Introduction

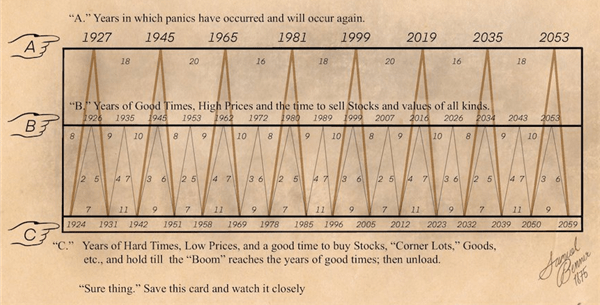

One may have seen the following graphic from an Ohioan farmer, Samuel Benner. It was originally published in 1884 where he predicted the volatility of future markets from 1924 to 2059.

Benner Cycle 1925-2059 (Public Domain)

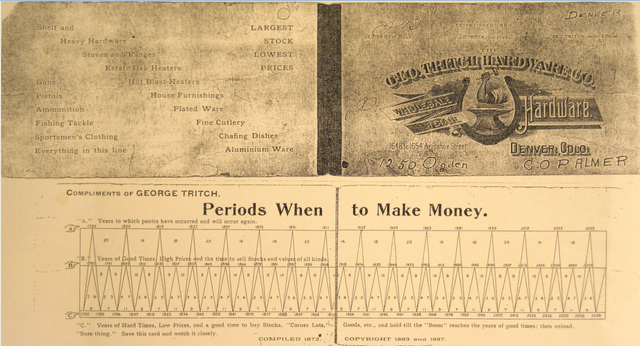

There is a more extensive chart if one is willing to look that uses back tested data.

Full Benner Cycle (Public Domain)

It is a bit tough to read, but a pretty good video on YouTube explains how to interpret it. The key is to understand that the stock price movements will happen the calendar year after the one printed. For example, it shows that the stock market outperforms its historical average from 2024 to 2026 and will underperform from 2027 to 2032. That means one should be aggressive for this year and the next two years. For the subsequent six years, one should be more conservative. I will show you why.

As I go through my analysis, I want to thank Professor Edward McQuarrie for sharing his database. I also used data from Goetzman, Ibbotson & Peng, Jeremy Siegel, Robert Shiller, and The NYU Stern School of Business for my review.

The 27-Year Cycle

If one looks at the charts, one sees a series of minor cycles that are 7-, 9-, and 11-years long. The patterns are very distinct and have the following repetitions:

|

Benner 27-Year Cycle |

Favorable Years |

Unfavorable Years |

|

7-Year Phase |

2 Years |

5 Years |

|

11-Year Phase |

4 Years |

7 Years |

|

9-Year Phase |

3 Years |

6 Years |

It is worth noting that the pattern starts with a 7-year cycle, followed by an 11-year cycle, and finishes with a 9-year cycle.

When I scan the dozens of articles about the Benner Cycles, there is a complete lack of understanding about what we are looking at. Too many people are trying to predict a specific year when a market might crash, instead, they need to look at the unfavorable years as periods when the stock market underperforms its historical average. This is where I would like to compare the 27-year Benner Cycle to the historical stock market returns since 1793.

|

Benner 27 Year Cycle (1793-2023) |

Average |

Standard Deviation |

Number of Years |

|

Favorable Years |

11.70% |

15.26% |

76 |

|

Unfavorable Years |

6.57% |

18.04% |

155 |

|

Average Total Return |

8.23% |

17.34% |

231 |

If one were to break down the Benner Cycle as such, one can see a significant difference (ρ = 0.0354) in stock market performance between favorable years and unfavorable years. During the favorable years, the stock market has averaged an annual return of 11.70% (±15.26%), which is far better than the meager returns (6.57% ± 18.045) during the unfavorable years. If we were to focus on the period many believe Benner was predicting, we find similar significant differences (ρ = 0.0344).

|

Benner 27 Year Cycle (1925-2023) |

Average |

Standard Deviation |

Number of Years |

|

Favorable Years |

16.62% |

12.99% |

33 |

|

Unfavorable Years |

7.19% |

23.14% |

66 |

|

Average Total Return |

10.25% |

20.71% |

99 |

One can claim Benner was accurate in his future predictions about 1925-2023. I also find it interesting that the volatility during favorable years is half the volatility seen during unfavorable years.

As a disclosure, it is worth noting that the average for the unfavorable years still showed opportunities to generate an investment gain. There was still a five in eight chance of seeing a positive return. Any claim that the Benner cycle can predict a “market crash” needs to be viewed cynically.

So How Do I Use This?

According to Benner, two-thirds of the years are “unfavorable.” Given that we have had sixty-two down years since 1793 and 27 years when losses amounted to more than 10%, it is not a statistical accident that some years would be part of any declared period of investment stagnation. My data shows that 74.2% (±5.6%) of the negative years happened during these unfavorable periods. I can claim some significance (ρ = 0.090) since this is more than the expected 67%.

Where this chart might be useful is anticipating the possibility of potential losses greater than 10%. Of the 27 times the market has seen these corrections, 22 or 81.5% (±4.6%) happened during the unfavorable periods. This would include the six out of seven years when the market suffered losses greater than 20%.

