Lucid (NASDAQ:LCID) was once hailed as the next Tesla or BYD because of its plan to conquer the EV market with its luxurious and technologically more advanced specifications, backed by the Saudi sovereign fund. But for an EV maker to out-compete Tesla, it first has to be able to compete. Lucid is far from that, with its under 2,000 unit quarterly sales and losing money on each car sold.

The investment sentiment towards the company is divided – bullish says with Saudi’s support, it can become a national brand and thus grow fast in the foreseeable future; while bearish says the company will continue to burn cash until it goes bankrupt. But when assessing and evaluating a company like Lucid, we have to rely on signals from news and company activities that reflect the company’s direction towards success or failure. Modelling out the financials will not work, since it will be all based on assumptions that are likely change drastically.

Therefore, the signs that we are looking at when writing this article are: 1) whether the company is able to turn around its troubled product line; 2) whether and when the company is planning for a financing round; and, perhaps most importantly, 3) whether Saudi’s support is for real and how likely will they cut their loss. But based on our analysis, the company has shown negative signals, which leads to our Sell rating.

Dangerous expansion strategy in products and markets

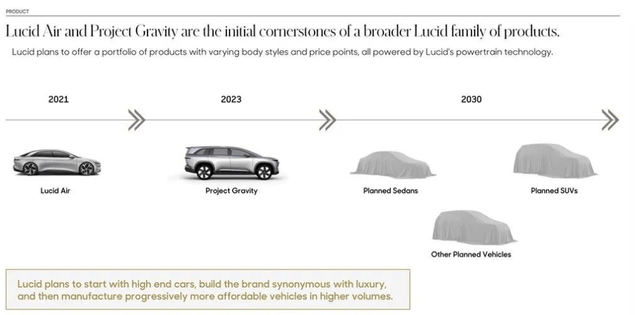

The company started in California with one model, Lucid Air, which is targeting the luxury electric vehicle market. Boasting its excellent power system which attracted Aston Martin to partner with the company, Lucid has planned to expand the product to the SUV market with a new model of Lucid Gravity in 2026. This product expansion strategy looks fine, given the company is aiming to directly compete with Tesla and its models in the normal passenger car and SUV markets.

Lucid

However, for context, Tesla was already selling approximately 50,000 Model S’, when Model X, the second generation SUV of Tesla, started to be sold in the market. On the other hand, Lucid is selling not more than 2,000 vehicles per quarter. This will put the company in a difficult situation in terms of supply chain costs, before it has achieved the economies of scale in Lucid Air production, considering that the company still had to slash price amid low customer demand and competition.

On the other hand, Lucid is looking to expand its market to Saudi Arabia and China by setting up sales teams and even production plants in both countries, following Tesla’s footsteps. This may seem to be a reasonable decision, given the huge EV market in China and the successful cases of its competitors. However, this optimistic view of investors and the company’s management is faced with the reality of the Chinese market – the economy is shrinking, and consumer spending is dropping, while there are established players locally like NIO (NYSE: NIO), who is already selling 50,000 cars per month.

As such, the expansion strategy of Lucid is not going to work to our view. This will not only divert the company’s focus on building up the foundation in the US market, but also cost the company more when it is burning a lot of cash per month and losing money per vehicle sold, which is another problem that we will discuss.

A company should stop if it loses money simply by selling more

According to Bloomberg, the company loses about $200,000 in EBITDA per vehicle sold, although improving from its 2022 data. This awful performance has kept heat on the company’s cash flow, and putting stress on the company’s balance sheet. This is primarily due to the high manufacturing costs, because of the under-capacity of the plants and sales. With the company’s over-expansion, as discussed, the company can only turn around its profitability by focusing on its product and market.

Bloomberg

With cash burn at this rate coupled with the maturity of a $2 billion convertible debt in 2026, investors can expect a decision for financing activities in the near future in my opinion, further impacting share price and investors. Saudi’s Public Investment Fund, as the largest shareholders of the company, might consider parting ways and not supporting the company, given the burn rate.

Saudi may, but unlikely, be a savior

Investors of Lucid who hold a bullish view will argue that with Saudi’s backing, the company will be as successful as China’s BYD, Germany’s Mercedes, US’ Tesla, because every country needs a brand of its own to show to the world. And there is nothing wrong with this view.

But what is wrong is that, Lucid is not the only EV company the Saudi fund is betting on. In recent years, creating a national EV brand has been one of the focuses for Saudi Arabia. In 2022, PIF announced a partnership with BMW and Foxconn to create Ceer, a new EV brand in the country. It has also received a contract and approval to construct a manufacturing plant in the country.

PIF

The question we would like to raise here is: why would Lucid, a money-losing company and created originally out of the US, be in favor instead of Ceer, a brand truly built by Saudi? PIF has lost more than $50 billion in value in this investment from its highest. A smart investor who sees the company unable to turn around, would be reasonably selling off its position to get what is left. So will PIF, in my opinion.

No share price catalyst in the next 1-2 years

No valuation is going to be useful, if the company cannot keep growing or improving, which may ultimately lead to the case of refinancing or even winding down in my opinion. In May 2023, share price of the company dropped more than 15% upon the announcement of a financing from the PIF. In the past 2 years, the company has burned around $2.2 – 2.5 billion of cash each year. With its cash and short-term investment balance at around $4 billion as of 2023, the company is likely to announce another round of financing activities by Q3 2024. Therefore, the share price may drop further.

InsideEV

Although the company announced that in Q1 2024, sales had increased and beat analyst expectations with 1,967 deliveries, which led to a 3% increase in share price on the following trading day, investors should not put their attention on the short-term delivery and expectations. This is because no sales can turnaround the company’s financials in the short term, the focus should remain on its strategy, cost management and cash flow.

Investment risks

- Investor risks: Currently, the company’s largest investor is the Saudi Arabia sovereign fund, who owns more than 70% of the shares. As analyzed before, if the Saudi considers Lucid as a failed investment and decided to write-off, or gives up to incubate the company as a signature brand of the country, the company will be heavily impacted because of the concentrated investor base in my opinion.

- Market risks: The EV market where Lucid operates in is a highly competitive market with prices going down. Major players like Tesla have gained a strong foothold in the market and, in my opinion, Lucid might not be able to compete as a late-comer, in terms of pricing, quality, branding, etc.

- Technological risks: The company has proposed different new technologies, hoping to differentiate from its competitors. However, these new technologies face the risks of long research and development period, or even the failure of realizing the plan. This will have significant impacts on the company’s products

Conclusion

Based on our analysis above, the company’s faulty business strategy in terms of business development and financials is going to make the company continue to sink, even with Saudi’s backing. But at the same time, even Saudi’s backing is not a reason for investment too, since the country treats it purely as an investment, and when an investment is showing signs of failure, an investor will have to cut its loss or write off, in my opinion.

But while all these are pointing to a Strong Sell, we think that the even slightest possibility for Saudi to privatize the company or inject more capital to incubate the company into a worldwide brand will excite investors and push the price higher. Therefore, it is just a Sell rating for now in our view.

Read the full article here