Artificial Intelligence emotion is spiking technology stocks higher and helping Nvidia Corporation (NASDAQ:NVDA) become more overvalued and overbought. It has our proprietary Buy Signal, but we like to buy on weakness, during a pullback in the market or the stock price.

We have two Timing signals that will be triggered when that happens. We like stocks that have both our Buy Signal and a pullback in price. We currently have about 40 stocks in the Index that have our proprietary Stocks In Demand, SID Buy Signal which uses both fundamentals and technicals. (We will be happy to send you that list.)

We like to use Seeking Alpha’s Quant system to do our due diligence on stocks picked by our SID computer system. We want to confirm what we are seeing on the technical analysis chart shown below. Seeking Alpha gives NVDA high grades except for Valuation, and if you hit that tab on the screen, up pops all the negative metrics for Valuation. We don’t mind overvalued stocks as long as the Growth is good. SA gives high grades for Growth, Profitability, Momentum and Revisions.

We just don’t like to buy stocks that are both overvalued and overbought. The technical analysis overbought factor is eliminated when price pulls back. We expect a market pullback is coming with the end of the best six months in the stock market and the seasonal trend of buyers “going away in May” to the Hamptons or some other vacation attractions. We expect the Fed’s continued high interest rates for the rest of the year will hurt technology stocks and help defensive stocks.

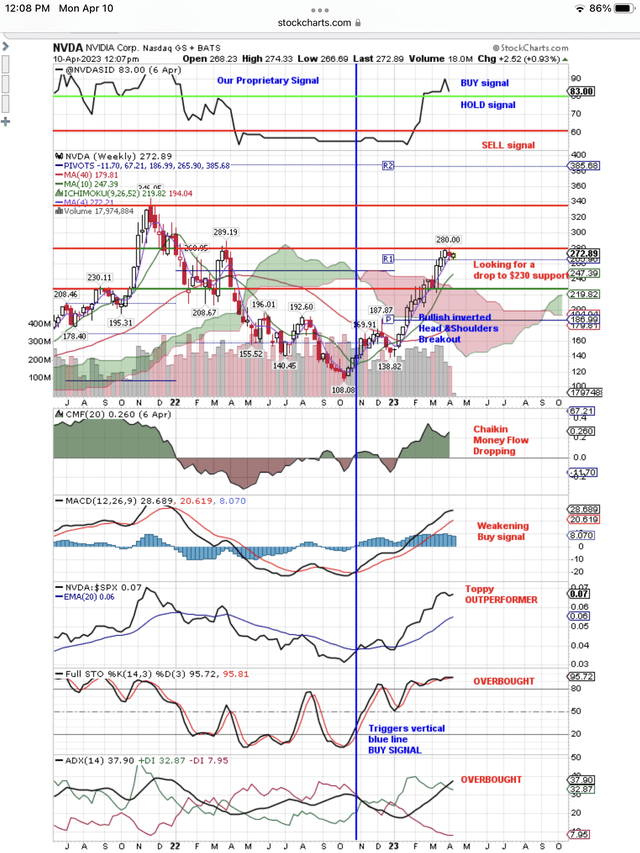

Here is our weekly, NVDA chart that shows our proprietary Buy Signal at the top of the chart. This signal uses both fundamentals and technicals. The other signals on the chart are purely technical.

Buy Signals early signs of weakening (StockCharts.com)

As you can see on the above chart NVDA has had a fantastic run-up in price from $108 to $280, but now it is hitting resistance, as the market is looking for a pullback. NVDA could still reach for $340 in April and May, but it is long overdue for a pullback to test support.

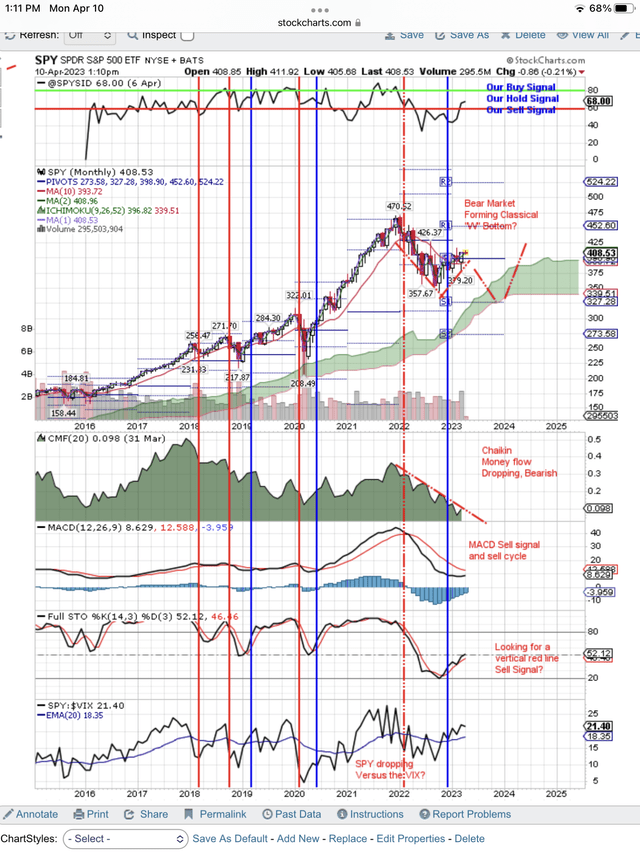

Here is our monthly market (SPY) chart where we outline our thesis for a pullback and a retest of the bottom because of high interest rates and a slowing economy in 2023.

SPY at peak of “W” bottom (StockCharts.com)

Because of the Fed and the cracks in the economy caused by high interest rates for 2023, we expect the market to bottom between now and October, forming the classical double bottom we have outlined in red on the prices shown on the chart above.

The signals are still positive including the blue vertical, buy signal line. However notice the big drop in Chaikin Money Flow. We think the buyers are almost exhausted except for safe harbor stocks like Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL) and winners like NVDA. But the market will take even these lower when it drops. A bear market takes all stocks down, just like a low tide takes all boats down.

It is possible that the market could keep moving higher, but we don’t think that is probable with the analysts downgrading earnings, the economy tanking, the banking crisis and companies announcing big layoffs. We think the market and technology stocks, in particular, will go down with these high interest rates to retest the bottom. Even Nvidia Corporation will be hit. The pros always buy on weakness.

Read the full article here