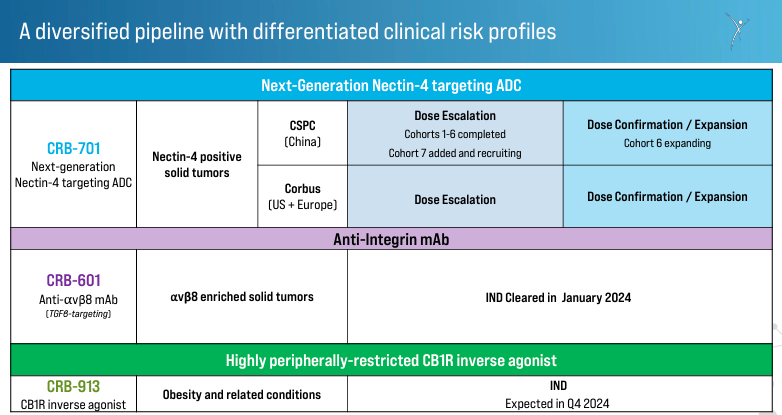

Corbus Pharmaceuticals Holdings, Inc. (NASDAQ:CRBP) is a biotech stock for investors seeking to gain oncology exposure. Their flagship research project is CRB-701, a Phase 1 drug that targets Nectin-4-positive solid tumors. CRBP also has other research projects that could be lucrative, but all of them are still in their stages and largely unproven.

From a financial perspective, CRBP is running low on funds, with less than a year of cash runway. However, the company recently filed with the SEC to raise up to $300.0 million in additional funds. This will likely cause dilution for investors and burden the balance sheet with more debt.

Overall, the underlying research is exciting. Still, from an investment perspective, I think Corbus Pharmaceuticals Holdings, Inc. stock is a “Hold” until we get more tangible clinical trial data corroborating its potential because oncology has notably low odds of FDA approval.

A Bet On Oncology: Business Overview

Corbus Pharmaceuticals is a clinical-stage biopharmaceutical company located in Norwood, Massachusetts. It was founded in 2009 and is focused on precision oncology, obesity, and related conditions. Today, CRBP is mostly a bet on the company’s ability to secure a lucrative oncology niche, primarily through its flagship research IP, CRB-701. CRBP is at the pre-revenue stage, with no foreseeable revenue generation sources for the near term. Moreover, their latest 10-K report indicates that CRB-701 remains in Phase 1 trials. This project shows promising early data, but its early stages make CRBP an inherently speculative investment.

Source: Corporate Presentation. March 28, 2024.

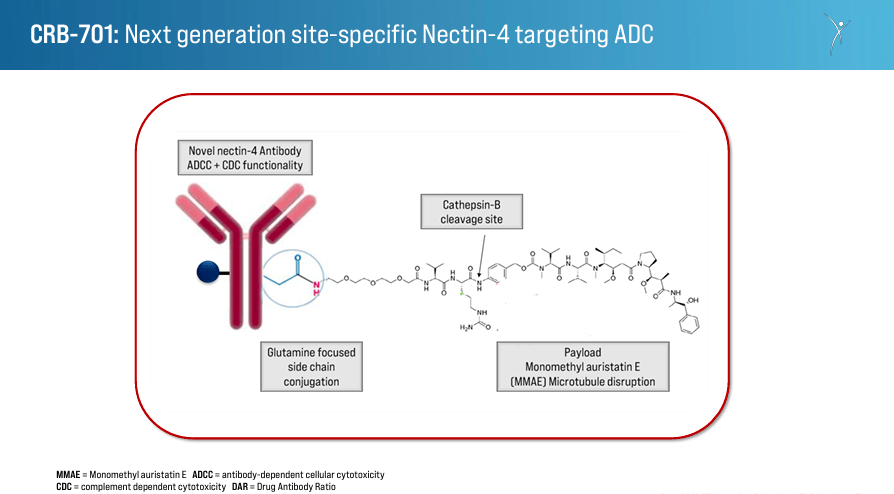

CRBP encompasses two approaches to cancer treatments directed at different mechanisms of malign cell proliferation: 1) Next-Generation Nectin-4 Antibody Drug Conjugate [ADC], and 2) Monoclonal Antibodies Targeting Integrins to Inhibit TGFβ Activation. The first one utilizes an antibody-drug conjugate targeting Nectin-4, a protein found on the cancer cells’ surfaces. ADCs are highly specific in delivering a cytotoxic agent to kill cancer cells. By targeting Nectin-4, this ADC reduces the impact in normal cells, diminishing side effects and eliminating cancer cells. This therapy’s efficacy is enhanced compared to earlier ADCs, so it’s a promising differentiator for CRBP’s IP.

