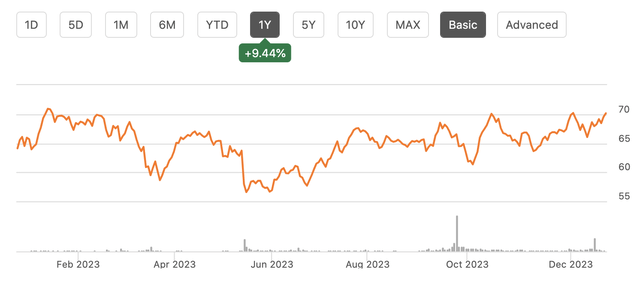

Shares of ONEOK (NYSE:OKE) have been a solid performer over the past year, gaining about 10%. This return has lagged the S&P 500, but it is higher than the 7% rally in the MLP ETF (MLPA), comprised of ONEOK’s peers. While its underlying business is performing well, its dividend growth is likely to be modest, particularly with deleveraging a focus after its acquisition of Magellan this year. As a consequence, I believe there are better opportunities for income-oriented investors.

Seeking Alpha

ONEOK is a large pipeline company; however, it is not an MLP. Rather, it is structured as a corporation. This means investors do not receive K-1 documents, and it pays out dividends not distributions. This article does not constitute tax advice, and there are pluses and minuses to both structures. K-1’s can add complexity to tax returns, but MLP distributions tend to have smaller tax burdens, instead also lowering your cost basis. However, they can cause issues when owned in tax-deferred accounts (like a 401k). This article focuses on ONEOK’s underlying investment merits, rather than tax-driven advice, where I would advise talking with a professional.

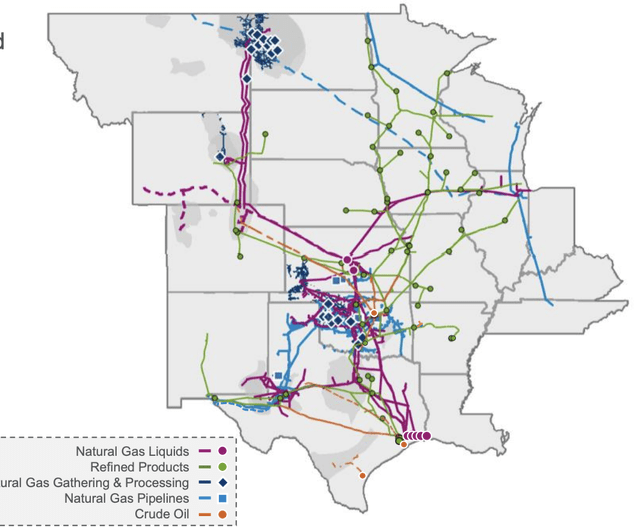

As you can see below, ONEOK primarily operates across the central United States, with meaningful operations in and around the Williston Basin of the Bakken Shale formation and the Permian Basin in Texas. It does not have meaningful exposure to gulf coast export facilities or the Marcellus Shale, though it does have the capacity to supply about half of our refining capacity.

