Investment Thesis

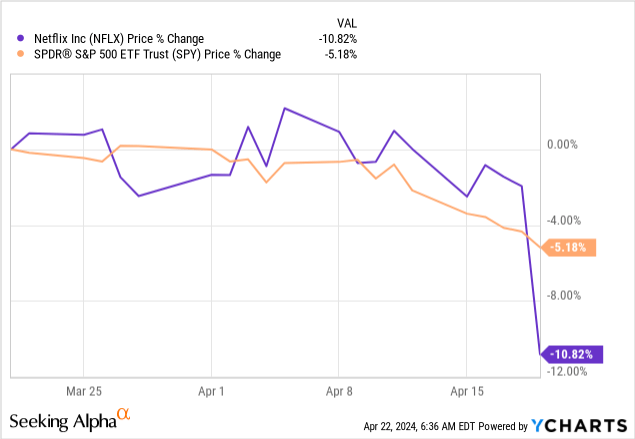

Netflix (NASDAQ:NFLX) announced its first quarter of FY2024 results late last week; the streaming company beat quarterly earnings and revenue estimates, plus it achieved a 16% year-over-year growth in global streaming paid memberships. But, the stock is selling off after the announcement last Thursday, down ~11% over the past month, as shown below. I believe the reason behind the sell-off is investor disappointment with management’s Q2 and FY2024 guidance. Netflix’s management is guiding for 16% year-over-year revenue growth to $9.49B, which trails the consensus expectations that sit at around $49.53B. It’s not a huge miss, and Netflix would still be maintaining double-digit top-line growth, but, in my opinion, the market’s reaction signifies the over-optimistic sentiment on Netflix’s monetization efforts. I think the market priced in a lot of the positives from management’s ad tier and their password crackdown initiative, prematurely. I’m initiating Netflix with a buy on pullbacks for the mid- to long-term investor.

My belief is that there’s more upside ahead for the company with management’s shift in focus to profitability and that the market now has a more balanced view of Netflix, making the company better adjusted to outperform expectations in 2HFY24.

YCharts

I don’t think we’ve seen the full positive impact of Netflix’s password crackdown initiative and its ad business translated into revenue growth yet. My takeaway from the first quarter of FY24 earnings call was that management is focusing on developing its “revenue model… adding things like advertising and our extra member feature, things that aren’t directly connected to a number of members.” After this quarter, I believe there’s a shift in the streaming industry’s go-to-market strategy and profit generation, which management discussed in terms of monetizing its subscriber base through developing different “pricing and plans with multiple tiers, different price points across different countries.” Further confirming this shift is management’s announcement that the company will “no longer report quarterly membership numbers and average revenue per membership starting in the first quarter of 2025.” I think the reason for the change is that management wants to focus the conversation on the “streaming wars” from subscriber growth to subscriber monetization, i.e., top-line growth. I see more upside for Netflix, especially now that Street expectations have reset after this quarter’s results, and the main focus for management is profitability.

Netflix’s Value Proposition: Monetization

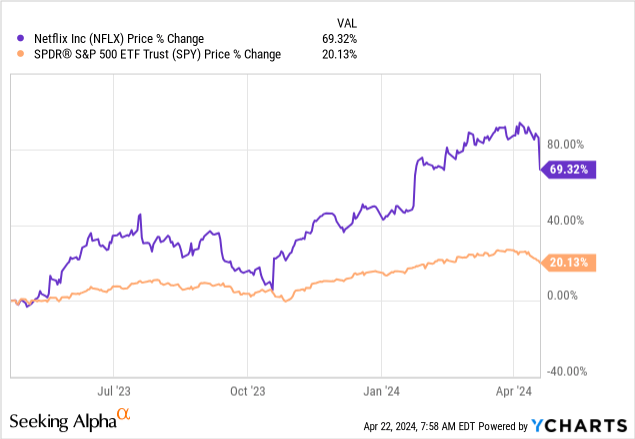

This quarter, Netflix reported revenue of $9.37B, representing a 14.8% year-over-year growth higher than the quarter prior, and is now guiding for a 16% year-over-year. In my opinion, the success of the password crackdown and price increases instated late last year has been reflected in this quarter’s beat. But the issue is with how high expectations got after Netflix’s comeback moment from its post-pandemic downturn; as shown in the graph below, Netflix had a bounce-back moment in terms of subscriber growth, and now we await its bounce-back moment in terms of revenue growth.

YCharts

Netflix generates the bulk of its money from one or more of the following three plans:

- The standard with ads priced at $6.99/month

- The ad-free basic plan, priced at $15.49/month

- The premium plan is priced at $22.99/month

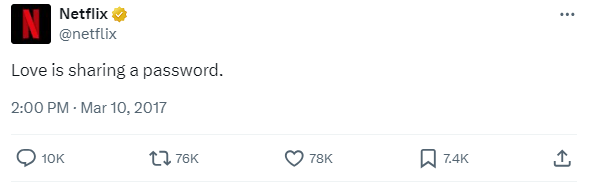

I expect Netflix will be under more pressure to retain its position in an increasingly competitive streaming industry. In my opinion, Netflix’s management will outperform the peer group in 2024 because it has already set in action its plans to monetize the subscriber base, and now it’s a waiting game. Among the plans set in action are the launch of the ad tier, the password crackdown, and last year’s price hikes. I remember when the news of the password crackdown came out, there was heavy debate about how it would be received by subscribers. Now, we know that what could’ve posed a big risk to subscription growth actually turned out positively; subscriber growth surged in 3Q23, reaching 247.15 million, versus 223.09 million in 3Q22, recording a 10.8% increase year-over-year. The password crackdown is a strategic monetization move that we’re still seeing pay off in 2024; it also shows that love for Netflix is not sharing a password but paying for one, unlike their infamous 2017 tweet.