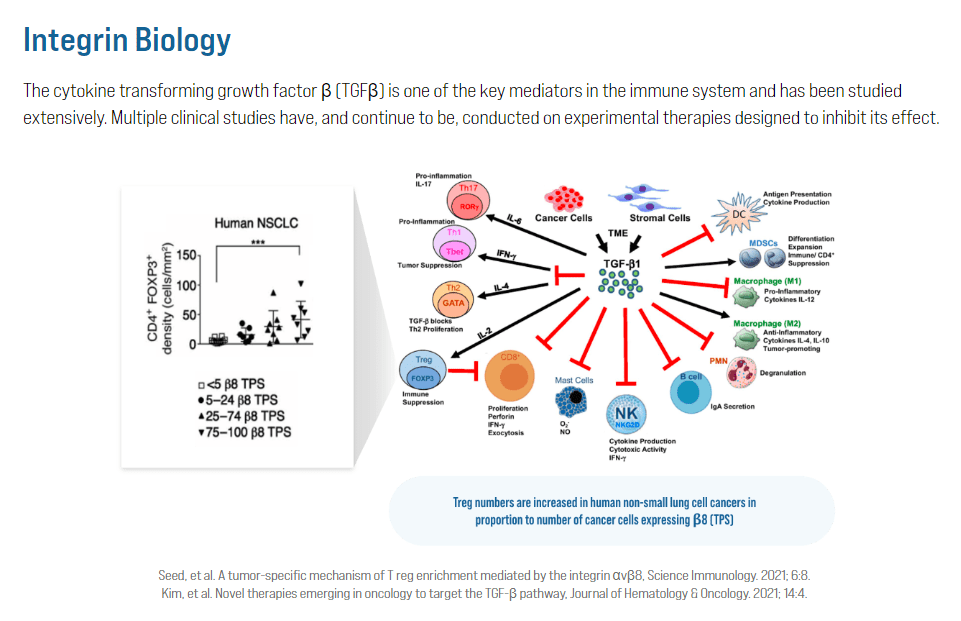

The second approach with monoclonal antibodies blocks integrins that activate the Transforming Growth Factor Beta [TGFβ]. This protein promotes tumor growth and suppresses immune response against cancer. By inhibiting integrins’ function, these monoclonal antibodies prevent the activation of TGFβ, stopping cancer progression and enhancing the immune system against the tumors.

Moreover, CRBP’s development pipeline includes the drug candidate CRB-701, which targets Nectin-4-positive solid tumors. Nectin-4 is often overexpressed in various types of solid tumors, including bladder, breast, and pancreatic cancers. By specifically targeting Nectin-4, CRB-701 has the potential to deliver its cytotoxic payload directly to cancer cells while minimizing damage to healthy cells. This means fewer side effects and improved efficacy compared to traditional chemotherapy. Corbus developed this therapy for the U.S. and Europe, and it is in phase 1 of the clinical trials. The first patient In [FPI] is scheduled for Q1 2024, with plans to enter Q2 2024 with dose escalation and Q3 2024 with dose confirmation/expansion. CRBP collaborates with CSPC Pharmaceutical Group Limited to develop and distribute this therapy in China, where the drug is in the dose-escalation phase.

It’s worth noting that while CRB-701 is CRBP’s flagship product, the company also has CRB_601, which was approved for clinical trials in January 2024. It is an anti-αvβ8 monoclonal antibody [mAb] targeting TGFβ-signaling. The treatment is indicated for solid tumors with a high presence of the αvβ8 integrin.

Source: Corbus Pharmaceuticals website.

Additionally, CRBP’s product pipeline also includes CRB-913, a peripherally restricted cannabinoid type 1 receptor [CB1R] inverse agonist. This drug can bind to CB1R, which is related to energy balance and metabolism, and acts outside the central nervous system to block the activity of the receptor that promotes appetite. Thus, inhibiting this receptor induces weight loss, useful in conditions like obesity and related disorders. The Investigational New Drug [IND] application is expected in Q4 2024, which, if approved, would be a significant milestone for CRBP as it would further validate its overall IP portfolio.

