Palantir Technologies Inc. (NYSE:PLTR) stock has lost its post-earnings luster, as we cautioned investors to “be fearful when others are greedy” in our previous update.

As such, we believe it’s opportune to assess whether the current buy levels are appropriate for investors who waited patiently for the momentum surge to dissipate as bottom fishers likely took profit.

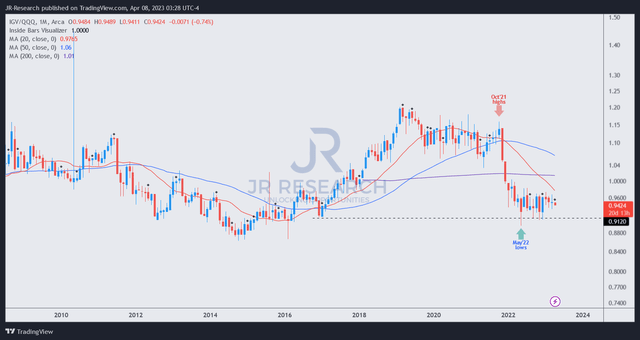

IGV/QQQ price chart (monthly) (TradingView)

Software or SaaS stocks represented by the iShares Expanded Tech-Software Sector ETF (IGV) have not followed through with Nasdaq’s (NDX) (QQQ) outperformance since the start of 2023.

The QQQ’s outperformance has been driven by the surge in semiconductor stocks (SOXX) (SMH) through the AI-hype cycle, as investors bet on companies providing the chips and software ecosystem to build the underlying infrastructure for AI training and inference.

As such, companies like Nvidia (NVDA) and AMD (AMD) have outperformed. Even recent laggard Intel (INTC) has performed remarkably well as investors rotated to semi stocks.

As one of the pre-eminent AI/ML plays among its SaaS peers, we believe PLTR will be able to leverage its well-developed capabilities as the world turns to more AI and not less.

Palantir’s real-world outcomes through the deployment of its system and analytics have been proven, given its exposure and contracts with the US Department of Defense or DoD.

Moreover, the company announced recently that it had expanded its partnership with Microsoft Azure (MSFT) to the public sector. Accordingly, Palantir Federal Cloud Service, or PFCS, “achieved FedRAMP authorization and accreditation to support workloads at US Department of Defense Impact Level or IL 4 and DoD IL5 on Microsoft Azure.”

As such, it has improved the integration capabilities for Palantir’s government and commercial customers on Azure, enhancing its moat against other AI upstarts.

Palantir also published two noteworthy articles on AI ethics and efficacy, and AI automation, which we urge investors to parse.

Notably, Palantir noted an AI hype cycle going on as the investing community deliberates which of these companies could be a multi-bagger. However, the company also stressed that investors must be wary about what AI can and cannot achieve.

In other words, Palantir reminded investors not to fall for unproven hype that has not demonstrated its efficacy in real-world outcomes and without a solid and executable ethical bedrock (not just wishy-washy guidelines) to guide their actions. The company added:

From self-driving vehicles to radiology and predicting job success based on candidate video snippets, there is a growing disillusionment with AI snake oil, alongside an increasing need to discover the credible bedrock underneath the sands of an AI hype cycle. In practice, this means examining what works, discarding what doesn’t, and recentering our moral frameworks around the contexts and whole-of-domain challenges of operationalized AI and away from vain musings about paper clips and trollies. We see both sides of this continued erosion of confidence as symptoms of a single confusion: the tendency to adopt lofty and often performative aspirations without working through the essential groundwork that should apply to any technology intended to be deployed in the real world. – Palantir blog post on The Efficacy and Ethics of AI Must Move Beyond the Performative to the Operational

Hence, investors are urged not to fall into the fallacy of chasing hype trains that have yet to prove their worth. As such, when investing in AI/ML stocks, it’s also important to consider whether they have the foundation to build effective AI systems that can solve real-world challenges.

Palantir stressed that its approach “is to start with the operational context and build and adapt software solutions that contextualize challenges in full view of their complexities.”

In addition, the company stresses that there are limitations to what its AI systems can achieve. Notably, this must be clearly communicated and aligned with “morally defensible technologies.”

Furthermore, the company stressed that its approach is not a “comprehensive panacea” but “a tool among other tools, rather than as a standalone entity.”

Makes sense? Palantir has been building AI systems for the last two decades. So if there’s one company that has likely put in place a comprehensive framework for building and applying AI/ML technologies in deploying bespoke systems ethically, we believe Palantir stands out.

The company warned investors that other companies that don’t have such a holistic framework could face unforeseen regulatory hurdles in the future, leading to “AI winter,” which could potentially scupper their business models.

Even the recent race between Google (GOOG) (GOOGL) and Microsoft has brought to the fore the ethical considerations in building and deploying their AI systems.

The need for speed to grab market share (Microsoft) and avoid possible disruption (Google) has lowered ethical guardrails. The NYT recently reported through interviews with current and former employees that the competition has intensified between the two tech behemoths to the point that both companies are willing “to take greater risks with their ethical guidelines set up over the years to ensure their technology does not cause societal problems.”

The NYT also surfaced an internal email by Microsoft Deputy CTO Sam Schillace that the failure to build with urgency was an “absolutely fatal error in this moment to worry about things that can be fixed later.”

With that in mind, we believe that Palantir is well-positioned to survive or even thrive when the regulatory backlash (We bet that it will come, just a matter of time) finally arrives. Those companies that don’t have the rock-solid foundation of Palantir could be sent to the “AI Winter” that Palantir argued.

Hence, investors are urged to be wary about piling into any AI stock and ride the hype train of the moment.

PLTR has declined nearly 25% from its February highs back to a level that we considered reasonable in early February. While it’s not yet close to the attractive levels we highlighted in December, we believe investors who waited can consider looking for an opportunity to add exposure.

However, the price action is not optimal and, therefore, not supported by constructive bottoming. Hence, investors should keep spare ammo to average down into more attractive zones if the volatility persists.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have you spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Read the full article here