Investment thesis

On March 10, 2023, I wrote an article about Minerals Technologies (NYSE:MTX) as inflationary pressures, increased energy and freight costs, severe cold weather in the Western United States, and a rebound in COVID-19 cases in China were negatively impacting profit margins, and a slow economic recovery in China, customer destocking, and foreign exchange headwinds were putting a brake on sales growth. Since shares declined by 31.46% from all-time highs as a consequence, I saw in these headwinds, which everything indicated were temporary due to their direct link to the macroeconomic landscape, a good opportunity for long-term dividend investors as the company remained profitable and the cash payout ratio remained low.

Since then, profit margins have expanded significantly and the balance sheet has improved slightly. Even so, suspicions of a slowdown in sales have been confirmed in 2023, and this is a headwind that is expected to persist at least through 2024. The most worrying thing, however, is not this slowdown (as growth was relatively strong in 2021 and 2022), but the recent increase in the cost of debt and the growing concerns of a potential recession due to recent interest rate hikes, are reasons why the share price has decreased by 1.89% since the last article I wrote while the S&P500 has risen by 11.11%.

Even so, I still think that the company continues to generate enough cash from operations to cover increased interest expenses and has a balance sheet robust enough to navigate through a potential recessionary territory for quite some time, which is why I consider that the poor performance of recent months represents a good opportunity to continue acquiring shares for the long term.

A brief overview of the company

Minerals Technologies is a global developer, manufacturer, and marketer of specialty mineral, mineral-based, and synthetic mineral products and supporting systems and services. The company was founded in 1968 and its market cap currently stands at $1.9 billion as it employs around 4,000 workers worldwide.

Minerals Technologies logo (Investors Day presentation: May 24, 2023)

The company operates under two main business segments: Consumer & Specialties and Engineered Solutions. Under the Consumer & Specialty segment, which provided 53% of the company’s total revenues during the third quarter of 2023, the company provides mineral-based solutions and technologies for end markets. This segment is divided into two product lines: Household & Personal Care and Specialty Additives. On the other hand, the Engineered Solutions segment, which is divided into the High-Temperature Technologies and the Environmental & Infrastructure product lines, the company provides engineered systems, mineral blends, and technologies for customers’ processes and projects, generating 47% of the company’s total revenues in the third quarter of 2023.

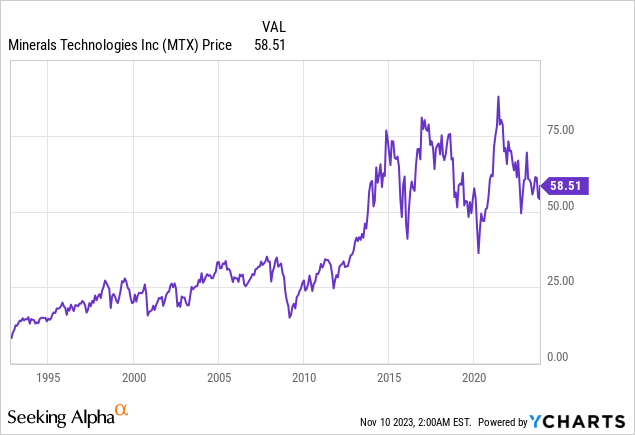

Currently, shares are trading at $58.51, which represents a 33.98% decline from all-time highs of $88.62 reached on June 2, 2021, despite recent performance improvements (mostly in terms of margins), as interest expenses are increasing at a very fast pace due to higher interest rates at a time marked by weaker demand and growing concerns of a potential global recession. Also, the company reported GAAP negative income in the third quarter of 2023 caused by the exiting of its talc business as its subsidiary Barretts Minerals recently filed for Chapter 11 Bankruptcy.

Exiting the talc business

In June 2023, the company announced its intentions to exit its talc business in Barretts Minerals, a subsidiary of Minerals Technologies, as cases filed against BMI regarding talc continued to increase.

