In a challenging market, investors should look to “well-known, great American companies with beaten down stocks,” CNBC’s Jim Cramer said Wednesday.

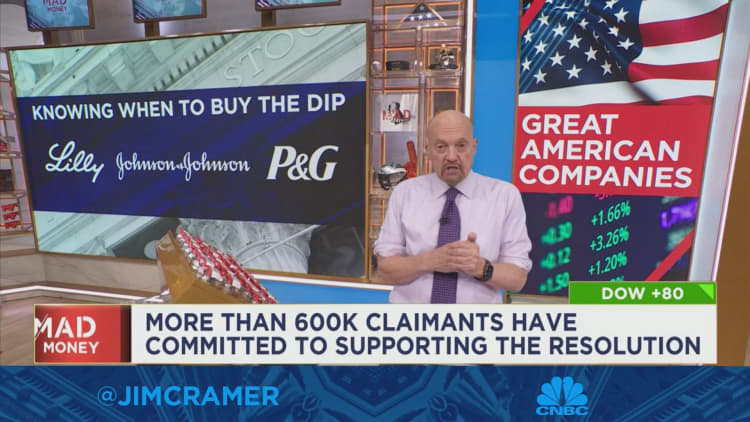

There are three companies that Cramer thinks have compelling stories and strength, even if their stock prices don’t necessarily reflect that: Johnson & Johnson, Eli Lilly, and Procter & Gamble.

At Johnson & Johnson, a bruising yearslong battle with lawsuits linked to the company’s talc powder battered the stock, Cramer said.

An attempted bankruptcy maneuver was struck down by an appeals court, Cramer continued, leaving his Charitable Trust’s play exposed. But J&J’s recently announced settlement with many of the claimants leaves the stock “free to run,” offering upside in a company that has historically been a “great” buy, Cramer said.

At Lilly, the stock price took a hit when investor excitement over a highly anticipated diabetes drug was dampened by investor fears that Federal Reserve maneuvering could weaken defensive stocks. But the company isn’t a “one-trick pony,” Cramer said, so investors should look to buy the dip and trust in Lilly’s research and development.

And finally, at P&G, Cramer thinks that there’s a “grudging recognition” that the stock of the consumer goods company is underpriced. It suffered from a flight as investors moved from safer picks into technology companies, but is poised for a renaissance and has come off its lows, Cramer said.

“What do all three of these have in common? How about the fact that they’re amazing American companies, with stocks that get cheaper as they go down,” Cramer said.

Read the full article here