ONEOK

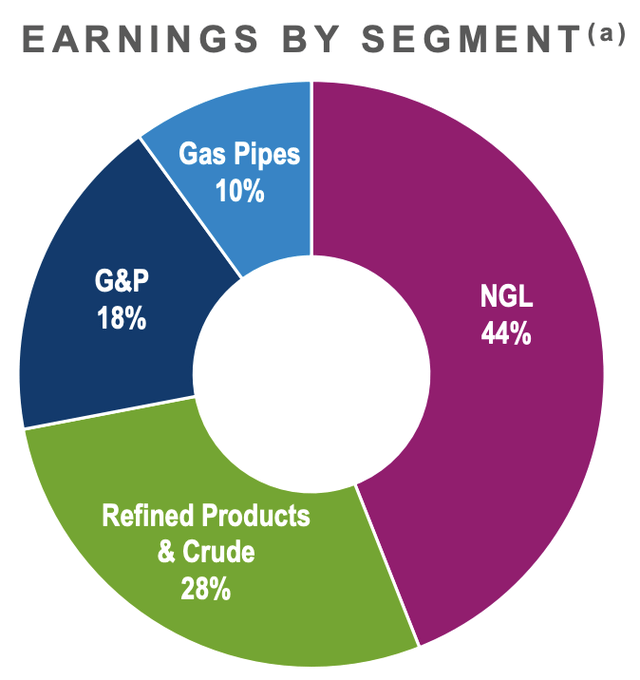

Historically, ONEOK has focused on natural gas liquids, alongside natural gas gathering and processing (G&P). With its acquisition of Magellan, the company now has more meaningful refined product and oil pipeline capacity, positive diversification in my view. Still, NGLs provide the lion share of earnings, at nearly 50% of the company. Refined products and crude is now about a quarter of the business, with the remainder serving natural gas.

ONEOK

In the company’s third quarter, we have seen strong operating performance. OKE saw 1% NGL throughout growth sequentially with 5% growth in the Rocky Mountain and mid-Continent regions while the Gulf Coast/Permian fell over 6%. This weakness in the Permian was somewhat surprising given ongoing production growth, and it should prove transitory. In fact, ONEOK is doubling its Permian capacity with a new $520 million pipeline online in 2025. This should help to improve results and supporting ongoing EBITDA growth. Throughput was up about 10% from last year, driving EBITDA up from $485 million to $614 million.

About 90% of ONEOK’s NGL earnings are fee-based. This is important to remember when looking through its financial statements. For instance, Q3 revenue was $4.2 billion, which was down from $5.9 billion last year. However, cost of sales fell by $2 billion to $2.8 from $4.8 billion. These movements are driven by commodity prices, with NGL and natural gas prices falling substantially from last year, as markets have normalized from their post-Ukraine shocks. Commodity prices drive both revenue and cost of goods sold as it processes these commodities, but because it earns a fee for doing so, it is mostly, but not entirely, agnostic to price levels. This is somewhat analogous to how a refiner is indifferent to crude oil prices, instead earning the spread on oil to gasoline/diesel prices.

While ONEOK’s earnings are largely “fee” based, it should be noted these fees have some commodity sensitivity. In particular, I would note that 75% of its natural gas G&P unit is fee-based. However, the fee-based contracts use a “percent of proceeds” system. Despite lower natural gas prices, its G&P unit earned a $1.17/mmbtu average fee, essentially flat to $1.16 last year. This speaks to the fact that fees have a low “beta” to natural gas prices. Additionally, with 2/3 of its capacity in the Williston Basin in the Dakotas and Montana, ONEOK’s natural gas takeaway capacity is not supply export markets, which drove higher NYMEX natural gas prices in 2022.

Still in periods where its local markets see lower natural gas prices, OKE will see some commodity price sensitivity, even in its fee-based revenue, though not nearly as much as actual producers. The Williston Basin is somewhat higher cost than the Marcellus; still, OKE saw 11% growth from last year. EBITDA rose a more modest 5% as operating costs rise. Should we see natural gas prices remain below $2.50, I think investors should expect volumes to face some pressure, and percent-of-proceeds rates could also decline.

Seeking Alpha

OKE’s natural gas pipelines are 95% fee-based while 90% of crude oil pipeline are fee-based, which largely came from Magellan.

Overall, in Q3, EBITDA rose by 11% to $1 billion even with $83 million in net transaction costs. As a result, management raised guidance by $125 million on a pre-acquisition basis from August, now expecting $5.1 billion in 2023 EBITDA; $4.8 billion excluding M&A, up by a third from 2022. So far this year, ONEOK has generated $2.9 billion in operating cash flow while spending $1 billion on cap-ex (about $200 million is maintenance). That has translated to $1.9 billion of free cash flow and $2.7 billion of distributable cash flow (operating cash flow less maintenance, but not growth cap-ex).