Twitter

In my opinion, the subscriber growth after the launch of the password crackdown strategy indicates that Netflix enjoys a loyal customer base. The company’s 3Q23 shareholder letter revealed that the “cancel reaction continues to be low, exceeding our expectations, and borrower households converting into full-paying memberships are demonstrating healthy retention.”

More on the price hikes, I think they come with strings attached; now Netflix has to live up to the increases by further improving its content through more hefty content investments and introducing new features. My bullish sentiment is based on my belief that management is well-equipped to make this happen; I’m particularly optimistic about the reception of the company’s more serious venture into sports through WWE Raw, which I expect will help maintain its global subscription rates while simultaneously increasing revenue. Management also emphasized their excitement about the WWE Raw venture on this quarter’s call, noting, “We’ve got 52 weeks of live sports with WWE RAW that’s going to be coming to our members every week on Netflix, and we think it’s going to be a real value-add to watch those things in real-time.”

In the mid-to-long run, I think Netflix’s outperformance will be supported by its ad tier, introduced in late 2022. Exactly one year after Netflix introduced the ad tier plan, the company reached 15 million active users per month. Over two months after that, Netflix announced +23 million active users, according to the streaming giant’s chief of advertising, Amy Reinhard.

In my opinion, given the current macro backdrop, Netflix’s ad tier is liquid gold and will continue to reflect positively on its subscription numbers. Initially, I was a bit skeptical about Netflix’s ad tier because of the budget cuts from major ad firms post-pandemic. Now, I think it’ll be a slower process of monetization, but I believe Netflix is laying the groundwork for future revenue growth by boosting ad memberships until ad firm spending rebounds.

Valuation

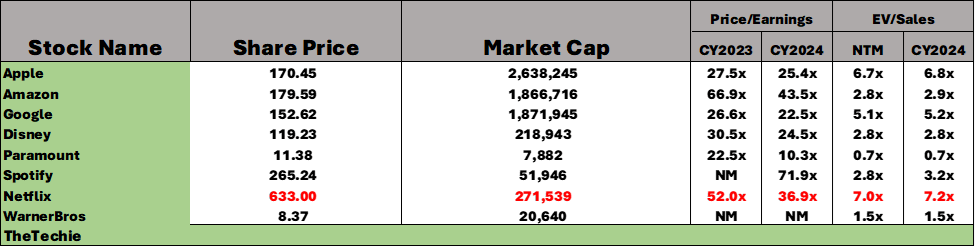

Based on a relative valuation methodology, Netflix presents a highly compelling investment prospect within the streaming peer group, in my opinion. Netflix stock trades at a ratio of 36.9 for CY2024, which is higher than its peer group average ratio of 31.5, according to data from Refinitiv shown in the table below. Netflix’s EV/Sales ratio for CY2024 currently stands at a ratio of 7.2, again higher than the peer group average of 3.8. I still see a favorable risk-reward scenario as management ups their monetization game. I argue that while Netflix is expensive, it proved itself as a leader among the peer group.

Image created by The Techie with data from Refinitiv

What Could Go Wrong?

No investment is without risk, and while Netflix’s success in the streaming industry speaks for itself, it’s still subject to the same market forces, and its biggest risk in 1H24 is competition. I think the biggest risk comes from Disney (DIS) penetrating the streaming industry. Back in 2022, Disney’s subscriber list, combined with Disney+, Hulu, and ESPN, reached 235 million, a total of 5 million more than Netflix’s base list at the time. More recently, however, Netflix is edging ahead at 260 million subscribers versus Disney’s total subscribers at 311 million as of 4Q23. Disney has the advantage of multiple offerings to attract different audience bases, compared to Netflix, which only has one. I’m not too worried about the increased competition because the streaming industry itself is ballooning; the streaming service market is estimated to grow at a CAGR of 7.46% between 2024-2029. I think Netflix’s loyal customer base will lower user turnover to other services, and I don’t see increased competition being a hindrance to the company’s monetization plans this year.

Bottom Line

I see Netflix as a buy for 2024. In my opinion, Netflix has all the tools to push its top-line growth and exit 2024 better positioned than it entered it. The company ended 2023 with revenue of $33.7B, up ~26% from $25B at the end of 2020. I believe we will see another boost in subscribers and monetization over the next four years.

I trust in management’s efforts to monetize what has proven through the pandemic to be a loyal customer base through password crackdowns for the current year and ad revenue for the mid-to-long term. I think investors should watch for top-line growth next quarter and how it correlates with subscription growth to see how the password crackdown initiative plays out. Furthermore, I also would recommend investors keep track of the ad tier sign-ups because I think they could turn into a solid revenue stream once the economic backdrop improves. I expect we’ll see windows to add more of the stock over the next few quarters and believe investors should be on the lookout, particularly if/when the stock hits the lower $540 range.

Read the full article here