Quick Background

If you’re like me at all, you enjoy being a stock picking voyeur. What I mean is that it’s both interesting and fun to listen to someone explain their stock picks. This is especially enjoyable as a fly on the wall, where you don’t necessarily have to interact or explain anything. Then again, it can be very enjoyable to respond, criticize, or agree. That’s what’s great about articles like this one.

That said, I’ll be talking about Johnson & Johnson (JNJ). I’m going to largely avoid recent news, such as:

I’m leaving out a bunch more, too, because you can easily get that news in other places and other articles. What I’m going to share here is more personal and direct, with an added injection of strategic thinking.

Let’s be specific. I’ll be covering a recent purchase of JNJ. Then, how this fits into my dividend cash machine. After that, I’ll briefly cover valuation and related thoughts on investing. Lastly, I’ll wrap it up, and look forward a bit.

Recent Purchase

I bought 15 JNJ @ $161.22 a few days ago. This is on top of a pile of JNJ that I have bought on and off for many years. Indeed, with JNJ, I’ve been a long-term investor since February 2015. So, we’re mighty close to nine years, it looks like.

In any event, you might also be interested to know that some of the funding for this recent purchase came from the following dividends landing from these stocks. Take a quick peek:

- Altria (MO)

- Philip Morris (PM)

- Imperial Brands (OTCQX:IMBBY)

- Disney (DIS)

For a good visual, just imagine Mickey Mouse with three cigarettes in his mouth. Smoking mouse, smoking dividends, when you add it all up.

I’m trying to be amusing here but seriously those dividends are not amusing at all. They are a serious part of the dividend growth machine I’ve built over many years. I’ll talk about that after I talk about value investor.

Not Really A Value Investor

I’m something of a value investor but I also knew that I wasn’t predisposed to be super serious about it. When you’re intense about this stuff, you’re very intense. For example, true value investors like special situations.

Special situation investment opportunities can take many forms and involve a number of asset classes. They often arise from breaking news stories or rumors of news about to break. They may concern spinoffs, tender offers, mergers, acquisitions, bankruptcy, litigation, capital structure dislocations, shareholder activism, stock buybacks, and any other event that might affect a company’s short-term prospects.

I’m certainly interested in this stuff, but frankly, it’s more intellectual. I don’t have the time or focus to “win” as a value investor with special situations. Obviously, there’s way more than this to value investing, but hopefully you get my point. Value investing, done right, done deep, is a lot of work.

I like the bigger picture ideals of value investing. For example, I like having a “margin of safety” when I buy. That language and that thinking helps me to do a better job buying at great prices. It helps me be patient. But, come on, this certainly doesn’t make anyone a value investor.

With that out of the way, I can say with clarity that I use value investing to help me do a better job with my growth stocks. I don’t chase high prices. I’m patient. For example, I bought Alphabet (GOOGL) at $93, Meta Platforms (META) at $229 and Amazon (AMZN) at $143. There’s a long story behind these buys. What matters here is that the “value investing” helped me secure good prices for these stocks.

I bring all of this up because JNJ isn’t a steal right now. But, the price isn’t terrible either. This is more of a Charlie Munger buy than a Benjamin Graham. I’m getting my hands on a great company at a fair price, not a good company at a great price. More about JNJ’s valuation later.

Building The Machine

Let’s pivot back to JNJ as part of my dividend investing approach. Here’s some rather fun math along with how I think about investing sometimes.

With those 15 shares of JNJ I bought, that means I am getting $4.76 in dividends per share per year, or $71.40 in total per year.

On the surface, that’s kind of boring. With JNJ trading at just above $160 right now, it would take over two years to even be able to buy one more share. That’s because the yield is just under 3% right now. It doesn’t feel sexy.

When I was a lot younger, this kind of math made me turn a blind eye to the power of dividends, and compounding. I need to say a few things about this:

- Dividend cash never looks awesome when you look at just a few shares. I’m not talking about the yield. I’m talking about the actual cash.

- Dividend cash really only starts to look sexy when you have a lot shares, you’ve seen those dividends grow and you get dividend raises too.

- Dividend cash feels the best when it’s landing in your account and you have enough to buy what you want, or you can buy more dividends (reinvest).

I’m saying this because getting $4.76 per year, after putting in $160 really looks and feels lame on the surface. Ask a younger investor about this. None of them will say that it’s sexy or awesome.

I’m going to fast forward now, just a bit. Since I’ve been doing this for so long, I have a machine. Money in, dividends out. Dividends out, reinvest again, grow more. Cash on cash on cash. It works in taxable accounts and also non-taxable accounts. It’s better when you’re not getting tax, but that’s fine.

Here’s how I enjoy my 15 new shares of JNJ. I’m literally talking about those exact shares. First, I’m thrilled that I didn’t have to inject new money. My dividend machine (MO, PM, IMBBY, DIS in this case) gave me the funds to buy these shares. Those 15 new shares are “free” to me. They aren’t, but they are. We can quibble all day about it. To me, I’m going to say I got 15 free JNJ shares, and that’s awesome.

