By Douglas R. Terry, CFA

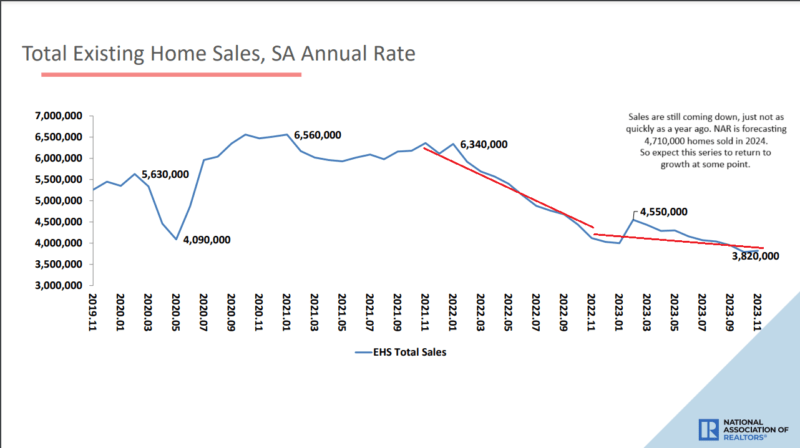

Existing home sales rose in November to an annual rate of 3,820,000 units from 3,790,000 in October. This is 7% lower than November 2022, but the negative growth in sales is improving. If the National Association of Realtors’ expectations for 4,710,000 sales in 2024 is correct, this series will show positive growth which could be north of 20%.

Inflation in the median price for a home is 4%, and this will be hard to improve upon through February 2024 given the price depreciation of roughly 13% from the middle of 2022 through February 2023. If the median sales price stays steady from Nov23 to Feb24, YoY price increase will be 6.6%.

Sales of homes priced from $750K-$1M are growing at 5.7%. Sales of homes priced from $1M and up are growing at 13.4%. Meanwhile, sales of homes below $750K are falling. Homes sold in the $100K-$250K price range dropped 15.3%. This could mean that all homes are going up in price, so there are less homes at lower price points. This could also reflect the K-shaped economy, where price inflation of the median house goes up just because there are more sales of higher-end homes.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here