When I last wrote about the Nasdaq tracker fund Invesco QQQ Trust ETF (NASDAQ:QQQ) in March, it was losing its edge to the S&P 500 (SP500) index following a significant lead in 2023. However, it’s back to growing faster (see chart below).

Price Returns, QQQ and SP500 (Source: Seeking Alpha)

This is despite the fact that seven of its top 10 constituents are the same as that for the S&P 500. In fact, the biggest three, Microsoft (MSFT), NVIDIA (NVDA) and Apple (AAPL) have the same ranking among both indices. But what differentiates QQQ significantly, is the higher share for information technology [IT]. Accounting for 52% in its sector allocation, it far exceeds that for the S&P 500 at 34%. With the S&P 500 IT index seeing a robust 28.3% increase YTD, QQQ’s edge over the S&P so far this year can be explained.

QQQ may well maintain a relative lead in the foreseeable future as well, considering that the IT sector can be less vulnerable to a macroeconomic slowdown, which is beginning to show up in the US. The S&P 500 is more exposed to cyclical sectors, which are more sensitive to economic fluctuations by comparison.

However, that doesn’t mean there aren’t risks ahead for QQQ at all. On the contrary, a look at its biggest constituents shows that downside risks have only risen since the last time I checked. But there is upside too. Here I assess how the balance is likely to play out for the remainder of 2024.

Robust gains cap future upside

The biggest risk to further gains for QQQ comes from the valuations of its top ten constituents. Here’s why:

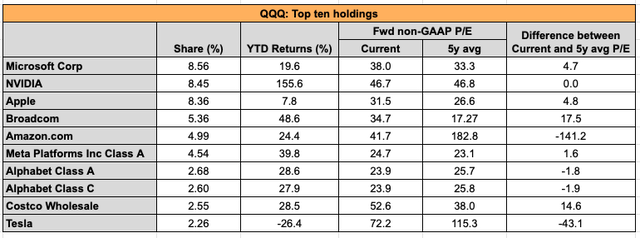

- While five of them are trading at lower forward non-GAAP price-to-earnings (P/E) ratios compared to their five-year averages [5y avg] in March, the number has dropped to four now. This is on account of NVDA’s big gains YTD, resulting in it now trading at the same level as its 5y avg (see table below).

- Of the four remaining, Alphabet’s shares, both Class A and Class C, now have a far smaller differential with their 5y avg at 1.8 and 1.9 respectively compared with 3.6 in March.

- Next, Tesla might still have a big differential, but it’s unlikely to go back to its 5y avg in the foreseeable future anyway. Electric vehicle [EV] sales are slowing down in the US, one of the biggest EV markets, and at Tesla’s cost. With rising competition among EV manufacturers, there’s downward pressure on profit margins and there’s upward pressure on the company’s costs. The probability of downside to the stock was high enough for me to actually assign a sell rating to it here.

Source: Invesco, Seeking Alpha, Author’s Estimates

- Among the five constituents that were already trading at ratios above their 5y avg levels in March, the gap has further expanded for three of them – Apple, Broadcom (AVGO) and Costco (COST). Microsoft and Meta (META) are the only exceptions to this and even the difference for them isn’t significantly improved from what it was a quarter ago. This raises the question of how much more upside there is to these stocks.

- Further, as a result of the improved performance over the past quarter, the weighted forward P/E for the top 10 constituent stocks has now risen to 38x from 33.8x in March.

It’s also worth mentioning that while IT could be more resilient in weaker economic times, the rise YTD has resulted in a higher forward P/E of 28.9x as of May 31 for the S&P 500 IT index, compared to QQQ’s ratio is, as of March 31, at 26x. While the time periods for the P/Es aren’t a perfect comparison, with both the index and the fund having only risen in price since, the trend is likely to have sustained. This indicates that the likelihood of a correction is higher in the sector going forward.

The positives

However, it’s not necessarily all downhill from here, even as the risks have risen. Missing from the discussion in the last section is Amazon (AMZN), which stands out as a positive since it is still trading at a discount compared with the past levels and has potential for further uptick too. With support to its margins for the remainder of this year, even with rising competition, costs and a slowing in the US market, the stock can continue to inch up.

Next, the weight of the communications sector has now increased 15.4% making it the second biggest sector constituent, compared to the consumer discretionary sector a quarter ago. With a fast 24.5% increase in the S&P 500 Communication Services Index YTD along with a forward P/E at 19.15x, which is lower than that for QQQ as a whole.

Sector Weightages, QQQ (Source: Invesco)

Finally, the consumer discretionary sector is now far less significant. In March, it had a weight of 19% in QQQ, which is now down to 12.15%. This is unsurprising considering that the S&P 500 Consumer Discretionary index has risen by just 4.7% YTD, which coincides with a cooling off in consumer demand in the US. Its relatively lower weight in the fund now implies that the fund can be even less vulnerable to expected macroeconomic fluctuations.

What next?

There’s still a good chance that QQQ can continue to perform better than the S&P 500 this year. But that’s not saying much considering that the risks to the S&P have risen even more because of its exposure to cyclical sectors.

In fact, there are genuine risks to QQQ on account of steeper valuations for its biggest constituent stocks. If these result in a sell-off in technology stocks, the fund can plunge.

The downside can be tempered by support from select stocks like Amazon and sectors like communications, but to what extent, remains to be seen. While there’s little doubt that the robust constitution of the fund can still deliver good returns in the medium term, I think there could be pullbacks in the short-term, which can lead to a better price point to enter. With that in mind, I’m downgrading QQQ to Hold.

Read the full article here