Later, in October 2023, the subsidiary filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in order to fix BMI’s liabilities associated with talc, and the company plans to divest the talc business in the foreseeable future and use the proceeds to fund the process and an anticipated section 524(g) trust.

In this regard, 2024 is expected to begin with the talc business fully removed from the company’s financial results, but the long-term impact should be minimal as the business is very small compared to the company’s total size. Considering BMI’s talc net sales only represented 2.7% of Minerals Technologies’ total net sales in 2022, the impact of the exit should not be material in the long run.

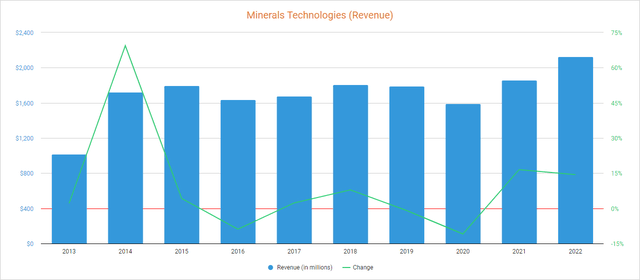

Revenues are stabilizing after two strong years

The company’s revenues increased by 69% in 2014 boosted by the acquisition of AMCOL International, and have remained stagnant for many years as the company has focused much of its efforts on paying down part of the debt incurred since then. Although sales declined by 11% in 2020 as a consequence of coronavirus-pandemic disruptions, 2021 and 2022 were very strong years as revenues increased by 17% and 14% respectively.

Minerals Technologies revenues (Seeking Alpha)

As for the current year, revenues increased by 5.20% year over year in the first quarter of 2023, and although they decreased by 0.99% in the second quarter, they increased by 1.09% (also year over year) in the third quarter boosted by pricing actions. Still, sales are expected to stagnate again at this level as they are expected to increase by 1.4% in full 2023 and by a further 1.4% in 2024. It is also important to mention that the company enjoys high geographic diversification. Using 2022 as a reference, 53% of the company’s revenues are generated within the United States, whereas 23% take place in Europe and Africa, 16% in Asia, and 7% in Canada and Latin America.

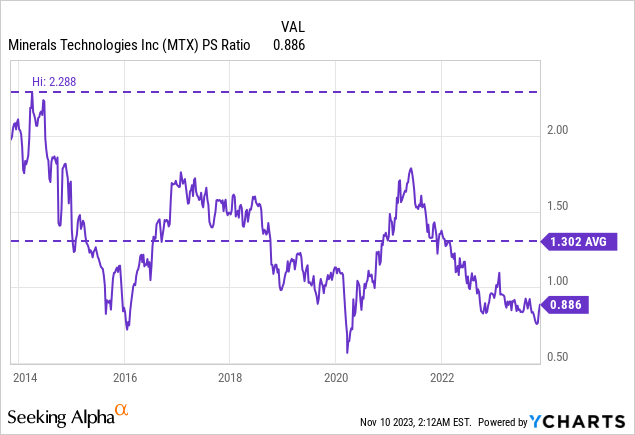

Also, revenue growth experienced in 2021, 2022, and 2023 along with declining share prices has caused a steep decline in the P/S ratio to 0.886, which means the company generates $1.13 in revenues for each dollar held in shares by investors annually.

This ratio is 31.95% lower than the average of the past 10 years and represents a 61.28% decline from 10-year highs of 2.288. Despite recent margin recovery, much more pessimistic expectations regarding sales growth (compared to 2021 and 2022), as well as increasing interest expenses and growing concerns of a potential recession have made the shares less attractive to investors.

