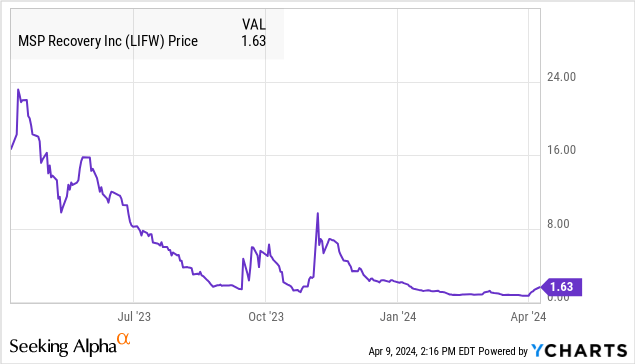

MSP Recovery (NASDAQ:LIFW) has had a turbulent history since its 2022 SPAC merger which initially valued the healthcare claims recovery specialist at $37 billion. A string of disappointing results failed to justify that lofty valuation, and some ongoing legal disputes have driven shares to a nearly catastrophic 90% decline over the past year.

Fast forward to the present and we see that the company received some welcomed news as artificial intelligence giant Palantir Technology Inc (PLTR) recently disclosed a 6.5% equity stake. While the extent of that relationship goes back since a 2021 engagement, the apparent reaffirmed nod of confidence was good enough for beaten-down shares of LIFW to more than double in value since the announcement.

On the other hand, our warning here is that LIFW remains a highly speculative and high-risk micro-cap stock with significant uncertainties. The company has requested an extension to file its annual report and still has a lot to prove in terms of the viability of its business model. We expect volatility to continue.

What Does MSP Recovery Do?

MSP Recovery operates under the “LifeWallet” brand, focused on recovering medical reimbursements by pursuing responsible parties under the Medicare Secondary Payer Law. This statute means that other insurance plans or programs are typically responsible for covering medical bills first, with Medicare stepping in as a last resort.

In practice, given the complexities of the U.S. healthcare system, identifying the responsible primary payer and coordination of benefits often becomes problematic. This leads to government-sponsored programs like Medicare and Medicaid overpaying or footing the bill that should have gone to private insurance companies.

LifeWallet attempts to identify these imbalances through medical records provided by Medicare Advantage Organizations (MAOs) that have irrevocably assigned their recovery rights associated with certain healthcare claims.

In this case, LifeWallet stands to receive a settlement amount that could include damages and fines, multiples of the original payment in a fee-sharing arrangement with its clients.

source: company IR

Within the approximately $1.6 Trillion in annual Medicare and Medicaid expenditures, it is estimated upward of 10% have improper payments, representing the serviceable market opportunity. From the company’s 2022 annual report:

Using Algorithms, we identify fraud, waste, and abuse in the Medicare, Medicaid, and commercial insurance segments. Our Algorithms have identified what we estimate to be significant value in potentially recoverable Claims.

Of the amount spent yearly by Medicare on medical expenses for its beneficiaries, we estimate that at least 10% are improper payments by private Medicare Advantage plans where a primary payer was responsible to make the payment. We seek recoveries of the Billed Amount from responsible primary payers, and in some instances, double damages and statutory interest pursuant to the MSP Laws.

The innovation from MSP Recovery is its big-data analytics approach that incorporates artificial intelligence and machine learning to identify the most compelling claims. This is in contrast to the traditional claims recovery method where a law office would proceed on a case-by-case basis.

The aspect of the ownership of rights is seen as a competitive advantage and otherwise unique compared to competitors that typically operate as a representative of the MAO provider.

source: company IR

What is Palantir Doing With MSP Recovery?

We believe MSP Recovery’s algorithmic and AI-driven model within the Healthcare medical records industry is the type of use-case application that fits within Palantir’s ecosystem.

We’ve covered PLTR previously, noting how the company was making an effort to grow its U.S. commercial user base with applications for its artificial intelligence platform (AIP). At the same time, the understanding is that MSP Recovery remains a very small player and likely not strategically material to Palantir’s long-term future.

While neither company has made public comments regarding this latest filing, we know that Palantir held 955,647 shares of LIFW as of March 22, 2024 with a current market value of approximately $1.5 million. The disclosure also noted that 256,410 of those shares were acquired as payment for certain outstanding receivables.

By this measure, it is fair to question how much of Palantir’s investment was made as a good-faith strategic decision or if the company accepted the shares as an alternative financing arrangement. That last point is important when thinking about MSP Recovery’s current circumstances.

source: company IR

MSP Recovery Financials Recap

What we have here is a compelling story that helps explain some of the early hype surrounding MSP Recovery including that original $33 billion valuation. Unfortunately, the company has simply been unable to translate that data-driven approach and even a climbing number of Potentially Recoverable Claims into a tangible financial.

We mentioned MSP Recovery has yet to file its Q4 2023 results and annual report. The last update from November noted an adjusted net loss of -$13 million, on only $440k in total claims recovery, down from $8.5 million in the prior year quarter. Through the first nine months of the year, the company generated just $7.0 million in total claims recovery revenue which was down from $22.0 million in 2022.

source: company IR

So while MSP Recovery is focusing on its growing portfolio of “Paid Value of Potentially Recoverable Claims” that reached $91.5 billion (as the amount estimated to be potentially recoverable), converting that figure into actual cash settlements has proven to be a challenge.

Our takeaway is that the logistics of reaching settlements and navigating the complete legal process has proven more difficult considering many issues that go beyond the “big data” approach. It’s possible the company’s early success through 2021 captured the low-hanging fruit of improper payments and the next cohort of recoveries is more complex.

A major setback here goes back to a 2022 court ruling that defined a four-year statute of limitations on certain claims under the Medicare Secondary Payer Act. Management explains that a large portion of its estimated recoverable claims amount may be substantially reduced. that From the Q3 update:

On August 10, 2022, the United States Court of Appeals, Eleventh Circuit held that a four-year statute of limitations period applies to certain claims brought under the Medicare Secondary Payer Act’s private cause of action, and that the limitations period begins to run on the date that the cause of action accrued. This opinion may render certain Claims held by the Company unrecoverable and may substantially reduce PVPRC and BVPRC as calculated.

source: company IR

The latest development for the company into 2024 includes the announcement in March of a “comprehensive settlement with 28 affiliated property and casualty insurers” that also provides enhanced data transparency for future claims. While the amount was not disclosed, the assumption is that the deal will be reflected in the financials into 2024.

As it relates to LIFW stock, the company will need many more “wins” to rebuild some credibility following what has been a string of disappointments. There are several ongoing investor lawsuits claiming marketing materials going back to the SPAC merger were misleading, resulting in large shareholder losses.

The other issue here is on the side of liquidity. MSP Recovery noted a $6.7 million balance sheet cash and cash equivalents position as of September 30, 2023. Considering more than $130 million in financial debt, the ability to generate sufficiently positive recurring cash flows is a concern.

Final Thoughts

Our take is that LIFW remains uninvestable considering the number of financial and strategic red flags. The investment from Palantir Technologies offers a glimmer of hope that the business model remains relevant and a turnaround could be on the horizon, but we simply haven’t seen enough quantifiable results.

We rate shares as a “hold” implying a neutral view on the stock price while recognizing that risks remain tilted to the downside. The key monitoring point in 2024 will be the evolution of the claims portfolio with some evidence of progress on settlements. Ultimately, we’d like to see some updated forward guidance with a realistic financial roadmap and earnings targets as a baseline to set long-term expectations.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here