Ray Dalio

Ray Dalio made waves in October, when he announced that the odds of WW3 went from 35% to 50% in two years. Commenting on the Israel/Gaza situation, he said that the conflict threatens to spread out to involve the entire region, all against a backdrop of China’s moves against Taiwan. Ultimately, he said, these factors combined moved the probability of a ‘hot’ world war to 50%.

Dalio did not reveal the exact methodology he used to peg the chances of WW3 in the next few years at 50%. His firm, however, has indirectly revealed who it thinks will make the most money in the changing world order:

China.

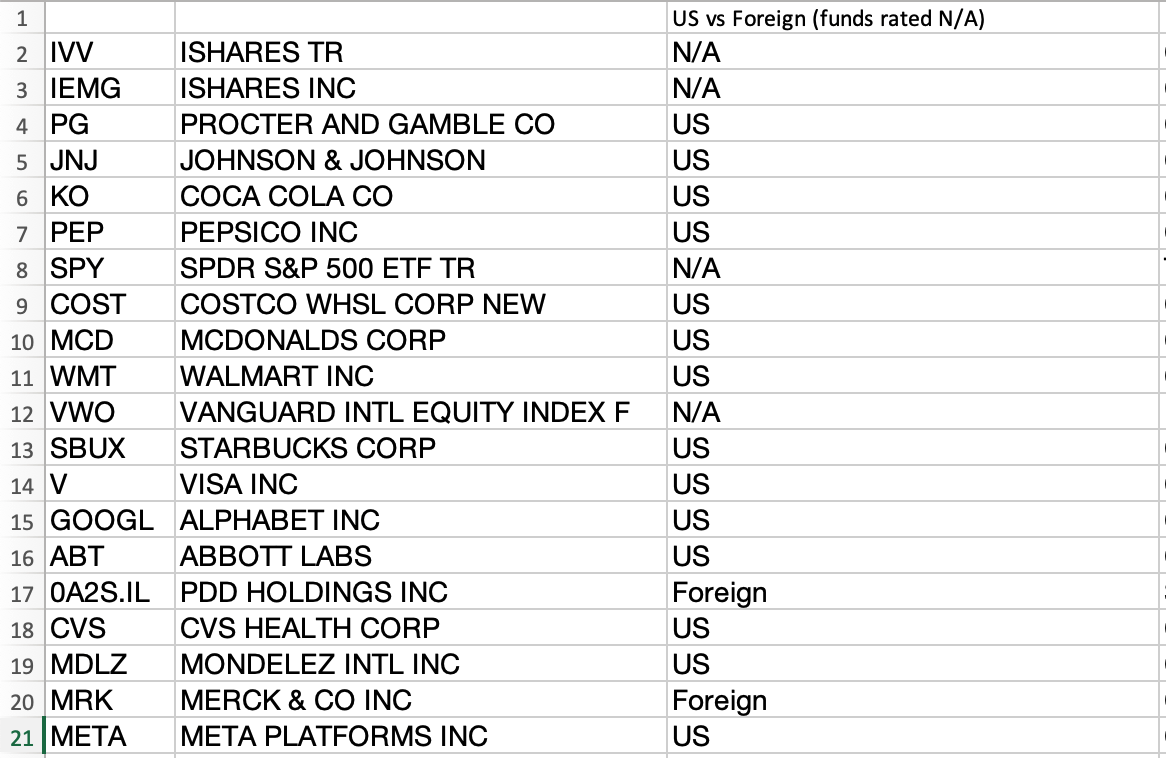

Bridgewater Associates’ most recent 13F showed that its largest position, along with IVV, was the iShares Emerging Markets ETF (IEMG). Both IEMG and IVV made up 5.5% of the total portfolio. The purchase of IEMG shares is essentially a bet on China, as Chinese stocks make up five out the fund’s top 10 holdings. Additionally, the most heavily weighted non-U.S. stock in Bridgewater’s portfolio is China’s PDD Holdings (PDD), which comes in at 16th place. PDD is one of only two foreign individual stocks to break the top 20 in Bridgewater’s portfolio.

Bridgewater Associates’ top holdings (Data from Bridgewater, chart by the author)

It’s quite possible that Dalio himself influenced the decision to invest in emerging markets. He no longer manages Bridgewater’s portfolios, but he is still at Bridgewater as director and CIO mentor. “CIO” means Chief Investment Officer, and Dalio is advising the person currently in this position. So, it is likely that Dalio still has some say in what Bridgewater’s funds are buying.