Margins are recovering boosted by pricing actions and easing inflationary pressures

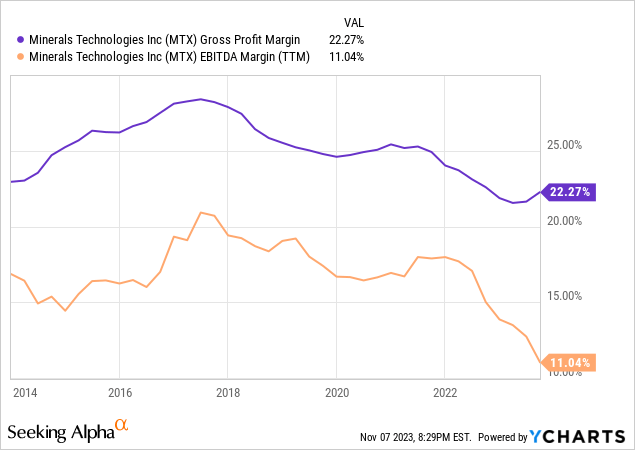

The company has historically reported high gross profit margins of over 25% and EBITDA margins of over 15%, but they were negatively impacted by inflationary pressures, increased energy and freight costs, severe cold weather in the Western United States, and a slower-than-expected recovery in China in 2021 and 2022. Despite this, they have started to show strong signs of recovery in 2023. In this regard, the company remains profitable as the trailing twelve months’ gross profit margin currently stands at 22.27%, and the EBITDA margin at 11.04%, but the EBITDA margin does not really reflect the real recovery of the company’s profitability profile due to one-time impacts.

Gross profit margins partially recovered in the past two quarters as the company reported a gross profit margin of 24.30% during the third quarter of 2023, but the EBITDA margin decreased to 2.98% as a consequence of a $72 million non-cash impairment of BMI’s fixed assets and $13 million of litigation costs associated with BMI’s Chapter 11 filing. In this regard, GAAP EPS were -$0.59 during the quarter but normalized EPS were positive at $1.49 (vs. $1.35 during the same quarter of 2022).

Operating margin improved by 170 basis points year over year (and 130 basis points quarter over quarter) to 14.1% of sales, and an adjusted EBITDA of $102 million, which represented 18.6% of sales, is the highest EBITDA reported in any given quarter. This margin expansion has been boosted by easing inflationary pressures, improved efficiencies, positive pricing, and increased volumes in higher-margin products at the expense of decreases in lower-margin products.

Therefore, GAAP EBITDA margins do not show the real prospects of the company’s profitability profile as it is actually reporting high cash from operations. Nevertheless, the attention of the investment community is currently pointing towards debt as the risk it poses for the company is increasing due to higher interest rates, which partially explains why the recent margin expansion is not reflected in the share price.

Increased interest expenses will limit the company’s decisions in the foreseeable future

