In 1973, the price of crude oil rose from below $3.00 per barrel to almost $12 per barrel. This quadrupling (+300%) of the crude oil price occurred as a result of the “Arab Oil Embargo.”

We believe that events in 2024 could potentially produce an oil price shock of equal or even greater magnitude.

In this article, I will describe how that could occur and why.

Context: The 1973-1974 Arab Oil Embargo

The word “embargo” somewhat exaggerates what actually happened in 1973-1974. What many people do not know is that during the Arab Oil Embargo, total global oil supplies were restricted by less than 4%, for only a few months. To put this into context, this would be roughly equivalent to a multi-month global crude oil supply disruption of 4 million barrels per day.

As we shall see, global oil supplies could easily be disrupted by far more than this amount in 2024.

Although the world is somewhat more prepared than it was in 1973, major supply disruptions could cause global oil prices to rise beyond $300 per barrel.

Risks to Global Oil Supply

There are several ways that global oil supplies could become disrupted. In this article, we will cover two of them: Blockage of oil transit choke points, and attacks on oil export infrastructure.

Global Oil Transit Choke Points

Blockage of key global transit choke points could cause extremely severe global oil supply disruptions. Roughly 30% of all global oil supplies pass through three choke points that would be severely threatened in the event of a regional war in the Middle East: The Strait of Hormuz, the Suez Canal, and Bab el-Mandab.

World Oil Transit Chokepoints (EIA, Investor Acumen)

The Strait of Hormuz. Roughly 20% of total global oil supplies pass through the Strait of Hormuz in any given year. Geographically, the straight is roughly 20 miles wide at its narrowest point, but the shipping lanes are only two miles wide. Because of the narrowness of the shipping lanes and the peculiar geography of the Strait, Iran can easily shut the Strait of Hormuz for many months through mining, sinking of ships (physical blockage), rocket launches, and drone strikes on ship traffic.

Strait of Hormuz — Chokepoint (Marine Link, Investor Acumen)

A total shut-down of the Strait of Hormuz could only be partially compensated with mitigation measures such as using over-land routes. Various estimates (including a U.S. GAO estimate in 2006) suggest that a shutdown of the Strait of Hormuz could cause a tripling or quadrupling of global oil prices, implying an oil price that could exceed $300. In our estimation, due to limited mitigation avenues, a total blockage of the Strait of Hormuz for a period of more than three months would result in global oil prices rising to $400 or above.

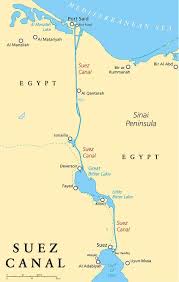

Suez Canal. Roughly 4% of global oil supplies pass through the Suez Canal. Due to its extreme narrowness, the Suez Canal is exceedingly easy to block.

Suez Canal — Choke Point (World Atlas)

In 2021, a single container ship that was buffeted by strong winds and currents became wedged across the waterway, with its bow and stern stock on opposite canal banks. All traffic was blocked for six days.

The sinking of one or more ships could result in a total blockage of the Suez Canal for several months.

Bab el-Mandeb. Called the Gate of Grief or the Gate of Tears, this is a strait in the Red Sea between Yemen in the Arabian Peninsula and Djibouti and Eritrea on the Horn of Africa. This small choke point is 14 nautical miles wide at its narrowest point, but the two shipping channels are only two miles wide each.

Bab el-Mandeb Chokepoint (World Atlas)

This choke point can pretty easily be shut down through mining, rocket launches and drone strikes by the Houthis in Yemen (Iranian proxies). The strait could also be obstructed through the sinking of vessels at key points.

The Houthis have already demonstrated their ability to effectively obstruct traffic through the strait. Various radical groups in Eritrea and Somalia could also threaten safe passage through the strait.

Oil Export Infrastructure

Oil export infrastructure is vulnerable all over the world. However, in this article, we will cover just a few vulnerable points that could cause massive disruptions of global oil supplies.

Abqaiq-Khurais. Saudi Arabia’s Abqaiq crude oil processing facility is the largest in the world, handling about 7 million barrels per day, or about 7% of all global oil supply. The Khurais oil field produces about 1.5 million barrels of oil per day and contains about 20 billion barrels of oil.

Al Qaeda attempted a suicide bombing of Abqaiq in 2006. The Houthis of Yemen successfully attacked the facility with Iranian-made drones and cruise missiles in 2019.

The 2019 attack reduced flows from the facility by about 5 million barrels per day. Fortunately, the damage was far less than it could have been, and most flows were restored within a matter of days. However, experts believe that a successful attack on certain key points in this facility could result in a total shutdown for many months.

Saudi Petroline pipeline. This oil transit pipeline carries over 5 million barrels of oil per day.

All pipelines can be fairly easily damaged through bombing and other forms of sabotage at key points.

Saudi Sea Ports. The Ras-Tanura port handles 3.4 million barrels of oil per day. The Ras al-Juaymah port handles 3 million barrels per day.

Seaport infrastructure can easily be damaged through bombing of key facilities, and blockage through sinking of ships.

UAE, Kuwait and other infrastructure. There are several processing facilities, pipelines, and ports in the Middle East and North Africa that handle over 1 million barrels of oil per day. All of these facilities are vulnerable in the event of a regional war.

