Considered a global leader in logistics real estate, Prologis, Inc. (NYSE:PLD) reported fiscal Q4 results today that landed in line with expectations. Despite this, shares hovered around the flat line immediately following the release of the results.

The movement in the share price upon the news mirrors its lackluster performance over the past month. Heading into the release, shares were down about 3% over the past month.

Seeking Alpha – PLD 1-Mth Share Price Returns

In prior coverage, I’ve consistently maintained a bullish posture on PLD citing its exceptional rental growth prospects as well as consistently high occupancy levels. Today’s results reflect a continuation. The warehouse landlord, however, will likely need to navigate through near-term sector-wide headwinds as market vacancies rise. This doesn’t affect the bull view in the stock by my assessment. And following today’s Q4 results, I believe PLD still warrants attention from long-term focused investors.

PLD Stock Key Metrics

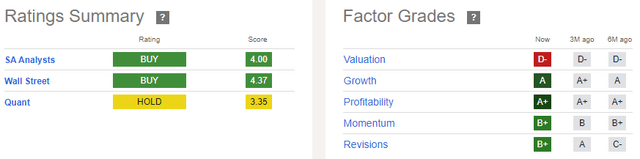

Prologis is viewed favorably by both the Seeking Alpha (“SA”) analyst community and Wall Street. Among the latter, the consensus views the stock as approximately 10% undervalued based on current trading levels.

SA’s quants, on the other hand, rate shares more neutrally due to its current valuation metrics.

Seeking Alpha – PLD Ratings Summary

At nearly 25x forward funds from operations (“FFO”), PLD commands a premium to the broader NAREIT index. In my view, the premium is warranted given PLD’s leadership position in the sector. In addition, other industrial names trade at similar multiples. EastGroup Properties, Inc. (EGP) is one such example. Despite its smaller size, it currently trades at about the same multiple as PLD.

Double-digit rental growth and upper-tier occupancy rates also support PLD’s premium pricing levels. Rising supply and vacancy rates across the sector could water down these metrics, but it doesn’t appear to have made a mark on PLD just yet.

PLD Q4 Recap

In the final reporting period of PLD’s fiscal year, Prologis turned in another strong quarter despite a more challenging macroeconomic backdrop. Core FFO, excluding net promote income, came in at $1.26/share. This was about 1.6% higher on a YOY basis. By the same measure, core FFO grew over 10% YOY for the full fiscal year.

Occupancy held at 97.1% over the quarter, supported in part by retention of 73.1%. The overall average portfolio occupancy rate was flat on a sequential basis but down 90 basis points year-over-year. I expect occupancy levels to remain in a tight range over the next few quarters. It could perhaps even come under mild pressure as the effects of negative customer sentiment seen in the back half of 2023 begin to weigh on demand.

Nevertheless, the lower sentiment doesn’t appear to be denting PLD’s pricing power. Net effective rent change was 74.1% following a record of 84% realized in the quarter prior. This contributed to a healthy same-store growth rate of 8.5% on a cash basis. In my view, the exceptionally high re-leasing spreads should enable above-average NOI growth in the years ahead, even if the market moderates in the nearer term.

PLD Stock Outlook

Looking ahead to 2024, PLD expects occupancy to average 97% at the midpoint. This would be essentially unchanged from the year-end occupancy levels attained in 2023. The muted change from the 2023 ending occupancy rate may be a further signal of a bottoming in warehouse demand.

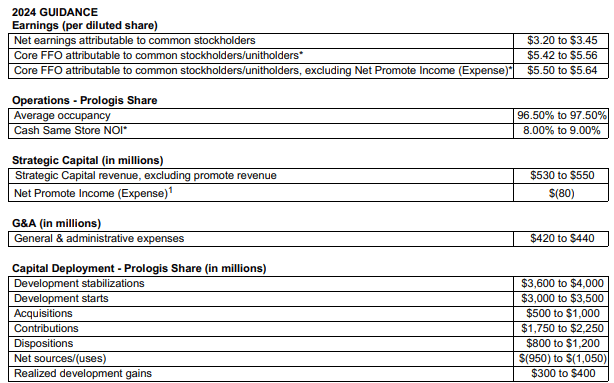

PLD Q4 Earnings Release – Summary Of FY24 Guidance

The expected occupancy levels ultimately translated to same-store guidance of between 8% and 9% on a cash basis, not bad in the face of slowing warehouse demand.

And in terms of strategic deployment, the management team is guiding for a range of +$530M to +$550M. The lower activity relative to prior year levels appears appropriate, given the current macro considerations.

Overall, PLD is guiding for core FFO, excluding promotions, to a midpoint of $5.57/share. This would represent growth of nearly 10% from the mark attained in 2023.

Is PLD Stock A Buy, Sell, Or Hold?

I remain bullish on Prologis and view the stock as an attractive holding in any long-term focused portfolio. The consensus Wall Street price target for PLD currently stands at just under $140/share. In my view, the stock can reach and perhaps even exceed this target.

To get there, PLD will first need to traverse through the near-term macro headwinds. Commercial real estate services firm, Cushman & Wakefield, recently reported that the industry-wide warehouse vacancy rate rose to 5.2% in the final quarter of 2023. It was the first such time that the vacancy rate rose beyond 5% since 2020. And looking ahead vacancies are likely to increase to the 6% mark as additional projects are completed and delivered to the market.

Higher vacancy rates may weigh on valuations and future rental growth. These headwinds are further compounded by the speculative nature of many of these projects. PLD, however, is well-positioned to confront these challenges. The sector bellwether is still capturing near-record rental growth and is operating on high occupancy levels. The overall quality of their diversified portfolio provides a further shield against the broader sector-wide challenges.

And despite the rising availability of warehouse space, vacancy rates are still trending below the 15-year average of 6.4%. With new starts also being held back due to the rate environment, the market also is likely to tighten in the 2025/2026 calendar years. This creates a more favorable medium to long-term outlook for PLD.

For investors seeking positioning in the REIT industrial sector, PLD remains attractive in my view due to its ongoing operating performance with exceptional rental rate growth, as well as its more diversified portfolio exposure. As such, I continue to view shares as a “buy” following Q4 results.

Read the full article here