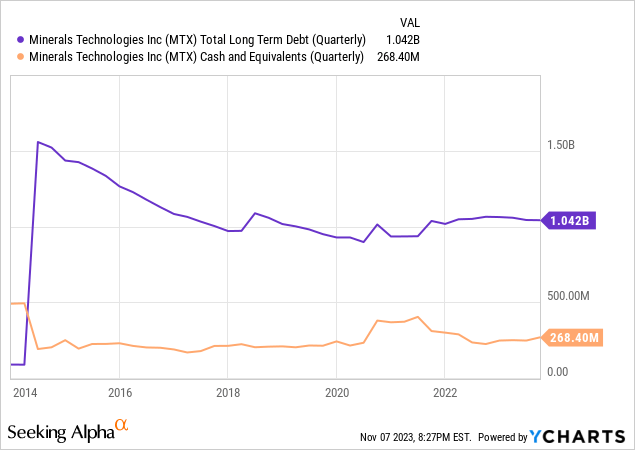

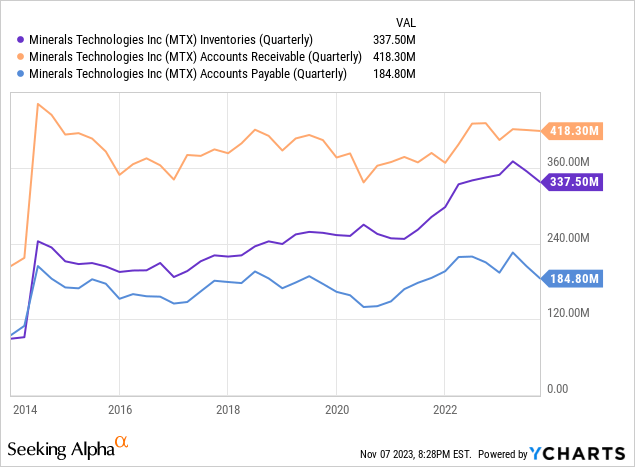

Year-to-date, long-term debt has only shown a very slight decline from $1.06 billion to $1.04 billion, but cash and equivalents improved at a faster pace from $247 million to $268 million. As for the rest of the balance sheet, inventories decreased by $11.3 million, but accounts receivable increased by $14.3 million while accounts payable decreased by $9 million. Still, it is important to note that long-term debt is still at a significant level, and the (increasing) interest expenses that such debt generates will limit the company’s ability to continue investing in growth initiatives and further acquisitions.

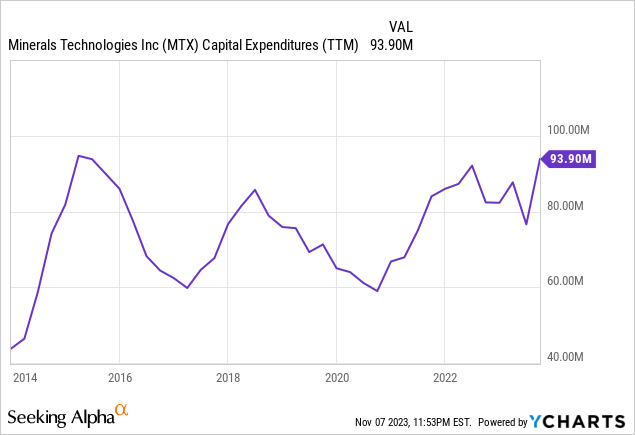

Currently, net debt is around the company’s targeted levels, and CEO Doug Dietrich stated, during the third quarter’s earnings call conference, that strong cash from operations will be used to fund capital expenditures, the increased dividend, the recently approved $75 million share repurchase program, and look for new potential acquisitions in order to keep growing, so it seems that reducing debt is currently not among the management’s priorities. All these items should be covered without major difficulties thanks to the robustness of the balance sheet. However, regarding acquisitions, the CEO stated that the management will be very careful as it does not represent more of a priority compared to organic investments.

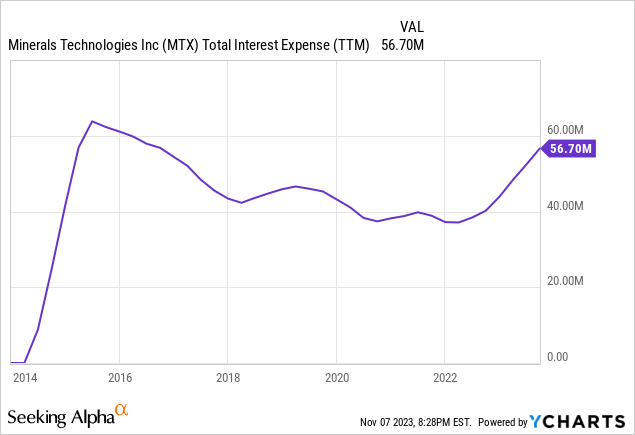

But despite the strength of the balance sheet (as well as expanded profit margins), one of the factors that weigh most on the current share price is the significant increase in the cost of debt as the trailing twelve months’ total interest expenses increased from $43.90 million to $56.70 million year-to-date.