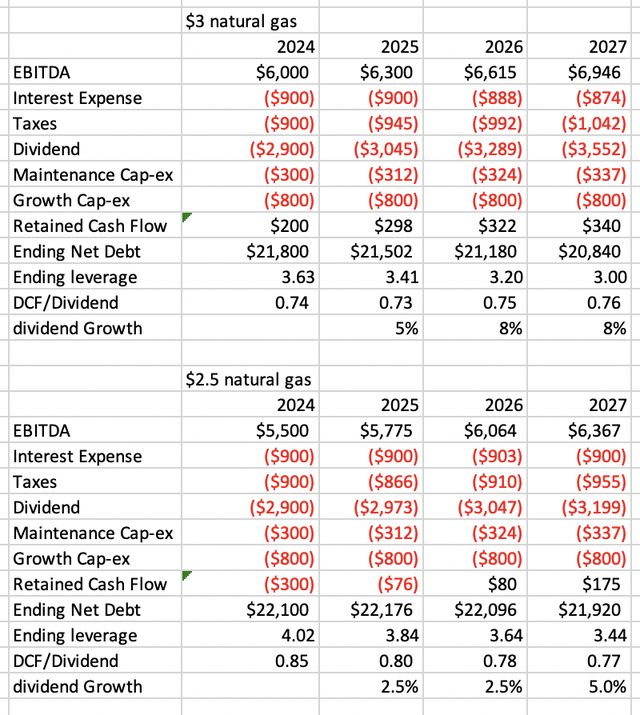

Now for next year with a full year of Magellan, management is targeting $6 billion in EBITDA. I believe this can be achieved in a $3 natural gas environment; however at $2.50, I would see risk down to $5.5 billion, given likely slower volumes and lower fee rates. Management targets 3.5x debt to EBITDA, and ONEOK took on $5.25 billion in new debt to fund M&A, leaving it with $22 billion in debt, leaving leverage temporarily closer to 4x. Its current dividend costs about $2.2 billion annually. Interest expense is about $900 million, and its larger operations likely will require about $300 million in maintenance cap-ex.

Based on ONEOK’s 2024 target, I believe it can achieve its leverage goal by early 2025, allowing for solid dividend growth. However, if natural gas stays lower for longer, it could take until 2027 for its leverage goal to be reached, which means dividend growth is likely to be slower.

ONEOK, my own calculations

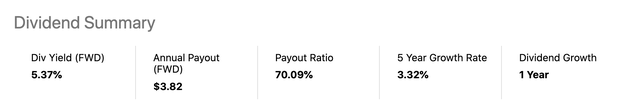

That 2.5-5% dividend growth scenario is more consistent with what ONEOK has generated in recent years, navigating periods of low commodity prices. As you can see, dividend growth has been just 3% over the past five years. With deleveraging a priority over the next ~2 years, I expect relatively muted growth.

Seeking Alpha

Now, a 5+% yield with modest dividend growth is not a bad absolute return. However, more oil-centric MLPs like MPLX (MPLX) and Hess Midstream (HES) offer higher yields (9.3% and 7.8% respectively) with strong balance sheets. As discussed in other pieces, I have been concerned at how quickly natural gas prices have fallen as the Russia-Ukraine shock proved to be far more manageable than expected. This leaves me viewing natural gas and NGL-centric investments a bit more warily than oil-centric ones. With ONEOK offering a lower yield, I view these risks are not being fully priced in. If you expect a return to $3 natural gas, I believe OKE can work as an investment, as it will delever more quickly and accelerate dividend growth. But in the current commodity price environment, I expect it to take several years. I would want at least a 6.5% yield to compensate for this risk, arguing for a fair value of ~$59. As such, I would take advantage of its rally this year to rotate into other pipeline companies, which offer higher income and similar income growth potential.

Read the full article here