From Setback to Revival: Corbus’s Pivot to Precision Oncology

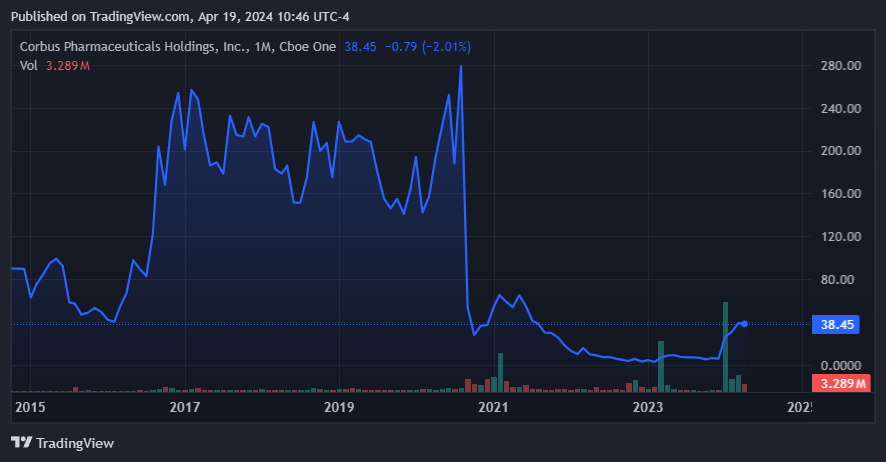

Nevertheless, in 2021, CRBP faced a setback with Lenabasum for dermatomyositis, failing to meet its primary endpoint in phase 3. Consequently, Corbus’s stock value significantly dropped that year. In response to this challenge, the company changed its focus to precision oncology and obesity treatments. This is part of biotech investments, as not every drug gets FDA approval. However, this particular setback is important to consider before investing in CRBP, as it shows that research progress is not guaranteed, even if it reaches the final FDA approval stages.

Source: Corporate Presentation. March 28, 2024.

In contrast, CRBP’s newer CRB-701 drug candidate presented promising phase 1 dose escalation study results. This is essentially a pivot from Lenabasum to a new IP, which seems to have been welcomed by the market to some extent. The shares rallied in early 2024 in response to this pivot, which has yielded favorable data.

So far, early clinical trial data from the study, presented at the 2024 ASCO GU symposium, showed a 43% objective response rate and a 71% disease control rate at therapeutically relevant doses for patients with Nectin-4 positive tumors without dose-limiting toxicities at the highest dose levels tested. There were no reports of peripheral neuropathy or skin rash, common adverse effects of similar drugs. Furthermore, the drug had promising pharmacokinetic profiles, suggesting that it could be given less frequently (every three weeks) and still maintain effective levels in the bloodstream.

The positive results for CRB-701, which may offer benefits over existing treatments, revived investor interest and market confidence in the future of CRBP.

Dilution & Too Early to Tell: Valuation Analysis

From a valuation perspective, CRBP remains a relatively small biotech company, trading at roughly $390.5 million market cap. Its balance sheet holds $20.9 million in cash and equivalents against $20.9 million in total debt. This means the company has the same cash and debt today.

Moreover, looking at its cash flow statement, I estimate its latest quarterly cash burn was about $6.0 million, which annualized implies a yearly cash burn of roughly $24.0 million. I obtained that figure by adding the most recent quarterly CFOs and Net CAPEX, then annualizing them. Thus, I calculate a cash runway of roughly 0.87 years, which is concerning as it indicates that the company will need additional financing in the near term.

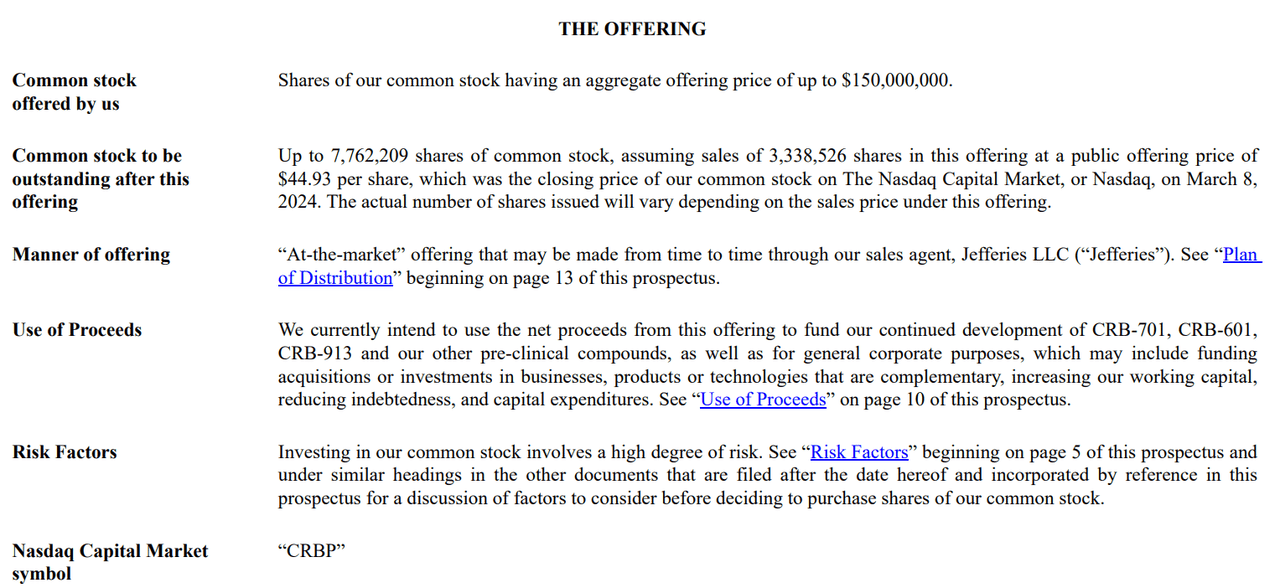

Source: CRBP, Form S-3 Filing.