Next, I’m going to tell you that those 15 shares give me $71.40 which I then translate into about $0.20 of cash per day, forever. Simple math. And, for fun, I take the $0.20 and realize it’s just under $0.01 per hour, forever.

I’ve had this conversation with other people and they usually miss the big points. I’m saying that buy owning dividend paying stocks, which are true assets that spit off cash, I’m truly getting free money on top of free money, and I’m going to keep growing that, all for free.

Remember, in this exact case study, my younger self bought shares in MO, PM, IMBBY and DIS. My younger self didn’t work anymore for those exact shares that I bought. The work is done, the shares are owned. Now, those assets dump cash on me, I take that cash, and I buy more. Yes, my friend, obviously I’m talking about compounding.

Thankfully, young kids like the idea of getting $0.01 per hour, forever. You can visually stack pennies up in front of them. At the end of the day, you can say, hey, look at these 20 pennies. They are yours, for free. You just need to own the engines behind these pennies. When you work, you take a pinch of your cash, and you buy these things that give you these pennies. The stacks will grow and grow for you, forever.

The best part? This kind of conversation doesn’t even include the fact that most great dividend paying companies are dividend growth companies. In this case, it won’t take too long before the $0.20 per day is $0.24 per day, and we truthfully hit $0.01 per hour, forever.

All of this explains how the vast majority of my investing is done. I will say that you can work growth companies into this, but also money market funds, bonds, mutual funds, ETFs, Bitcoin and all the rest. That’s for another day.

Current Valuation

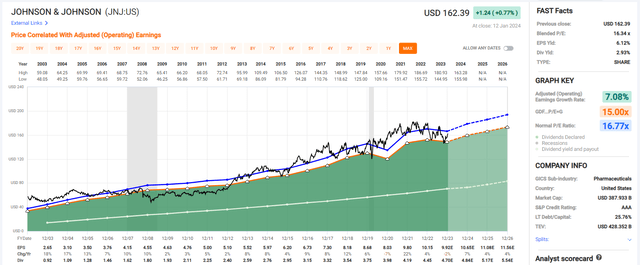

I don’t want to worry much here about getting JNJ’s valuation perfect. I just want to make sure I get a rational margin of safety. Please understand that when you’re holding these dividend growth companies in your portfolio, a few pennies or even $1-2 is very unlikely to ruin your money machine. That said, I do want a deal if I can get one, and I do want that buffer. In the spirit of the great Charlie Munger, that’s rational. Here’s a quick look using FASTgraphs:

JNJ Valuation (FASTgraphs)

I know that’s hard to see. You should be able to open it up.

I don’t love the P/E since we’re not getting a big discount. But, I do like that it’s a pinch below the normal P/E. The EPS yield isn’t quite 7%, which is what I’d like to see here, but 6.12% is in the “good enough” category.

You can’t see all these details, but the earnings growth over 20 years is 7% and then if you look at 15 years it’s close to 6%, 10 years it’s down around 5.5% and 5 years, it’s about 3.4%, which I definitely don’t like. I think we’ll be seeing something like 6-8% this year, and probably down to 4-5% in 2025 and 2026, respectively. I’m hoping for more.

I also love the AAA credit rating. I love the size and scope of JNJ with nearly $400B in market cap. I also like that it’s more focused now, after dropping off Kenvue (KVUE). I think there could be some growth surprises. We’ll see.

Wrapping up, JNJ has underperformed the S&P 500 (SPY) over the last 20 years, 15 years and 10 years. I’m not going sugar coat this; that sucks. It’s really, really annoying but I do think JNJ is a superior choice due to the starting dividend and dividend growth. I also think that with KVUE out of the picture, there’s that potential for surprise.

Of course, real quick, there are litigation risks, such as the talc. There are also risks with new pharmaceuticals and equipment. It’s certainly not a ‘zero risk’ investment. Further, it’s a single stock, not the market, therefore I’ll say: diversification is your friend. Size accordingly.

Final Thoughts

I’d rate JNJ a BUY right now, but not for long. I’m definitely not interested above $165. We’ve barely got a margin of safety right now, and that’s only because JNJ is such a powerhouse with an amazing quality rating and very long, and successful track record. So again, it’s just barely a BUY.

I also would urge you to look at how JNJ is really just one piece of the puzzle. I’ve mentioned MO, PM, IMBBY and DIS several times, because they offered seed money for me, for my recent JNJ purchase. But, without getting into the weeds, you might be interested in buying one of those companies right now, instead of JNJ. You might get higher starting dividends, more dividend growth, or more capital appreciation.

The point? Know your goals, know your machine. If you’re just buying and praying, you simply won’t do as well as you could. You’ll buy high and sell low. You’ll invest in stocks that don’t help you achieve what you want. You’ll miss the boat on growing cash flow. I could go on and on.

In the spirit of Napoleon Hill, you need to have a burning desire for what you want, then you need a tangible plan, then you need to work at it. The end.

Go ahead now, like, share, and comment. Talk about it here, talk about it with friends and family. Have a great day.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here