Ability to Mitigate Disruptions

The main way that the U.S. and EIA partners have devised to mitigate the risk of oil supply disruptions is through the Strategic Petroleum Reserve ((SPR)) program.

When the US SPR is totally filled and fully operational, it is designed to enable the release of 4.4 million barrels of oil per day for a period of 90 days.

Currently, because the SPR has been significantly depleted, it is estimated by the US Department of Energy that the current maximum flow is only 2.26 million barrels per day for 90 days. Some experts believe that the flow capacity is actually substantially less due to reduced pressure in the storage caverns and various sorts of damage in the facilities.

The U.S. controls about half of global strategic reserves held by EIA members. Assuming that other members reserves and facilities are working similarly to the U.S., the capacity of global EIA members to mitigate a disruption in global oil supplies would be roughly 4.5 million barrels per day for 90 days.

Note that more than 18 million barrels per day pass through the Strait of Hormuz. Other transit choke points and vulnerable facilities probably account for another 20 million barrels of oil flow per day. Therefore, global strategic reserves are woefully inadequate to deal with a serious disruption of oil supplies caused by major attacks on strategic passageways and export facilities.

Strategic reserves can deal with relatively minor disruptions caused by terrorist acts or accidents. It cannot deal with the capacity of a large state actor such as Iran and its proxies to massively disrupt global oil supplies.

Some people have cited the ability of shale oil in North America to be brought online fairly quickly. At most, North American producers could muster an incremental 2 million barrels per day within roughly one year of oil prices rising to $150 or higher. The ability of North American producers to ramp up production within 6 months or less is very limited.

Demand Destruction

Some people believe that a rise in oil prices will be limited in extent and in time through demand destruction. This is only partially true.

The demand for oil is extremely inelastic. For example, during the Global Financial Crisis in 2008, the total global demand for oil declined by only 0.66%. Despite the massive rise in prices in 1973-1974, global oil demand fell by only -1.42%.

What these two examples show clearly is that demand destruction is a minor factor when it comes to mitigating the effects of a major disruption of global oil supplies. There is no realistic scenario in which demand destruction would prevent oil prices from rising beyond $300 – and being sustained at that level for a significant period – if more than 5 million barrels per day of global oil supplies were disrupted for a period of three months or more.

I would again note that a blockage of the Strait of Hormuz would disrupt more than 18 million barrels per day. There is no realistic amount of demand destruction that would be able to keep oil prices below $300 in the event of a prolonged disruption of the Strait of Hormuz.

Why Would a Disruption Occur?

Some people might be wondering: Why would a major disruption in oil supplies every occur? Who would have an interest in such a scenario? How realistic is such a scenario?

In this article, I mainly highlight the vulnerability of global oil supplies. I do not want to go into any great depth regarding the motivations of various actors to disrupt such supplies. I will merely highlight two realistic scenarios in which two large state actors have major incentives to disrupt global oil supplies.

1. Iran. Iran currently exports slightly less than 2 million barrels of oil per day into the global oil market. In the event of a war with Israel or the U.S., Iran lose its ability to obtain oil revenues. At that time, it will have every incentive to shut down global oil supplies, to gain leverage. Indeed, if sanctions are re-imposed on Iran’s oil exports and or if their export infrastructure is attacked, Iran will have almost nothing to lose and a great deal to gain from such disruptions, as it would confer them maximum leverage.

Indeed, in a war with Israel, Iran’s greatest weapon is its ability to disrupt global oil supplies – particularly through the Strait of Hormuz. Iran does not need to fire a single shot at Israel. By cutting off the Strait of Hormuz, Iran can blackmail the entire world into pressuring Israel to end its conflict with Iran and with Iran’s friends, such as Hamas and Hezbollah.

2. Russia. The current Russian regime faces what could become an existential crisis if they cannot bring the Ukraine war to a speedy end. The easiest and most effective way that Russia can do this is by ensuring that current President Joe Biden is defeated by former President Trump. Trump has stated that he would withhold aid from Ukraine to bring an end to the Russia-Ukraine war.

History has shown that the surest way to defeat an incumbent president in a U.S. election is through high gasoline prices and high inflation. Putin knows this very well. It would be astounding to this analyst if Putin does not take actions that will encourage a disruption in global oil supplies in the second half of 2024 that produce high gasoline prices and high inflation. The Russians have very close relations with Iran, and they have cultivated close relations with various Islamic terrorist groups that can carry out attacks on oil infrastructure in the Middle East and North Africa. Through their relations, financing and material, Russia has the capacity to cause massive oil disruptions through various channels. They could even orchestrate “false flags” on their own export facilities.

Conclusion

In this article, I have shown that global oil supplies are extremely vulnerable to a possible war in the Middle East and or geopolitical games played by other state actors such as Russian President Vladimir Putin.

In our view, a major oil price shock in 2024 is not only possible, but likely.

We expect an oil price shock to send global oil prices up above $150 per barrel at some point in 2024 and potentially above $300 per barrel.

We urge all investors to prepare for this. At our Investing Group, our portfolios are prepared to thrive in such a scenario.

Read the full article here