Given this, Bridgewater’s bet on emerging markets, and China especially, is very interesting. Dalio has said in the past that the U.S. and China are on a collision course for conflict. Indeed, his recent 50% odds of WW3 forecast would seem to suggest that such a conflict is imminent, as the U.S. and China would likely be on opposite sides of such a war. The big China bet would seem to imply that Dalio and/or his team thinks China will come out of the expected conflict relatively unscathed, or at least no worse than any of the other major players. If that assumption proves correct, then Chinese stocks may prove to be good investments over the long run–although a short term crash on the outbreak of an event like WW3 would likely be very large.

The reasoning above probably explains why Bridgewater has gone with the IEMG fund instead of individual Chinese bets. China exposes investors to considerable tail risk: in a WW3 scenario, its business’ supply chains would be disrupted, and their shares would likely be delisted from the NYSE. The latter of these two scenarios actually happened during the Trump administration, and the U.S. was not even at war with China then. A massive single-stock bet on China is therefore risky. IEMG, on the other hand, gives investors a heavy amount of China exposure, in an ultra-diversified package consisting of 2,700 stocks. Plus the fee is a mere 0.09%! For those seeking exposure to China in a diversified package, IEMG may be worth the investment.

History Says U.S. Stocks Set for a Correction

I have long been of the opinion that foreign stocks are set to enter a long term phase of out-performing U.S. stocks. My confidence in this scenario is based on the steep valuations of U.S. stocks (especially U.S. tech stocks), and some observations about financial history. Unlike Dalio, I do not see WW3 as particularly likely to occur. The fact that the Cold War never turned into a third world war suggests that global tensions would need to get extremely severe for a “hot” third world war to occur.

However, relative valuations make the case that the U.S.’s decades-long streak of outperforming global stocks is likely to end soon. The S&P 500 currently trades at 24 times earnings. Meanwhile, the rest of the world is at 11.8 times earnings! U.S. stocks are currently TWICE as expensive as their global peers. In a word, these stocks aren’t cheap.

In itself, that doesn’t mean that U.S stocks are set for a crash. They could keep performing well from here. However, it is likely that foreign stocks will perform better than U.S. stocks, as they are cheaper, while growing just as rapidly, or even faster. Currently, JPMorgan (JPM) forecasts that global equities will grow at 7.8%, while U.S. equities will grow at 7%. This forecast comes from JPMorgan asset management, a global asset manager with no geographic bias. It echoes similar forecasts from individual investors like Charlie Munger, Li lu and yes, even Ray Dalio himself.

So we’ve got foreign stocks at half the multiple of U.S. stocks, while most say that their earnings growth will be just as good as that of U.S. stocks, or even better. This would suggest that the benefit of multiple expansion in the decade ahead will go to foreign stocks, not U.S. stocks.

The only fundamental factor that could possibly argue for U.S. stocks outperforming from here is risk. If the global markets are exceptionally risky compared to the U.S. markets, then U.S. stocks deserve a premium. However, the risk premium at play here would need to justify U.S. stocks being twice as expensive as foreign stocks. That seems unlikely to hold forever. Indeed, situations like these have historically not lasted forever. Near the end of the 1960s, the U.S. stock markets entered a famed “lost decade,” while Japanese stocks went on an epic bull run. It was not until 1989 that Japan’s winning streak finally ended.

Where Does This Leave Us Today

Whatever Ray Dalio’s reasons are for liking global stocks, one thing is certain:

History and multiples both argue that they will outperform starting from today. The valuation gap is immense, and history shows that the outperformance of U.S. markets is far from guaranteed.

What should investors do with this information?

Well, one could easily buy Emerging Markets funds, like the one Bridgewater is buying. I personally have increased my exposure to emerging markets this year, for reasons similar to Dalio’s. I went with the Vanguard All-World ex-US fund (VEU) plus some individual Chinese stocks, but IEMG should work too.

Another option is to focus on one foreign market specifically. Currently, Buffett is betting big on Japan, while others (such as myself) are focusing more on China. Which part of the global stocks trade you choose to focus on is up to you. I will say, though, that if you think WW3 is likely to begin shortly, then you might prefer Japanese and Singaporean stocks to Chinese ones. The logic outlined in this article applies to all foreign markets, not any one specific one. So, you can skip the markets that are exposed to “WW3 risk” if you wish. The point is that, now more than ever, you need some global stocks in your portfolio. What was once merely a good idea, is now bordering on a necessity.

Read the full article here