high levels of debt or have difficulty obtaining traditional financing. This is because floating loans tend to be more expensive than traditional bonds and in many cases, the companies need to post real estate or something else as collateral that can be seized in the event of default. Loans made to highly creditworthy companies do not have this collateral requirement. Thus, the risk of default losses is going to be higher here than it would be with a traditional bond fund. We can clearly see this by looking at the credit ratings that have been assigned to the securities that comprise the fund’s portfolio. Here they are:

Nuveen

An investment-grade security is anything rated BBB or higher. As we can see, that only describes 13.2% of the assets in this portfolio. As such, the overwhelming majority of the securities in this portfolio are speculative grade (colloquially called “junk bonds”). This will naturally be concerning to those conservative investors that are worried about the principal loss. However, we can see that 79.9% of the securities in the portfolio are rated either BB or B. These are the highest two ratings possible for speculative-grade securities and the official bond ratings scale states that companies whose securities are assigned these ratings have the financial strength to carry their debt loads even through a short-term economic shock. Thus, unless we experience an economic downturn that resembles The Great Depression, these securities are probably pretty safe from default losses. In addition to this, the fund has 486 unique securities in the portfolio, so any single default will have a negligible impact on the portfolio. Overall, we should not really worry about default risk here.

Another nice thing to see about this fund is that the Nuveen Floating Rate Income Fund has a fairly low turnover. In 2022, the fund had an annual turnover of 38.00%, which is not especially high for a fixed-income fund, although it is also not the lowest that I have seen. The reason that this is important is that it costs money to trade bonds or other securities. These expenses are billed to the shareholders of the fund and thus create a drag on the fund’s performance and reduce its overall returns. It also makes management’s job more difficult because the fund’s managers will need to earn a sufficiently high return to both cover these expenses and still have enough left over to satisfy the shareholders. This is a task that few managers manage to achieve on a consistent basis, which is one of the biggest reasons why actively-managed funds tend to underperform their benchmark indices. As we have already seen, the Nuveen Floating Rate Income Fund is no exception to this as it did underperform the floating-rate securities index over the past year, but the closed-end fund does have a substantially higher yield, which helps to close the gap.

Leverage

As stated in the introduction, closed-end funds like the Nuveen Floating Rate Income Fund have the ability to employ certain strategies that have the effect of boosting their yield beyond that of any of the underlying assets. One of the most common ways to do this is through the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase floating-rate securities and similar assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are significantly lower than retail rates. As such, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This could be one reason why the fund has not held up as well as the floating rate index during the recent period of rising interest rates. As a result of this concept, we want to ensure that the fund is not using too much debt because that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason. The Nuveen Floating Rate Income Fund, unfortunately, does not satisfy this requirement as its levered assets currently comprise 38.97% of its portfolio. As the fund’s assets are generally invested in reasonably safe securities that should hold their value regardless of interest rates, this is probably okay, but it is admittedly still more than we really want to see. The risk here may be more than some investors are comfortable with.

Distribution Analysis

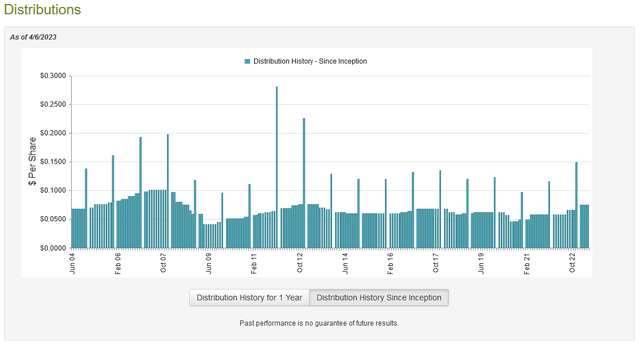

As stated earlier in this article, the primary objective of the Nuveen Floating Rate Income Fund is to provide its investors with a high level of current income. In pursuit of this objective, the fund purchases floating-rate securities from less creditworthy entities, which tend to have a reasonably high yield. The fund then applies a layer of leverage to boost the yield even more. As such, we can assume that this fund itself will boast a reasonably high distribution yield. This is certainly true as the fund currently pays a monthly distribution of $0.0745 per share ($0.894 per share annually), which gives it a 10.81% yield at the current price. Unfortunately, the fund has not been particularly consistent about its distribution over the years, although it has been increasing it since 2021:

CEF Connect

The fact that the fund has a variable distribution is likely to be a bit of a turn-off to those investors that are looking for a safe and secure source of income that can be used to pay their bills or otherwise finance their lifestyles. However, it is not particularly surprising considering that the interest paid by the securities in the fund’s portfolio varies with conditions in the market. It is, after all, never a good idea for a fund to pay out more than it can earn from its investments. Let us have a look and see how sustainable the fund’s current distribution is likely to be.

Fortunately, we have a very recent document that we can consult for our analysis. The fund’s most recent financial report corresponds to the six-month period that ended on January 31, 2023. This is a much more recent financial report than we had available the last time that we looked at this fund and as such, it should give us a better idea of how well the fund is handling the current conditions in the market. During the six-month period, the Nuveen Floating Rate Income Fund received a total of $33,919,774 in dividends and interest along with $240,517 in fees. This gives the fund a total income of $34,160,291 over the period. The fund paid its expenses out of this amount, which left it with $23,062,850 available for the shareholders. This was not enough to cover the $23,991,134 that the fund paid out in distributions over the period, although it did get pretty close. The fact that the fund’s net investment income was lower than the distributions might still be concerning at first glance, though.

As is the case with other funds, this one does have other methods through which it can get the money to cover its distribution, though. For example, it might have capital gains that can be paid out. Unfortunately, this fund did fail at that task during the period as it had net realized losses of $17,502,347 over the six-month period. Although the fund did manage to partially offset this loss with $13,894,517 net unrealized gains, it still had its assets decline by $4,536,114 over the six-month period after accounting for all inflows and outflows. This is something that is somewhat concerning, especially because the fund just increased its distribution in the face of this decline. However, we should consider the timing of the fund’s interest receipts. As already mentioned, the net investment income was very close to the actual distributions paid out. As such, it is possible that the fund is simply paying out its net investment income to the investors but a disconnect exists between the time that it receives the money from its investments and the date of the distribution payment. The fund can probably maintain its distribution since this appears to be what it is doing. However, once interest rates decline, the fund will probably be forced to cut for the same reason.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Nuveen Floating Rate Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of April 6, 2023 (the most recent date for which data is currently available), the fund had a net asset value of $9.17 per share but the shares currently trade for $8.27 per share. This gives the fund a 9.81% discount on the net asset value at the current price. This is not quite as good as the 10.28% discount that the shares have averaged over the past month, but it is still a reasonable price to pay. Overall, this appears like a decent entry price.

Conclusion

In conclusion, today’s incredibly high inflation rate has resulted in a desperate need for income among many investors. The Nuveen Floating Rate Income Fund may be one of the better ways to obtain it because the assets that the fund invests in should perform much better than traditional bonds in a rising-rate environment. In addition, it appears that this fund is simply paying out its net investment income so the current distribution should be sustainable as long as rates remain at today’s levels. The fund is also trading for a very attractive price, so buying it today could be a good idea.

Read the full article here