Leggett & Platt, Incorporated (NYSE:LEG), a manufacturer that specializes in diversified furniture and automobile products, has seen its stock tank during the first quarter. The company posted disappointing earnings results for the fourth quarter and announced a corporate restructuring plan that led to the withdrawal of shareholder return goals. Despite the bad news, I think the company is oversold and investors can earn income by either purchasing its shares or by selling cash secured puts.

SEC 10-K

Leggett & Platt saw its earnings face headwinds during 2023. The company’s net sales declined by $400 million. While cost of goods sold also declined, it was not by more than revenue, which led to gross profit dropping $120 million to $853 million. This decline was driven by sales losses in the bedding group, which is the company’s largest product family.

Unfortunately, there were more problems than sales. Expenses grew compared to last year with selling and general administrative expenses rising and a $443 million asset impairment charge. This led to a net loss, but it is important to note that the impairment charge was a non-cash expense.

SEC 10-K SEC 10-K SEC 10-K

Leggett & Platt’s balance sheet shows the extent of the asset impairment charge. The write-off occurred under other intangibles and directly led to the drop in total assets. Working capital (mainly receivables and inventory) declined slightly during the year. The company did pay down approximately $100 million of long-term debt, but the asset write-off was too large to offset elsewhere as shareholder equity fell by $300 million to $1.3 billion.

SEC 10-K SEC 10-K

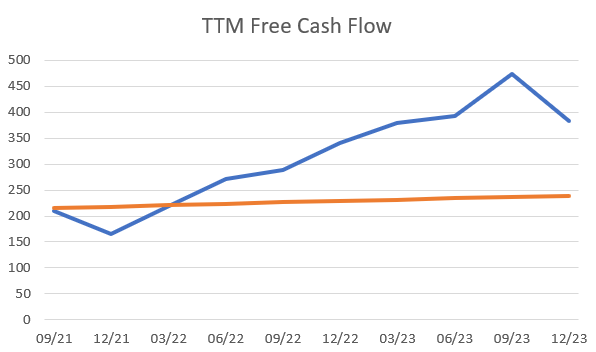

For the purposes of dividend sustainability, the statement of cash flows is the most important report to review. For Leggett & Platt, the removal of the asset impairment charge, combined with the $135 million drawdown in working capital, led to a growth in operating cash flow to nearly $500 million for 2023. After capital expenditures of $114 million, there was $383 million in free cash flow. Leggett & Platt’s free cash flow was sufficient to cover the dividend obligation of $239 million plus $106 million in debt paydowns, and a $50 million increase in cash.

SEC 10-K SEC 10-K

Looking ahead to 2024, Leggett & Platt is expecting sales to slump between 2 and 8%, along with a drop in earnings per share of approximately 10 cents due to the restructuring costs and asset sales associated with it. What’s important for investors to watch is the cash flow guidance, which shows free cash flow coming in at up to $40 million short of the projected dividend obligation. While the guidance suggests that Leggett & Platt will be walking a cash flow tightrope, they had done that prior to 2023.

Earnings Presentation Earnings Presentation TIKR

Outside of the 2024 guidance, there are a couple more risks to the dividend. First, the company hinted in the conference call that restructuring costs in some product areas may extend into 2025, which will extend the hinderance of cash flow. Additionally, the company has $300 million of debt maturing in 2024. While Leggett & Platt has the cash on hand to pay off this debt, it leaves very little cushion left to cover a dividend that may exceed free cash flow.

Earnings Transcript SEC 10-K

While investing in Leggett & Platt’s debt may be another income option that avoids the dividend cut, the company’s bonds are currently highly priced with only modest returns. In fact, I would argue the debt’s solid pricing is bullish for the shares. Instead of buying shares outright, I am selling cash secured puts at a strike price of $17.50 with an April 19th expiration. The May 17th expiration options are also offering a great annualized return. At the $17.50 per share strike price, investors would be acquiring Leggett & Platt shares at 13 times next year’s earnings.

FINRA Yahoo Finance Yahoo Finance

Leggett & Platt’s restructuring plan combined with its sales erosion have left investors nervous about the company. The 30% drop in share prices this year has been overblown, as the company has continued to maintain its free cash flow and cover dividends. Once the restructuring is over, Leggett & Platt, Incorporated earnings growth should resume. For the time being, I am selling short term put options to gain income and establish a great entry price.

Read the full article here