What is more, total interest expenses continued to rise in the third quarter of 2023 to $15.30 million (for the quarter), meaning the company is expected to pay more than $60 million in annual interest expenses at current debt levels and rates, which will likely have a material impact on the company’s prospects in the coming quarters as annual interest expenses increased from $40 million to $60 million in just a few quarters, but the dividend remains sustainable despite increasing interest rates and a recent 100% dividend raise.

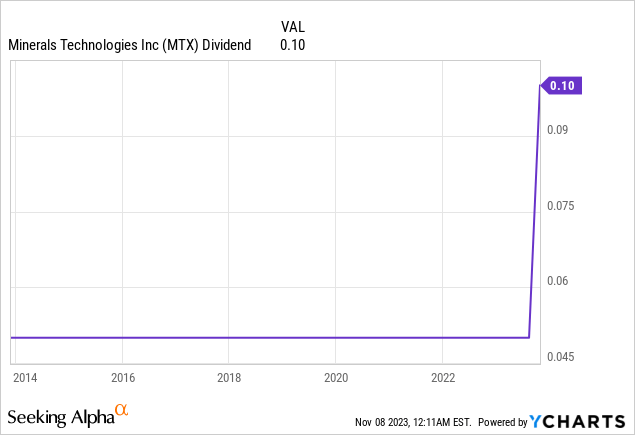

The dividend is sustainable as the cash payout ratio has historically been very low

The dividend has remained frozen at $0.05 per share a quarter since 2014, but the company announced a 100% dividend raise during the third quarter of 2023 to $0.10 per share which, according to management, is permanent. This means the dividend yield stands at 0.68% considering the current share price of $58.51 (vs. 0.33% at the time I wrote the last article). I know this is a very low yield for the majority of dividend investors, but the expense it represents compared to cash from operations is very low, so the cash payout ratio has historically remained very low as the management prefers to prioritize growth initiatives, the deleveraging of the balance sheet, and regular share buybacks.

As we can see in the table below, the cash payout ratio has remained at very healthy levels in the past few quarters (despite ongoing headwinds), which has made possible the recent strengthening of the balance sheet despite higher capital expenditures, and the last quarter reflected a significant improvement in terms of cash from operations, which has made possible the recent increase in the dividend and the new share repurchase program.

| Year | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

| Cash from operations (TTM, in millions) | $255.3 | $232.4 | $181.8 | $147.6 | $132.9 | $105.7 | $139.1 | $151.7 | $180.4 |

| Dividends paid (TTM, in millions) | $6.8 | $6.8 | $6.7 | $6.7 | $6.6 | $6.5 | $6.5 | $6.5 | $6.5 |

| Interest expenses (TTM, in millions) | $40.8 | $40.6 | $40.5 | $41.8 | $43.6 | $47.3 | $51.7 | $55.8 | $60.1 |

| Cash payout ratio | 18.6% | 20.40% | 26.0% | 32.9% | 37.8% | 50.9% | 41.8% | 41.1% | 36.9% |

During the third quarter of 2023, the company reported cash from operations of $59.1 million (vs. $30.4 million during the same quarter of 2022). During the quarter, inventories decreased by $17.2 million and accounts receivable by $1.5 million, but accounts payable also decreased by $19.5 million, which means current cash from operations is sustainable for as long as profit margins remain at current levels. Year to date, cash from operations is more than double compared to the same period of 2022, and the company expects record cash flows during the fourth quarter of 2023. Still, net income was negative at -$19.2 million during the third quarter as the Consumer & Specialties segment reported operating losses of $46.6 million due to special items related to BMI.

In short, the company will have to cover dividends worth $13 million each year, more than $60 million in interest expenses, and capital expenditures of around $100 million as it is currently prioritizing the launch of new products to the market in order to continue expanding sales in higher margin segments. Given recent operational performance (regarding cash from operations), the company should be able to cover these expenses (especially if we consider it can convert part of its high inventories into actual cash), albeit with a very limited margin, so sooner or later it will likely be necessary to reduce capital expenditures in order to free up some cash to cover share buybacks and a potential acquisition.