Consequently, it’s unsurprising that the company recently filed with the SEC for capital raising purposes. CRBP looks to raise up to $300.0 million in additional funds through a mix of equity, preferred stock, financial derivatives, and debt. The funds will be primarily used for continuing their research projects (ostensibly CRB-701 being the main focus) and other general corporate needs. The terms are quite general and flexible for CRBP, which is common for this filing type. It essentially allows the company to raise capital as needed, and dilution might occur if it’s done through equity.

However, preferred stock and debt wouldn’t necessarily be as dilutive immediately. I believe $300.0 million would be more than enough to finance the company’s research efforts for the foreseeable future, as that would imply roughly 12.5 years of cash runway if raised fully today.

Nevertheless, since the company’s market cap remains relatively small, a $300.0 million stock raise would dilute current shareholders considerably. So, it’s a risk worth considering before investing in the shares. I doubt they’ll do it all at once, and I expect them to use a mix of equity and debt.

Source: American Council on Science and Health.

Furthermore, what investors buy today is essentially CRB-701, which is CRBP’s main value driver. This research remains in Phase 1, but it has received IND clearance from the FDA and started clinical testing in Q1 2024. The FDA’s IND clearance is key, as it shows regulators feel comfortable with human testing for this drug. Although it’s still early, I believe this shows a slight positive attitude towards CRB-701, which is a good omen overall.

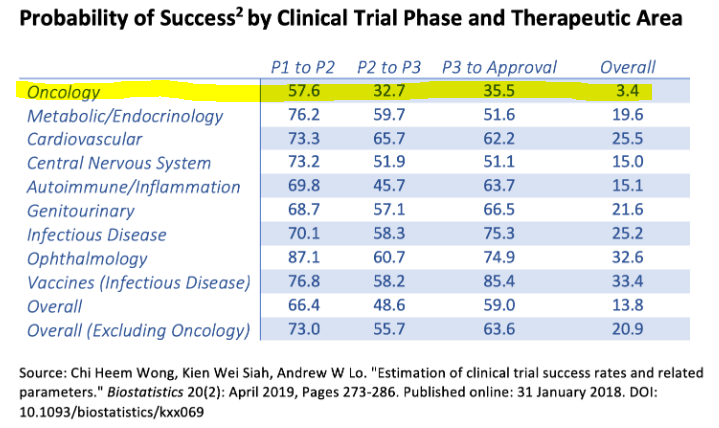

Nevertheless, the road to an eventual FDA approval is long and uncertain. For context, oncology drugs usually have about a 57.6% odds of making it through Phase 1 into Phase 2 trials. And overall, the odds of going from Phase 1 to an eventual FDA approval are quite slim, at just 3.4%. For practical purposes, I think it’s likely that CRBP will get to Phase 2 with CRB-701, which could be a welcome catalyst for the stock. Yet, beyond that, this is still highly speculative.

Additionally, CRBP does have CRB-601 and CRB-913, which are both promising in their own right. However, these research projects are just in their beginning stages. CRB-601 should start the first patient enrollment in the summer of 2024, a significant milestone. CRB-913 is aiming for its IND filing by late 2024 as well. However, these projects are still largely experimental, and I wouldn’t consider them significant value drivers yet.

So, assuming that CRBP will likely dilute shareholders in the near term and its IP is still quite undercooked, I think it’s inappropriate to rate it a “Buy” just yet. I believe CRBP’s highly speculative nature could pay off eventually, but it’s prudent to remain cautious until we get more concrete trial data results. Hence, I rate the stock a “Hold” for now, but it is a good addition to your watch list for the catalysts I’ve mentioned.

Source: TradingView.

Undercooked: Conclusion

CRBP is a promising biotech in the oncology sector, particularly with its flagship research project, CRB-701. CRBP also has additional projects in its pipeline, but they are still in the very early stages. Moreover, the company’s balance sheet needs to raise additional funds to finance its research efforts, which will likely dilute shareholders and burden the balance sheet with debt.

So, on balance, I believe that the stock’s risk-reward profile is not compelling enough to justify an investment. However, I think Corbus Pharmaceuticals Holdings, Inc. stock is worth watching in the future because if its IP progresses as expected, the upside potential could be substantial. But for now, I think it’s a “Hold.”

Read the full article here