If one were to use this kind of tool, it would be useful in helping one to understand that after the markets have gone through a period (2 years to 4 years) of aggressive gains, it would be prudent for one to take action to hedge against market downturns. Even with that, one should never use this tool as an absolute. For example, 2017-2023 were unfavorable years, yet generated a market gain of over 100%; even with the COVID crisis in 2020 and the bond shock in 2022.

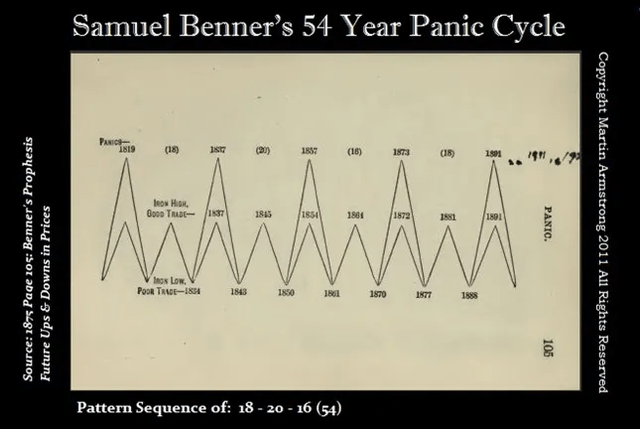

The 54-Year Major Cycle

Either for 16-, 18-, or 20-year periods, Benner claimed there would be periods of even greater market shocks that would be more pronounced than what might be seen during the minor periods. 2023 saw the completion of the most recent cycle. These cycles do not happen in succession. They have periods where they are followed by the more minor periods. When these cycles occurred, they came in three types of phases. Here is a table showing how the major cycles work with the minor cycles.

|

Benner 54-Year Cycle |

Favorable Years |

Unfavorable Years |

|

7 Year Phase (Major Cycle) |

3 Years |

4 Years |

|

11 Year Phase (Minor Cycle) |

4 Years |

7 Years |

|

9 Year Phase (Major Cycle) |

3 Years |

6 Years |

|

7 Year Phase (Minor Cycle) |

2 Years |

5 Years |

|

11 Year Phase (Major Cycle) |

7 Years |

4 Years |

|

9 Year Phase (Minor Cycle) |

3 Years |

6 Years |

Here is a chart showing these alternating cycles, so one can see how these phases occur over a 54-year period.

Benner’s 54 Year Panic Cycle (Armstrong Economics)

Like the 27-year cycle analysis, Benner’s theories seem to hold up with this series of phases also.

|

Benner 54 Year Cycle (1793-2023) |

Average |

Standard Deviation |

Years |

|

Favorable Years |

9.92% |

14.39% |

59 |

|

Unfavorable Years |

4.69% |

18.22% |

60 |

The favorable years outperform the unfavorable years (9.92% v. 4.69%) with a lesser level of volatility (14.39% v. 18.22%). The difference for these two groups is significant (ρ = 0.0829) if one assumes the hypothesis that they cannot be equal. What is interesting are the predictions for 1925-2023. The results are very telling.

|

Benner 54 Year Cycle (1925-2023) |

Average |

Standard Deviation |

Count |

|

Favorable Years |

17.54% |

12.01% |

26 |

|

Unfavorable Years |

4.76% |

23.29% |

28 |

Mr. Benner did quite well with his predictions, and they were significant (ρ = 0.0163). The favorable years (17.54% ± 12.01%) outperformed the unfavorable years (4.76% ± 23.29%).

It is again necessary to point out that unfavorable periods are not automatically periods where one loses portfolio value. The data merely shows that losses were more likely.

My Take

The data suggests that Mr. Benner saw certain patterns in market prices, and one might apply them to the stock market. The statistics are compelling. Even if we were to disaggregate the data to separate it between major and minor cycles and the 7-, 9-, and 11-year phases, the results are significantly different between favorable years and unfavorable years.

|

Cycles |

Favorable Years |

Unfavorable Years |

Difference |

|

27 Year Cycle |

11.70% |

6.57% |

5.12% |

|

11.08% |

7.60% |

3.48% |

|

|

13.13% |

5.58% |

7.56% |

|

|

11.02% |

6.61% |

4.40% |

|

|

54 Year Cycle |

9.92% |

4.69% |

5.23% |

|

9.97% |

2.34% |

7.63% |

|

|

12.97% |

5.74% |

7.23% |

|

|

8.88% |

5.35% |

3.53% |

2024 marks the beginning of a minor nine-year phase where 2024-2026 are favorable years and 2027-2032 are unfavorable years. On average, the minor nine-year phase has seen an overall growth rate of 100.6%. Past performance is not an indicator of future returns.

So far, 2024 is a robust year for those who invested in the S&P 500. So far, the market has seen a total return of 15.12%. According to the historical data, 2024 through 2026 should be prime investing years, so one should stay aggressive. After 2026 through 2032, the market will slow down, and there could even be a market correction. I am guessing that year will be 2029.

Since 1793, there have been periods of 2 to 7 years when the market has outsized gains, the data also shows that there will be periods of 4 to 6 years when it would have been prudent to pull back and find alternative investments that could potentially outperform the market. Adjust your strategies accordingly.

Good luck and have fun.

Read the full article here