In this sense, the company’s current situation is not so delicate if we take into account that a significant part of its expenses is not so much an obligation (the recent dividend raise, share buybacks, and part of its capital expenditures to fund growth), but are part of the management’s efforts to expand operations and distribute cash to shareholders.

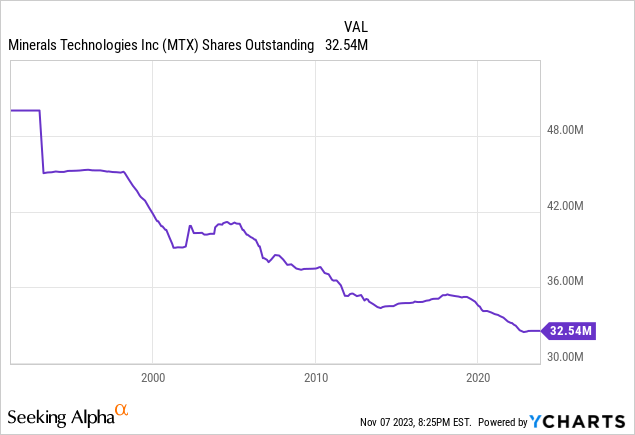

Share buybacks remain in force

In the past 10 years, the total number of shares outstanding has decreased by 5.26%, and in addition to increasing the dividend by 100% during the third quarter of 2023, the company has also announced a one-year $75 million share repurchase program, which means share buybacks remain in force.

This means that each share represents an increasingly larger portion of the company, which boosts per-share metrics, a trend that is expected to continue in the long term due to a historically very low cash payout ratio as the management gives preference to share buybacks as they offer more flexibility (for the company). Note that the pace of buybacks has been rather slow in recent years as the management has focused on paying down debt since 2014.

Risks worth mentioning

Overall, I consider Minerals Technologies’ risk profile to be fairly low over the long term. The company has been operating since 1968 and has demonstrated in recent years its ability to constantly generate positive cash, which is perfectly reflected in the steady reduction of long-term debt. Even so, the current situation is marked by strong volatility and there are certain risks that I would like to highlight.

- Recent interest rate hikes could cause a global recession, which would likely have a significant impact on both revenues and profit margins due to lower volumes.

- A new intensification of inflationary pressures could again lead to a significant contraction in profit margins.

- Interest expenses are reaching high levels, so the company could be forced to reduce the dividend, pause share buybacks, or reduce growth initiatives in order to free up some cash, especially if cash from operations suffers again as a consequence of a new margin contraction.

- Further interest rate hikes could continue causing increases in the company’s cost of debt, which would further limit the company’s prospects and increase the overall investment risk.

Conclusion

Since the last article I published in March 2023, the profit margins of Minerals Technologies have improved significantly and the balance sheet is slightly more robust, but expectations of a significant slowdown in sales growth have finally materialized, and no improvement is expected for 2024. In my opinion, this fact is not actually a cause for concern as 2021 and 2022 were strong years, and stabilization at current levels could even be seen as a relatively positive aspect. Actually, the two main reasons I think are behind investors’ concerns are two: the increasing cost of debt and the risk of a potential recession.

Interest expenses have significantly increased in recent quarters, despite deleveraging efforts in recent years, as a consequence of higher interest rates, and recent interest rate hikes could cause a global recession that would likely impact the company’s operations. Furthermore, these concerns come at a time marked by weak demand, so the impact of a potential recession could be significant.

Despite this, I think investors should not lose perspective and should keep in mind that the balance sheet is robust and the company is highly profitable. If operations weaken due to the current macroeconomic landscape, there are many places to temporarily cut expenses: share buybacks, capital expenditures, and dividends. Therefore, and despite potential short-term shareholder pain, I consider that a 34% decline in the share price from all-time highs represents a good opportunity for those long-term investors with enough patience to wait for the prospects of the company to improve.

Read the full article here